In the intricate dance of global finance, where trillions of dollars flow seamlessly across borders and through digital channels, there exists an often underestimated partner: financial institutions are prioritizing credit risk today”>inflation. Like a shadow that grows and shrinks with the economic sun, inflation subtly yet powerfully influences the rhythm of financial institutions. As a key driver of credit risk, it possesses the ability to reshape the financial landscape, turning stable portfolios into precarious towers of cards. This article delves into the profound impact of inflation on credit risk, unraveling the complex interplay between rising prices and the stability of financial institutions. By exploring historical precedents, economic theories, and real-world examples, we aim to illuminate why understanding inflation is not merely an academic exercise, but a crucial component of risk management in today’s volatile economic environment. Prepare to journey into the heart of financial systems, where inflation’s pulse beats at the core of credit risk assessment, guiding decisions that can make or break financial giants.

Inflations Ripple Effect on Financial Stability

In the intricate web of global finance, inflation acts as a silent architect, shaping the contours of credit risk with subtle yet profound implications. As inflation rates rise, the purchasing power of money diminishes, leading to increased costs for goods and services. This, in turn, affects borrowers’ ability to repay loans, escalating the risk of defaults. Financial institutions, therefore, find themselves in a precarious position, as the value of their loan portfolios becomes increasingly volatile.

- Increased Borrower Default Risk: Higher inflation can erode real income, making it challenging for borrowers to meet their debt obligations.

- Asset-Liability Mismatch: Inflation can cause discrepancies between the interest rates on assets and liabilities, impacting profitability.

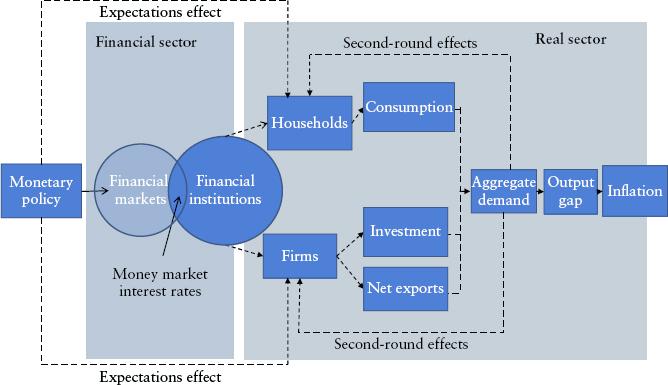

- Regulatory Challenges: Inflation may lead to tighter monetary policies, affecting the availability and cost of credit.

Financial institutions must adopt robust risk management strategies to navigate these challenges. By understanding the ripple effects of inflation, they can better anticipate shifts in credit risk and safeguard their financial stability.

Decoding the Credit Risk Equation in Inflationary Times

In the intricate world of finance, understanding the dynamics of credit risk during inflationary periods is akin to solving a complex equation. Inflation, often perceived as the silent thief of purchasing power, exerts a profound influence on credit risk, reshaping the landscape for financial institutions. As prices soar, the cost of borrowing escalates, leading to a potential increase in default rates. This is particularly true for borrowers with fixed incomes or those whose earnings do not keep pace with inflation. Financial institutions, therefore, must recalibrate their risk assessment models to account for these shifts, ensuring they remain resilient in the face of economic volatility.

- Rising Interest Rates: Central banks often hike interest rates to combat inflation, which can lead to higher borrowing costs and increased default risks.

- Asset Value Fluctuations: Inflation can cause asset prices to fluctuate unpredictably, impacting collateral values and increasing the risk of loan defaults.

- Operational Costs: Higher inflation leads to increased operational costs for businesses, which may strain their ability to service debts.

For financial institutions, the challenge lies in balancing the need for profitability with the imperative of risk management. This requires a strategic approach that involves enhancing credit monitoring systems, diversifying loan portfolios, and maintaining robust capital reserves. By decoding the credit risk equation in these inflationary times, financial institutions can not only safeguard their interests but also contribute to the overall stability of the financial system.

Strategic Risk Management in an Era of Rising Prices

In today’s volatile economic landscape, financial institutions are navigating a labyrinth of challenges as they grapple with the implications of inflation on credit risk. Inflation, once a distant economic indicator, now sits at the forefront of strategic risk management discussions. Rising prices erode purchasing power, impacting both consumer behavior and corporate profitability. This, in turn, affects borrowers’ ability to service debt, escalating the potential for credit defaults.

To effectively manage these risks, financial institutions must adopt a proactive approach. Consider the following strategies:

- Dynamic Risk Assessment: Continuously update risk models to reflect the current economic environment, incorporating inflationary trends.

- Enhanced Credit Monitoring: Implement robust monitoring systems to detect early signs of borrower distress.

- Portfolio Diversification: Spread exposure across different sectors and geographies to mitigate localized inflationary impacts.

By integrating these strategies, financial institutions can better shield themselves from the ripple effects of inflation, safeguarding their portfolios against the tide of rising prices.

Proactive Measures for Mitigating Inflation-Induced Credit Risk

In the face of inflation-induced credit risk, financial institutions must adopt a proactive stance to safeguard their portfolios. Risk assessment and monitoring should be prioritized, utilizing advanced data analytics to identify potential vulnerabilities in real-time. Institutions can leverage machine learning algorithms to detect early warning signals, enabling timely interventions. Additionally, diversifying asset portfolios can mitigate concentration risk, ensuring that no single sector or asset class becomes a liability.

Implementing dynamic interest rate strategies is another critical measure. By adjusting rates in response to inflationary trends, institutions can maintain their margins while offering competitive terms to borrowers. Moreover, enhancing credit underwriting standards is essential. This includes revisiting credit scoring models to account for inflationary pressures and potential borrower distress. Lastly, maintaining robust liquidity reserves can provide a buffer against unexpected financial shocks, ensuring stability and confidence in the institution’s ability to weather inflationary storms.