In the intricate dance of modern finance, where every transaction is a step and every regulation a rhythm, the strength of a financial compliance program is the unseen conductor orchestrating harmony amid complexity. As businesses navigate the labyrinthine corridors of global markets, the need for robust compliance structures has never been more paramount. This article delves into the key components that form the backbone of a strong financial compliance program, offering a roadmap to not only safeguard against regulatory pitfalls but also to foster a culture of integrity and trust. Through the lens of seasoned expertise, we will explore how these essential elements converge to create a resilient framework, empowering organizations to thrive in an ever-evolving financial landscape. Join us as we unravel the tapestry of compliance, where precision meets prudence, and discover how to fortify your financial fortress against the tides of uncertainty.

Building a Robust Compliance Framework: Essential Elements for Success

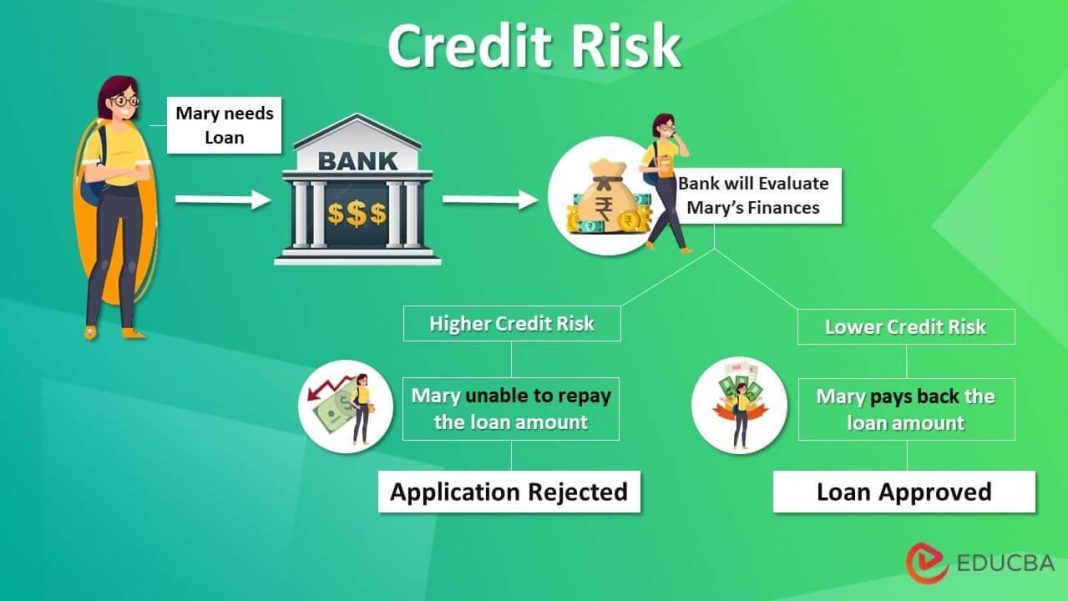

In the ever-evolving landscape of financial regulation, establishing a resilient compliance program is paramount for any organization. A robust framework should encompass several key components to ensure adherence to legal standards and safeguard against potential risks. Firstly, a comprehensive risk assessment is crucial, identifying and evaluating potential compliance vulnerabilities. This proactive approach allows organizations to tailor their policies and procedures to address specific risks effectively.

Additionally, fostering a culture of compliance is essential. This involves not only creating a code of conduct that aligns with regulatory requirements but also ensuring that it is communicated effectively across all levels of the organization. Regular training and education programs are vital, empowering employees with the knowledge to recognize and respond to compliance issues. Moreover, establishing a robust monitoring and auditing system ensures ongoing oversight and the ability to swiftly address any discrepancies. Lastly, a clear and accessible reporting mechanism encourages transparency and accountability, allowing employees to report concerns without fear of retaliation.

Navigating Regulatory Waters: Strategies for Effective Risk Management

In the complex landscape of financial compliance, a robust program is built on several critical pillars. Comprehensive risk assessment is paramount, serving as the foundation for identifying potential vulnerabilities within the organization. This involves not only understanding the current regulatory environment but also anticipating future changes and challenges. A dynamic approach ensures that the compliance program evolves in tandem with the regulatory landscape.

Another essential component is the establishment of clear policies and procedures. These should be meticulously documented and easily accessible to all stakeholders, ensuring that everyone from the boardroom to the front line is aligned with the organization’s compliance objectives. Furthermore, ongoing training and education play a crucial role in fostering a culture of compliance. Regular workshops and updates help keep employees informed and vigilant, minimizing the risk of inadvertent breaches. Lastly, a strong compliance program relies on robust monitoring and reporting mechanisms. These tools not only detect and address issues promptly but also provide valuable insights for continuous improvement. By integrating these elements, organizations can navigate the regulatory waters with confidence and agility.

Harnessing Technology: The Digital Edge in Compliance Programs

In today’s rapidly evolving financial landscape, leveraging technology is not just an advantage—it’s a necessity. Digital tools are revolutionizing compliance programs by providing robust solutions that enhance efficiency and accuracy. Financial institutions are increasingly adopting artificial intelligence and machine learning to automate complex processes, identify potential risks, and ensure adherence to regulatory requirements. These technologies not only streamline operations but also provide a proactive approach to compliance, allowing organizations to anticipate and mitigate issues before they escalate.

Key components of a tech-driven compliance strategy include:

- Real-time Monitoring: Implementing systems that continuously analyze transactions and flag suspicious activities.

- Data Analytics: Utilizing big data to gain insights and detect patterns that may indicate compliance breaches.

- Blockchain Technology: Ensuring transparency and traceability in financial transactions, reducing the risk of fraud.

- Cloud-based Solutions: Facilitating secure and scalable data management and storage.

By integrating these digital tools, financial institutions can not only meet regulatory demands but also foster a culture of compliance that is agile and resilient in the face of change.

Cultivating a Culture of Integrity: Empowering Employees for Compliance Excellence

In the realm of financial compliance, the foundation of a robust program is built on a few pivotal components that drive excellence and empower employees. At the heart of this structure lies a comprehensive training program. This ensures that every team member is not only aware of the regulations and standards but also understands their practical application. Regular workshops and interactive sessions can transform theoretical knowledge into actionable insights, fostering a proactive compliance culture.

Moreover, a strong compliance program thrives on the pillars of transparency and accountability. Establishing clear policies and procedures, accessible to all employees, sets a standard of openness. Encourage a feedback-rich environment where employees feel empowered to voice concerns or suggestions. This is complemented by a robust monitoring and auditing system, which serves as the program’s watchdog, ensuring adherence and identifying areas for improvement. Together, these elements cultivate a culture where integrity is not just encouraged but is the expected norm.