In the rapidly evolving landscape of digital marketing, where personalization is the key to capturing consumer attention, the art of tailoring strategies to individual preferences has become more sophisticated than ever. Enter the realm of credit scores—a seemingly unconventional yet profoundly insightful tool for marketers aiming to refine their approaches. As businesses strive to understand their customers on a deeper level, credit scores offer a unique lens through which to view consumer behavior, financial health, and purchasing potential. This article delves into the innovative practice of leveraging credit scores to craft personalized marketing strategies, exploring how this data-driven approach not only enhances customer engagement but also fosters a more responsible and mutually beneficial relationship between brands and consumers. With authority and insight, we will unravel the complexities and ethical considerations of this strategy, guiding marketers through the nuances of harnessing credit scores to unlock unprecedented opportunities in personalization.

Unlocking Consumer Potential with Credit Score Analysis

In the realm of modern marketing, understanding the nuances of consumer behavior is paramount. By leveraging credit score analysis, businesses can gain profound insights into the financial habits and potential purchasing power of their target audience. This data-driven approach allows for the creation of highly personalized marketing strategies that resonate with consumers on a deeper level. Consider the following ways in which credit score insights can transform marketing efforts:

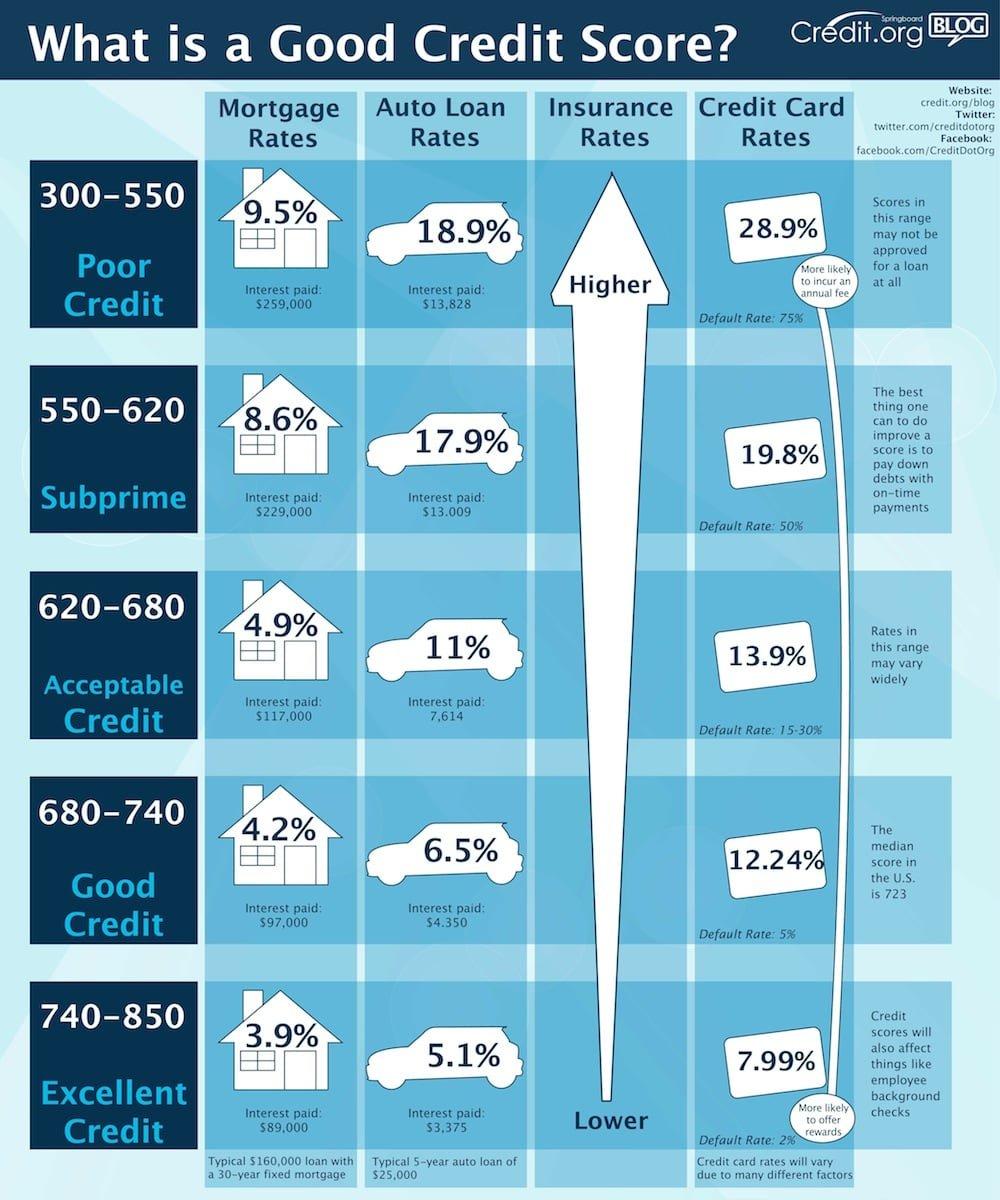

- Segmentation: Identify distinct consumer segments based on creditworthiness, enabling tailored messaging that speaks directly to their financial reality.

- Product Recommendations: Offer products and services that align with the financial capabilities and aspirations of each segment, increasing conversion rates.

- Risk Assessment: Evaluate the potential risk associated with offering credit-based promotions, ensuring that marketing efforts are both effective and secure.

By integrating credit score data into marketing strategies, businesses not only enhance customer engagement but also drive growth by tapping into the latent potential of their consumer base. This strategic approach not only builds trust but also fosters long-term loyalty by meeting consumers where they are in their financial journey.

Crafting Tailored Marketing Campaigns through Financial Insights

In today’s competitive marketplace, leveraging financial insights like credit scores can significantly enhance the effectiveness of marketing strategies. By understanding the credit profiles of potential customers, businesses can tailor their campaigns to resonate more deeply with their audience. Credit scores offer a window into consumer behavior, allowing marketers to segment their audience more precisely and craft messages that align with their financial realities.

- Targeted Offers: Customize promotions based on creditworthiness, offering exclusive deals to high-credit individuals or flexible payment plans to those with lower scores.

- Personalized Messaging: Craft communication that speaks directly to the financial needs and aspirations of different credit segments, fostering a sense of understanding and trust.

- Enhanced Customer Experience: Use credit insights to anticipate customer needs, offering timely solutions that can improve their financial health and loyalty to your brand.

By integrating credit score data into marketing strategies, businesses not only increase the relevance of their campaigns but also build stronger, more personalized relationships with their customers. This approach not only drives engagement but also positions the brand as a financially savvy partner in the consumer’s journey.

Leveraging Credit Data to Enhance Customer Engagement

In today’s competitive market, businesses are constantly seeking innovative ways to connect with their customers on a deeper level. By utilizing credit data, companies can unlock a treasure trove of insights that allow for highly personalized marketing strategies. Credit scores, when used ethically and responsibly, provide a glimpse into consumer behavior, financial health, and spending patterns. This information can be leveraged to tailor marketing campaigns that resonate with individual customers, offering them products and services that truly meet their needs.

- Targeted Offers: By understanding a customer’s credit profile, businesses can craft offers that align with their financial situation, ensuring relevance and increasing the likelihood of conversion.

- Customized Communication: Credit data can help segment audiences more effectively, allowing for personalized messaging that speaks directly to the customer’s financial journey.

- Enhanced Loyalty Programs: Credit insights can be used to design loyalty programs that reward responsible financial behavior, fostering a stronger relationship between the brand and the customer.

By integrating credit data into marketing strategies, businesses not only enhance customer engagement but also build trust by demonstrating an understanding of their customers’ unique financial landscapes.

Ethical Considerations in Credit-Based Marketing Strategies

In the realm of personalized marketing, leveraging credit scores presents both opportunities and ethical challenges. While credit-based marketing strategies can enhance customer experiences by tailoring offers to individual financial profiles, they also raise concerns about privacy and discrimination. It is crucial for marketers to navigate these waters with care, ensuring that their practices are not only effective but also ethically sound.

- Transparency: Companies must be transparent about how they use credit information. Customers should be informed about what data is collected and how it influences the offers they receive.

- Consent: Obtaining explicit consent from consumers before using their credit scores for marketing purposes is vital. This empowers customers to make informed decisions about their data.

- Non-discrimination: Marketing strategies should avoid reinforcing financial inequalities. Offers should be designed to be inclusive, ensuring that no group is unfairly targeted or excluded based on their credit profile.

- Data Security: Protecting consumer data from breaches and unauthorized access is paramount. Implementing robust security measures can safeguard sensitive credit information.

By adhering to these ethical principles, businesses can build trust with their consumers, fostering long-term relationships that benefit both parties. The key lies in balancing personalization with respect for individual rights and privacy.