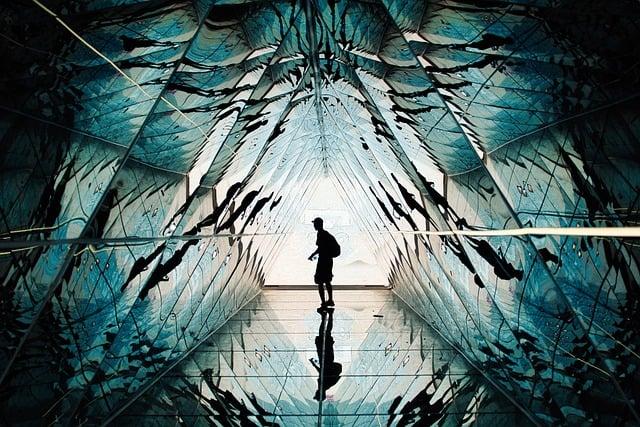

In an era where financial markets are as interconnected as the world wide web, ensuring compliance with cross-border financial regulations has become both a strategic imperative and a formidable challenge for businesses. Navigating this intricate maze requires more than just a cursory understanding of international laws; it demands a nuanced grasp of diverse regulatory landscapes, a keen eye for detail, and a proactive approach to risk management. As financial transactions transcend borders with unprecedented speed and volume, the stakes for compliance have never been higher. This article serves as your compass in the complex world of cross-border financial regulations, offering authoritative insights and practical strategies to help your organization stay ahead of the curve. From understanding the intricacies of global regulatory frameworks to implementing robust compliance programs, we delve into the essential steps necessary to safeguard your business against the pitfalls of non-compliance, ensuring not just survival, but success in the global financial arena.

Navigating the Complex Landscape of International Financial Laws

In the ever-evolving realm of international finance, staying compliant with cross-border regulations is akin to navigating a labyrinth. Understanding the nuances of each jurisdiction’s financial laws is crucial for businesses operating on a global scale. To effectively manage compliance, companies must first develop a comprehensive strategy that includes:

- Thorough Research: Conduct detailed research on the financial regulations of each country where you operate. This involves understanding both local laws and international agreements that may impact your business.

- Regular Training: Implement ongoing training programs for your compliance team to keep them updated on the latest regulatory changes and best practices.

- Technology Utilization: Leverage advanced compliance management software to monitor transactions and ensure adherence to international standards in real-time.

- Expert Consultation: Engage with legal experts who specialize in international financial law to gain insights and advice tailored to your specific operational landscape.

By adopting these strategies, businesses can not only avoid the pitfalls of non-compliance but also gain a competitive edge in the global market. The key is to be proactive, adaptable, and informed in this intricate web of international financial regulations.

Strategic Approaches to Mitigate Cross-Border Compliance Risks

In the complex landscape of international finance, businesses must adopt strategic approaches to effectively navigate compliance challenges. A proactive strategy involves establishing a robust compliance framework that aligns with both domestic and international regulations. This includes implementing comprehensive risk assessment tools to identify potential vulnerabilities in cross-border transactions. Furthermore, fostering a culture of compliance within the organization is crucial. This can be achieved by conducting regular training sessions and ensuring that all employees are well-versed in the latest regulatory requirements.

Another key approach is leveraging technology to streamline compliance processes. Automated compliance software can significantly reduce the risk of human error and ensure timely reporting and documentation. Additionally, forming strategic alliances with local experts and legal advisors in foreign markets can provide invaluable insights into region-specific regulations. Businesses should also maintain a dynamic compliance monitoring system to adapt swiftly to regulatory changes, thereby mitigating potential risks before they escalate. By integrating these strategies, companies can not only ensure compliance but also gain a competitive edge in the global marketplace.

Harnessing Technology for Seamless Regulatory Adherence

In today’s globalized financial landscape, the integration of technology is not just a luxury but a necessity for ensuring adherence to complex regulatory frameworks. Leveraging advanced technological solutions can transform the way financial institutions navigate the labyrinth of cross-border regulations. By adopting cutting-edge tools, businesses can streamline compliance processes, reduce manual errors, and enhance data accuracy. This approach not only ensures that all transactions meet international standards but also significantly reduces the risk of non-compliance penalties.

Key technological strategies include:

- Automated Reporting Systems: These systems can automatically generate and submit compliance reports, ensuring timely and accurate filings.

- Blockchain Technology: Utilizing blockchain can enhance transparency and traceability, providing an immutable record of transactions that regulators can easily audit.

- Artificial Intelligence and Machine Learning: AI-driven analytics can identify patterns and anomalies in transaction data, helping to detect potential compliance breaches before they occur.

- Cloud-Based Solutions: These offer scalable resources for data storage and processing, facilitating real-time compliance monitoring across multiple jurisdictions.

By harnessing these technologies, financial institutions can not only comply with current regulations but also adapt swiftly to new regulatory changes, maintaining a competitive edge in the international market.

Building a Robust Compliance Culture Across Global Operations

Creating a resilient compliance culture within an organization that operates across borders is not just a regulatory requirement but a strategic advantage. A strong compliance framework is essential for navigating the complexities of international financial regulations. To build this framework, companies must focus on several key elements:

- Leadership Commitment: The tone from the top is crucial. Executives must demonstrate a commitment to compliance by embedding it into the company’s core values and strategic objectives.

- Comprehensive Training Programs: Regular and tailored training sessions for employees at all levels ensure that everyone understands the importance of compliance and the specific regulations relevant to their roles.

- Robust Monitoring and Reporting Systems: Implementing advanced technologies to monitor transactions and flag suspicious activities can significantly enhance compliance efforts. These systems should be supported by clear reporting lines and accountability structures.

- Local Expertise: Employing local compliance experts who understand the nuances of regional regulations can provide invaluable insights and guidance, ensuring that global policies are effectively adapted to local contexts.

By integrating these elements, organizations can foster a compliance culture that not only meets regulatory demands but also enhances operational efficiency and reputation on a global scale.