In an era where digital transactions have become the lifeblood of global commerce, the specter of fraud looms larger than ever, casting shadows over businesses and consumers alike. As cybercriminals grow more sophisticated, the traditional reactive measures that once sufficed are now woefully inadequate. Enter the age of proactive fraud monitoring—a vigilant sentinel standing guard over the intricate web of financial interactions. This approach not only anticipates and thwarts potential threats before they manifest but also fortifies trust in an increasingly interconnected world. In this article, we delve into the critical importance of adopting proactive strategies, exploring how they serve as the cornerstone of robust security frameworks and safeguard the integrity of our digital ecosystems. Join us as we unravel the complexities of fraud prevention and underscore the imperative for businesses to stay one step ahead in the relentless battle against financial deception.

Detecting Deception Unveiled How Proactive Monitoring Shields Your Business

In today’s rapidly evolving digital landscape, the art of deception has become increasingly sophisticated, posing significant threats to businesses worldwide. Proactive monitoring serves as a vigilant guardian, meticulously scanning for anomalies and suspicious activities that could indicate fraudulent behavior. By employing advanced algorithms and machine learning, businesses can detect deception before it spirals into a full-blown crisis. This not only safeguards assets but also preserves the trust and integrity of your brand.

- Real-time alerts: Stay ahead of potential threats with immediate notifications.

- Pattern recognition: Identify unusual patterns that may signal fraudulent activity.

- Comprehensive data analysis: Leverage vast datasets to uncover hidden risks.

- Enhanced decision-making: Make informed choices based on accurate, up-to-date information.

Implementing a proactive monitoring strategy is not just a defensive measure; it’s a strategic investment in your business’s future. By unveiling deception before it takes root, you empower your organization to operate with confidence and resilience in an unpredictable world.

Unmasking Threats The Strategic Advantage of Early Fraud Detection

In today’s digital landscape, where transactions are swift and often anonymous, the ability to identify fraudulent activities before they escalate is a game-changer. Early fraud detection is not just a defensive measure; it’s a strategic advantage that can safeguard your organization’s reputation and financial health. By integrating advanced analytics and machine learning algorithms, businesses can spot anomalies and irregular patterns that human eyes might miss. This proactive approach not only minimizes potential losses but also strengthens customer trust by ensuring their data and assets are protected.

- Real-time Monitoring: Implementing systems that provide real-time alerts can prevent fraud from occurring, rather than just reacting to it.

- Behavioral Analysis: Understanding user behavior through data can help in identifying suspicious activities, allowing for quicker intervention.

- Comprehensive Reporting: Detailed reports and dashboards enable businesses to track fraud trends and adapt strategies accordingly.

By prioritizing early detection, companies can transform potential threats into opportunities for improvement, reinforcing their market position and ensuring long-term success.

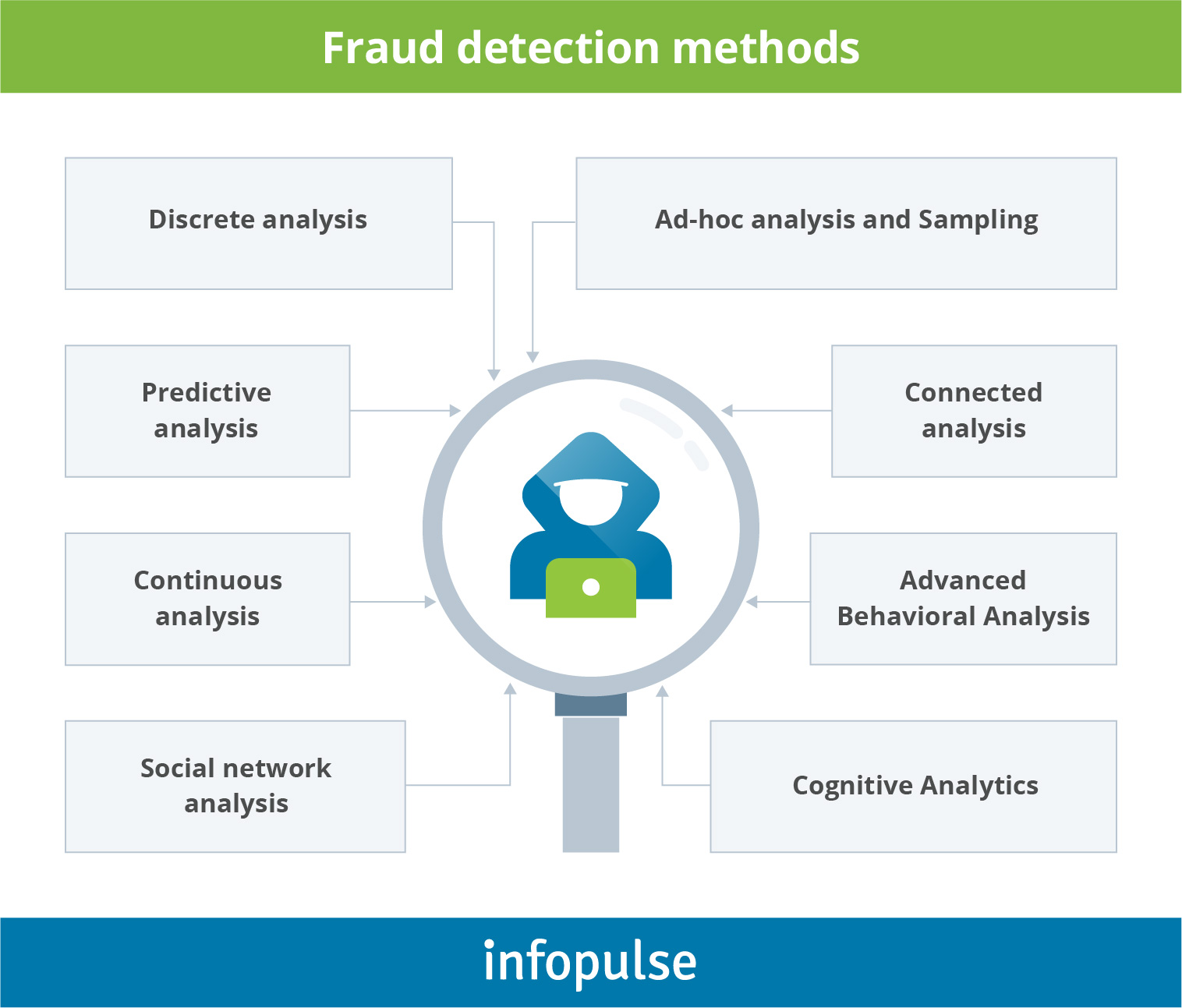

Beyond the Basics Implementing Advanced Fraud Monitoring Techniques

In today’s rapidly evolving digital landscape, staying ahead of fraudulent activities requires more than just traditional methods. Implementing advanced fraud monitoring techniques is essential for businesses aiming to protect their assets and maintain customer trust. By leveraging cutting-edge technologies such as machine learning and artificial intelligence, organizations can identify and mitigate threats before they escalate. These technologies allow for the continuous analysis of large datasets, detecting anomalies that human eyes might miss. Predictive analytics can forecast potential fraud scenarios, enabling companies to take preemptive measures and fortify their defenses.

To effectively deploy these sophisticated strategies, businesses should consider the following key components:

- Behavioral Analytics: Understanding user behavior patterns helps in distinguishing legitimate actions from fraudulent ones.

- Real-time Monitoring: Instant alerts and responses to suspicious activities can prevent significant losses.

- Integration with Other Systems: Seamless integration with existing security infrastructure enhances overall protection.

- Continuous Learning: Adaptive systems that evolve with new data ensure that fraud detection remains relevant and effective.

By embracing these advanced techniques, businesses not only safeguard their operations but also enhance their reputation as secure and trustworthy entities in the eyes of their customers.

Guardians of Integrity Building a Robust Framework for Fraud Prevention

In the ever-evolving landscape of digital transactions, the need for a vigilant and proactive approach to fraud monitoring has never been more crucial. As the custodians of trust, organizations must embrace a robust framework that not only detects but also preempts fraudulent activities. This involves leveraging advanced technologies such as machine learning and artificial intelligence to analyze patterns and anomalies in real-time. By doing so, businesses can stay one step ahead of potential threats, safeguarding their assets and reputation.

- Data Analytics: Harnessing the power of big data to identify suspicious activities.

- Behavioral Biometrics: Understanding user behavior to detect deviations.

- Automated Alerts: Implementing systems that notify stakeholders of potential risks instantly.

Furthermore, fostering a culture of integrity within the organization is paramount. This means educating employees about the importance of fraud prevention and encouraging them to report suspicious activities without fear of retribution. By integrating these strategies, companies can build a fortress of trust that not only protects but also empowers them to thrive in an increasingly interconnected world.