In the bustling world of startups and small businesses, where innovation meets ambition, financial stability often dances on a razor’s edge. While the thrill of entrepreneurship propels many forward, the specter of credit risk looms large, casting a shadow over even the most promising ventures. Welcome to the intricate realm of credit risk management—a crucial, yet often overlooked, discipline that can spell the difference between soaring success and untimely demise. In this authoritative guide, we unravel the complexities of credit risk management tailored specifically for the dynamic landscape of startups and small businesses. Here, we will equip you with the insights and strategies needed to navigate financial uncertainties with confidence, ensuring that your business not only survives but thrives in the face of adversity.

Understanding the Fundamentals of Credit Risk Management for Emerging Enterprises

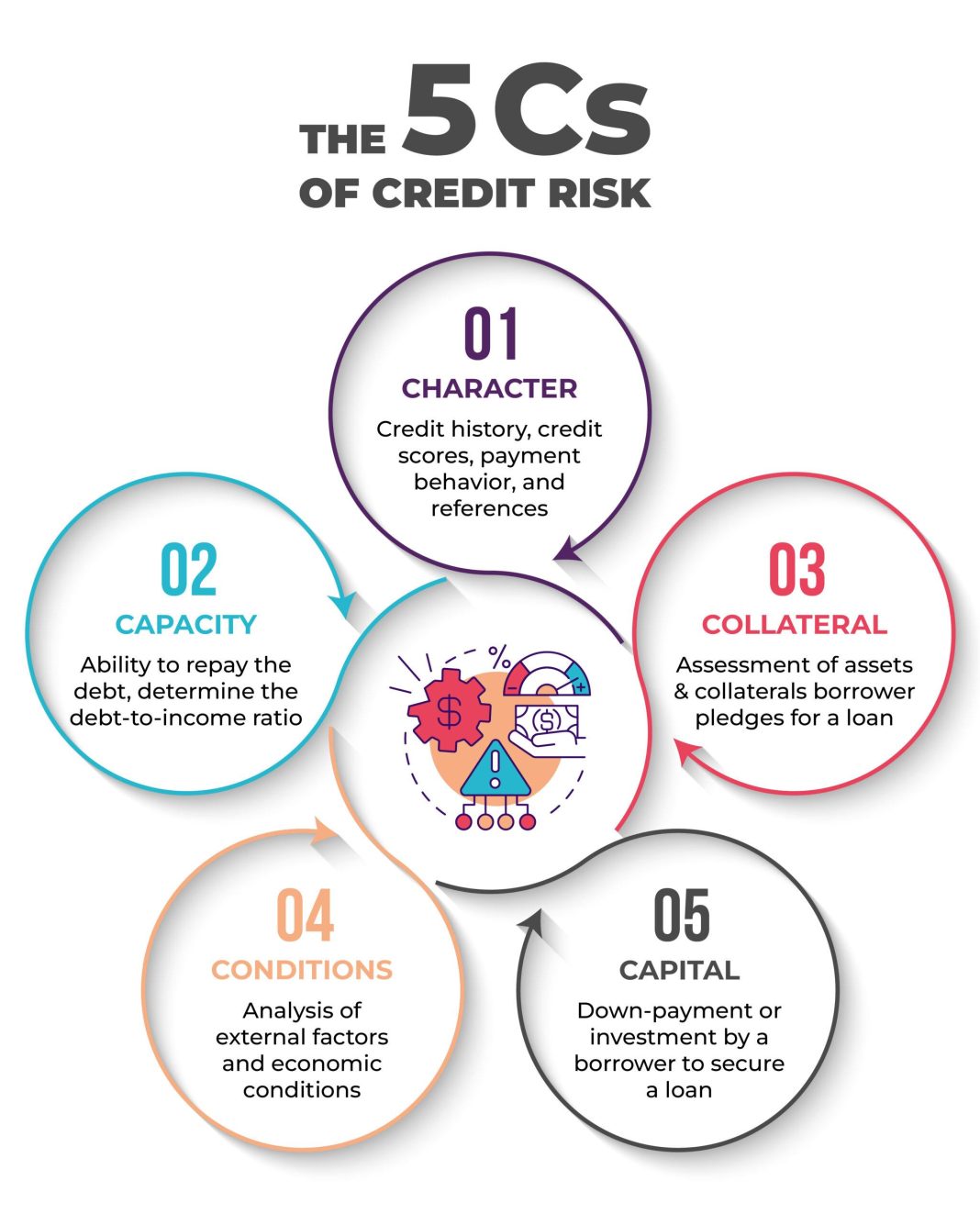

In the ever-evolving landscape of entrepreneurship, credit risk management stands as a pillar of financial stability for startups and small businesses. This crucial practice involves assessing and mitigating the risk of financial loss due to a borrower’s inability to meet contractual obligations. For emerging enterprises, understanding these fundamentals is not just beneficial—it’s essential for survival and growth. Effective credit risk management can be the difference between a thriving business and one that struggles to stay afloat.

- Identify Potential Risks: Start by identifying potential credit risks through a thorough analysis of customer creditworthiness. This includes evaluating financial statements, credit scores, and payment histories.

- Establish Clear Credit Policies: Develop clear, concise credit policies that define terms, limits, and conditions. Ensure these policies are communicated effectively to all stakeholders.

- Monitor and Review: Regularly monitor customer accounts and review credit terms. This proactive approach helps in adjusting strategies in response to changing market conditions.

- Leverage Technology: Utilize financial software and analytics tools to streamline credit assessments and decision-making processes, enhancing accuracy and efficiency.

By embedding these practices into their financial strategies, startups and small businesses can not only safeguard their cash flow but also build a robust foundation for long-term success.

Crafting a Robust Credit Policy: Essential Steps for Startups

In the dynamic landscape of startups, establishing a strong credit policy is paramount to safeguarding financial health and fostering growth. To begin, it’s crucial to define clear credit terms that align with your business model and customer base. This includes setting payment deadlines, interest rates on overdue accounts, and any discounts for early payments. A well-articulated credit policy not only mitigates risk but also sets expectations for clients, ensuring transparency and trust.

Moreover, implementing a comprehensive credit assessment process is vital. This involves evaluating the creditworthiness of potential clients through credit reports, financial statements, and industry references. Consider the following elements when crafting your policy:

- Credit Limits: Establish maximum credit limits based on the client’s financial stability and payment history.

- Payment Terms: Clearly outline payment schedules and methods, including any late fees or penalties.

- Monitoring and Review: Regularly review client accounts to adjust credit terms as needed, ensuring they remain aligned with the client’s evolving financial situation.

By embedding these elements into your credit policy, startups can effectively manage credit risk, enhance cash flow, and build a resilient financial foundation.

Leveraging Technology to Enhance Credit Risk Assessment

In today’s fast-paced digital landscape, startups and small businesses must harness the power of technology to stay ahead in credit risk management. By integrating artificial intelligence and machine learning algorithms, businesses can analyze vast amounts of data to predict potential risks more accurately. These technologies enable real-time monitoring and assessment, providing insights that were previously unattainable.

Moreover, leveraging cloud-based platforms offers scalable solutions that can grow with your business. These platforms provide access to sophisticated analytics tools without the need for substantial upfront investment in infrastructure. Key benefits include:

- Enhanced Data Analysis: Utilize predictive analytics to forecast credit risks with greater precision.

- Improved Decision-Making: Make informed credit decisions faster with real-time data insights.

- Cost Efficiency: Reduce operational costs by automating routine risk assessment tasks.

Embracing these technological advancements not only mitigates risks but also positions businesses for sustainable growth in a competitive market.

Building Strong Relationships with Lenders and Investors for Financial Stability

For startups and small businesses, establishing a robust network with lenders and investors is crucial for ensuring financial stability. This involves more than just securing funds; it requires nurturing relationships that can withstand the test of time and economic fluctuations. Effective communication is the cornerstone of these relationships. Regular updates about your business’s progress, challenges, and future plans can help build trust and transparency. It’s essential to be proactive in addressing any concerns or potential risks that might arise, as this demonstrates your commitment to maintaining a healthy financial partnership.

Consider the following strategies to strengthen these connections:

- Personalized Engagement: Tailor your interactions to meet the specific interests and concerns of each lender or investor.

- Consistent Reporting: Provide regular financial statements and reports to keep your stakeholders informed and confident in your business’s trajectory.

- Mutual Goals: Align your business objectives with the goals of your lenders and investors to foster a sense of shared purpose.

- Responsive Communication: Be prompt and thorough in your responses to inquiries or feedback, showing that you value their input and partnership.

By implementing these strategies, startups and small businesses can cultivate lasting relationships that not only provide financial support but also offer valuable insights and opportunities for growth.