In the dynamic landscape of modern business, understanding the nuanced behaviors and preferences of customers is akin to navigating a vast, intricate tapestry. At the heart of this endeavor lies a powerful tool: credit data. Once confined to the realms of risk assessment and financial vetting, credit data has emerged as a pivotal asset in the art and science of customer segmentation. By delving into the depths of credit histories and financial patterns, businesses can unlock unprecedented insights, allowing them to craft personalized experiences that resonate with precision. This article explores how leveraging credit data not only enhances segmentation strategies but also propels companies toward a future where customer relationships are both profoundly understood and meticulously optimized. As we journey through this exploration, we will uncover the transformative potential of credit data, setting the stage for a new era of customer engagement and business growth.

Unlocking the Power of Credit Data for Precision Customer Segmentation

In today’s competitive market, leveraging credit data can significantly enhance the precision of customer segmentation strategies. By analyzing credit scores, payment histories, and credit utilization, businesses can gain deep insights into consumer behavior and financial health. This allows for the creation of more tailored marketing campaigns and product offerings, which can lead to increased customer satisfaction and loyalty.

- Enhanced Risk Assessment: Credit data provides a clear picture of a customer’s financial reliability, helping businesses to segment customers based on risk levels and tailor offerings accordingly.

- Personalized Marketing: With detailed credit insights, companies can craft personalized messages that resonate with specific customer segments, increasing engagement and conversion rates.

- Optimized Resource Allocation: By understanding the credit profiles of different segments, businesses can allocate resources more efficiently, focusing efforts on high-value customers while managing risk with more caution.

Incorporating credit data into segmentation strategies not only sharpens the focus on target audiences but also fosters a more responsive and dynamic approach to customer relationship management. As a result, businesses can achieve a competitive edge by delivering the right message to the right customer at the right time.

Harnessing Credit Insights to Tailor Marketing Strategies

In today’s competitive market, leveraging credit data is no longer just an option—it’s a necessity. By tapping into the wealth of information that credit insights provide, businesses can refine their customer segmentation strategies with precision. This allows for the creation of more personalized marketing campaigns that resonate with distinct customer profiles. Credit data helps in identifying key customer traits such as:

- Spending Habits: Understanding how customers allocate their finances enables businesses to predict future purchasing behaviors.

- Creditworthiness: Segments can be crafted based on risk levels, ensuring that marketing efforts are aligned with the financial reliability of different groups.

- Lifecycle Stages: Credit insights can reveal where customers are in their financial journey, allowing for tailored offers that meet their evolving needs.

By integrating these insights, marketers can not only enhance the effectiveness of their campaigns but also foster deeper connections with their audience. This data-driven approach ensures that every marketing dollar is spent wisely, targeting the right people at the right time with the right message.

Elevating Customer Engagement Through Data-Driven Segmentation

In today’s competitive market, leveraging credit data to refine customer segmentation is a game-changer for businesses aiming to enhance engagement. By harnessing the power of credit data, companies can create highly personalized experiences that resonate with individual customer needs and preferences. This approach not only boosts customer satisfaction but also drives brand loyalty and revenue growth.

Key Benefits of Using Credit Data for Segmentation:

- Precision Targeting: Tailor marketing strategies to specific customer segments based on their credit profiles, ensuring that the right message reaches the right audience.

- Enhanced Customer Insights: Gain a deeper understanding of customer behaviors and financial health, allowing for more informed decision-making.

- Increased Conversion Rates: By aligning product offerings with the financial capabilities of different segments, businesses can significantly improve conversion rates.

- Risk Mitigation: Identify high-risk customers early and adjust engagement strategies accordingly to minimize potential losses.

Utilizing credit data effectively transforms customer segmentation from a broad-stroke approach to a finely-tuned strategy, ensuring that every interaction is meaningful and impactful.

Strategic Recommendations for Leveraging Credit Data in Customer Analysis

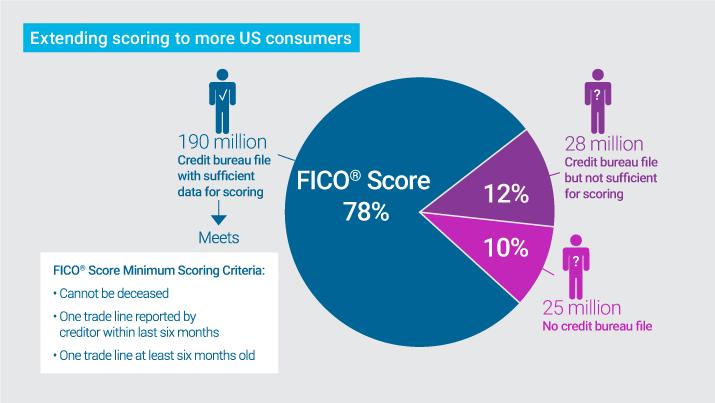

In the quest to optimize customer segmentation, leveraging credit data emerges as a powerful strategy. Credit data provides a wealth of insights that can refine segmentation processes, ensuring businesses target the right customers with the right products. By integrating credit scores and histories into customer profiles, companies can discern patterns and behaviors that are otherwise invisible. This data can help in identifying high-value customers, understanding their purchasing power, and predicting future spending habits.

- Enhanced Targeting: Credit data allows for the creation of more precise customer segments, enabling tailored marketing strategies that resonate with specific financial profiles.

- Risk Assessment: By understanding credit histories, businesses can assess potential risks associated with certain customer segments, leading to more informed decision-making.

- Personalized Offerings: Utilizing credit data can aid in crafting personalized offers that align with the financial capabilities and needs of different customer groups.

By strategically incorporating credit data into customer analysis, businesses not only enhance their segmentation capabilities but also foster stronger customer relationships through personalized and relevant interactions.

Concluding Remarks

In the intricate dance of modern commerce, where precision and personalization reign supreme, the strategic use of credit data emerges as a powerful ally in the quest for optimized customer segmentation. As we have explored, this treasure trove of information not only illuminates the financial behaviors and preferences of consumers but also empowers businesses to craft experiences that resonate on a deeply personal level. By leveraging credit data, companies can transcend traditional boundaries, transforming their marketing strategies from broad strokes into finely tuned masterpieces that captivate and convert.

In this era of data-driven decision-making, the ability to harness credit data effectively is not just an advantage—it’s a necessity. It equips businesses with the insights needed to navigate the complexities of consumer behavior, anticipate needs, and foster lasting relationships built on trust and relevance. As we conclude our exploration, let us embrace the potential of credit data to redefine customer segmentation, unlocking a future where every interaction is as unique as the individuals it serves. The path forward is clear: innovate, adapt, and let credit data be the compass that guides your journey to unparalleled success.