In the intricate world of finance, where the flow of capital dictates the rhythm of global economies, compliance audits stand as the vigilant sentinels safeguarding integrity and trust. These meticulous examinations, often perceived as the unsung heroes of financial institutions, play a pivotal role in ensuring that organizations adhere to the labyrinthine regulations governing their operations. As financial landscapes evolve with unprecedented speed, driven by technological advancements and shifting geopolitical tides, the importance of compliance audits has never been more pronounced. They serve not only as a bulwark against fraud and malfeasance but also as a cornerstone for building investor confidence and fostering sustainable growth. In this article, we delve into the indispensable role of compliance audits, exploring how they fortify the financial sector’s foundation and illuminate the path toward a more transparent and accountable future.

Navigating Regulatory Landscapes Ensuring Financial Integrity through Rigorous Compliance Audits

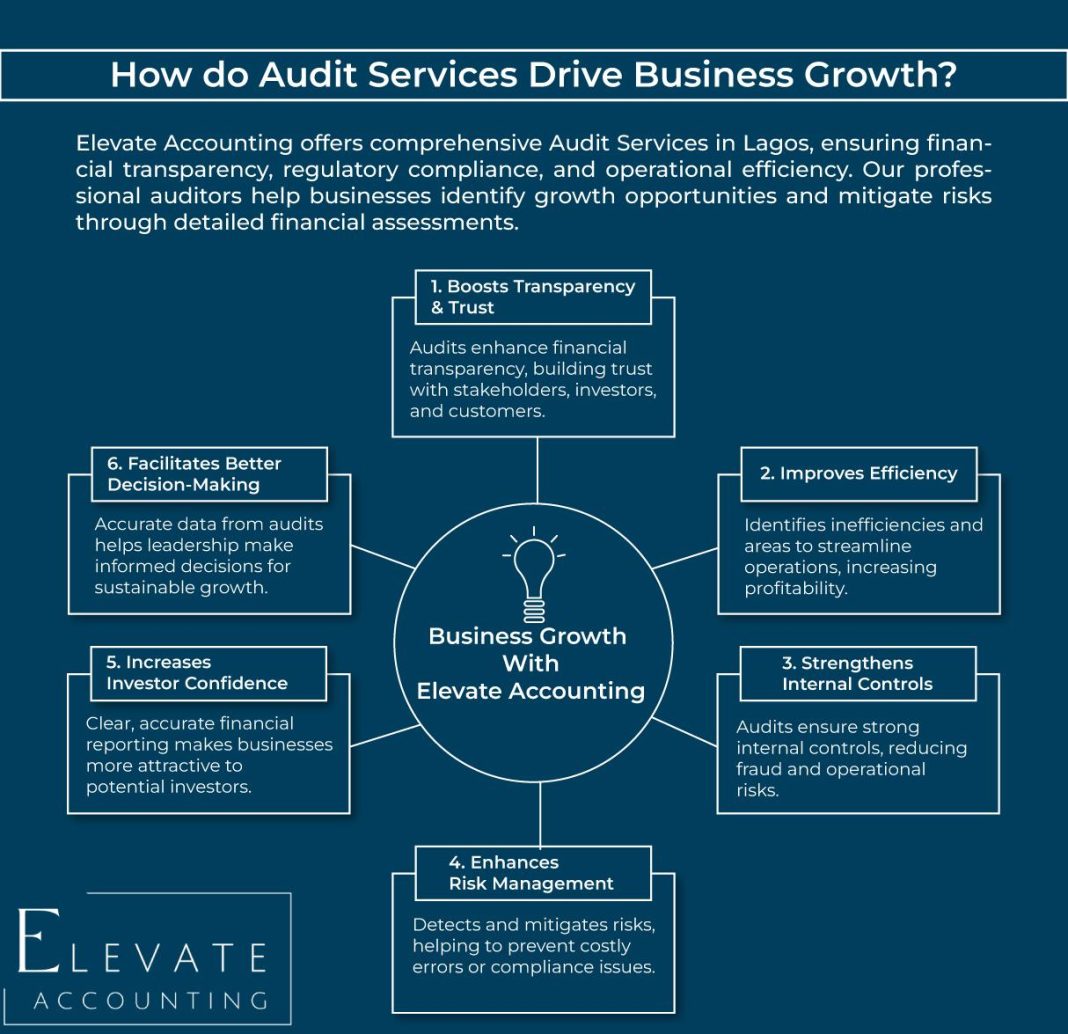

In the intricate world of finance, maintaining the delicate balance between innovation and regulation is paramount. Compliance audits serve as the vigilant guardians of this balance, meticulously scrutinizing financial institutions to ensure adherence to the ever-evolving regulatory frameworks. These audits are not mere formalities; they are comprehensive evaluations that delve into every facet of an institution’s operations, from financial reporting to risk management. By identifying potential discrepancies and areas of non-compliance, these audits safeguard the institution’s reputation and foster trust among stakeholders.

Key elements of a successful compliance audit include:

- Thorough Documentation: Ensuring all transactions and processes are well-documented and easily accessible.

- Risk Assessment: Identifying potential risks and implementing strategies to mitigate them.

- Continuous Monitoring: Establishing ongoing review processes to adapt to new regulations swiftly.

- Stakeholder Engagement: Involving all relevant parties to ensure comprehensive understanding and adherence.

By embedding these elements into their operational DNA, financial institutions not only comply with current regulations but also build a robust framework capable of adapting to future regulatory changes, thereby securing their financial integrity.

Unveiling Hidden Risks How Compliance Audits Mitigate Potential Financial Threats

In the intricate landscape of financial institutions, compliance audits serve as a vigilant guardian, meticulously uncovering potential pitfalls that could lead to substantial financial threats. These audits delve deep into the operational fabric, identifying discrepancies and ensuring adherence to regulatory frameworks. By doing so, they not only protect the institution’s integrity but also safeguard its financial stability. The vigilance of compliance audits helps in detecting early signs of non-compliance, which, if left unchecked, could escalate into severe financial repercussions.

Key benefits of compliance audits include:

- Risk Identification: Pinpointing vulnerabilities that could lead to financial losses.

- Regulatory Adherence: Ensuring all operations align with the latest legal requirements.

- Operational Efficiency: Streamlining processes to prevent financial leakages.

- Reputation Management: Maintaining trust with stakeholders by demonstrating commitment to compliance.

By integrating these audits into their routine, financial institutions not only mitigate risks but also enhance their resilience against unforeseen financial threats.

Strengthening Institutional Trust Building Confidence with Transparent Audit Practices

In today’s rapidly evolving financial landscape, the role of compliance audits cannot be overstated. These audits serve as the backbone of institutional integrity, ensuring that financial institutions adhere to established regulations and ethical standards. By implementing transparent audit practices, organizations can foster a culture of accountability and trust. This transparency not only reassures stakeholders but also strengthens the institution’s reputation in the marketplace.

To effectively build confidence, financial institutions should focus on several key elements:

- Regular and Thorough Audits: Conducting audits on a consistent basis helps identify potential risks and areas for improvement.

- Open Communication: Sharing audit findings with stakeholders in a clear and accessible manner enhances trust and understanding.

- Independent Oversight: Engaging third-party auditors ensures impartiality and credibility in the audit process.

- Continuous Improvement: Using audit results to refine and enhance compliance strategies demonstrates a commitment to excellence.

By embracing these practices, financial institutions can not only meet regulatory requirements but also set a benchmark for industry standards, ultimately reinforcing their commitment to ethical operations and long-term success.

Strategic Recommendations Enhancing Audit Effectiveness in Financial Institutions

To bolster the efficacy of compliance audits within financial institutions, a multi-faceted approach is essential. Integrating advanced technology is paramount; employing AI and machine learning can streamline data analysis, identify patterns, and flag anomalies more efficiently than traditional methods. Additionally, fostering a culture of continuous learning and adaptability among audit teams ensures that auditors remain agile and responsive to the ever-evolving regulatory landscape.

- Enhance Training Programs: Regular workshops and seminars on the latest compliance standards and auditing techniques.

- Leverage Data Analytics: Utilize big data tools to enhance risk assessment and decision-making processes.

- Strengthen Internal Controls: Implement robust internal control systems to preemptively address potential compliance issues.

- Encourage Cross-Departmental Collaboration: Facilitate communication between departments to ensure comprehensive compliance oversight.

By adopting these strategic measures, financial institutions can not only enhance their audit effectiveness but also fortify their overall compliance posture, safeguarding against potential risks and regulatory breaches.