In the intricate dance of modern marketing, where data reigns supreme and consumer behavior is a coveted enigma, credit scores emerge as an unexpected yet powerful partner. Once relegated to the realm of financial assessments and loan approvals, these numerical indicators are now stepping into the spotlight, revealing their potential to transform marketing strategies and elevate performance. As businesses strive to understand and anticipate the needs of their audience, credit scores offer a treasure trove of insights, enabling marketers to tailor their approaches with unprecedented precision. This article delves into the dynamic role of credit scores in the marketing arena, exploring how these figures, often misunderstood and underestimated, can unlock new dimensions of consumer engagement and drive success in an increasingly competitive landscape.

Harnessing Credit Scores to Tailor Marketing Strategies

In the evolving landscape of digital marketing, leveraging credit scores offers a unique opportunity to refine and personalize marketing strategies. By integrating credit score data, marketers can craft more precise customer profiles, enabling them to deliver highly targeted campaigns. This approach not only enhances customer engagement but also maximizes the return on investment. Credit scores provide insights into consumer financial behavior, which can be instrumental in predicting purchasing power and tailoring offers accordingly.

- Segmentation: Use credit scores to segment audiences into distinct groups, allowing for more personalized communication.

- Targeting: Design campaigns that align with the financial capabilities and preferences of different credit score brackets.

- Product Recommendations: Offer products or services that match the financial profile and needs of each segment.

- Risk Management: Mitigate potential risks by understanding the financial reliability of your target audience.

By harnessing the power of credit scores, businesses can not only enhance the relevance of their marketing efforts but also build stronger, more meaningful relationships with their customers. This strategic use of data ensures that marketing messages resonate on a personal level, driving both engagement and conversion rates.

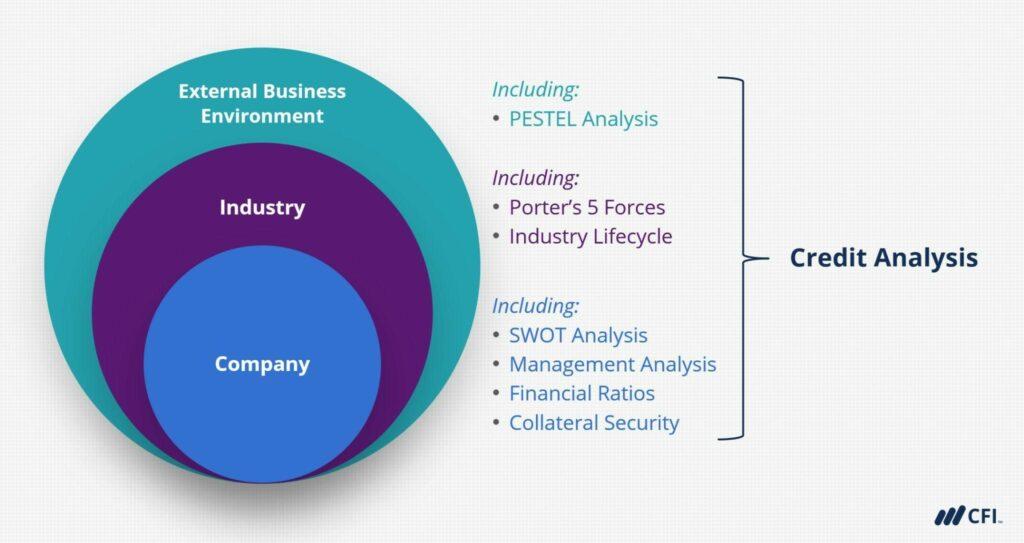

Decoding Consumer Behavior through Credit Analysis

Understanding the intricacies of consumer behavior is akin to unlocking a treasure trove of marketing potential. Credit scores, often perceived as mere financial indicators, offer profound insights into consumer tendencies and preferences. By delving into credit analysis, marketers can uncover patterns that reveal spending habits, financial reliability, and even lifestyle choices. This information is invaluable in crafting personalized marketing strategies that resonate with the target audience, enhancing engagement and conversion rates.

- Targeted Campaigns: By analyzing credit data, businesses can segment their audience more effectively, ensuring that marketing messages reach those most likely to respond.

- Product Development: Insights gleaned from credit behavior can guide the creation of products that meet the specific needs and desires of different consumer segments.

- Risk Assessment: Understanding credit trends allows marketers to assess the potential risk of targeting certain demographics, ensuring resources are allocated efficiently.

By leveraging credit scores, companies not only enhance their marketing performance but also build a more nuanced understanding of their customer base, leading to more meaningful and profitable interactions.

Optimizing Campaigns with Credit-Based Segmentation

In the realm of modern marketing, leveraging credit scores can significantly enhance the precision and effectiveness of your campaigns. By segmenting your audience based on their creditworthiness, you can tailor your marketing strategies to align with the financial behaviors and preferences of different consumer groups. This approach not only optimizes resource allocation but also maximizes engagement and conversion rates.

- Targeted Messaging: Craft personalized messages that resonate with the financial realities of each segment, increasing the likelihood of a positive response.

- Resource Efficiency: Allocate marketing budgets more effectively by focusing on segments with higher potential for conversion.

- Risk Mitigation: Reduce the risk of extending offers to high-risk consumers, safeguarding your brand from potential financial losses.

By integrating credit-based segmentation into your marketing strategy, you can create a more dynamic and responsive campaign framework. This not only fosters stronger customer relationships but also drives sustainable business growth.

Leveraging Credit Insights for Enhanced Customer Engagement

In the ever-evolving landscape of digital marketing, understanding the nuances of credit scores can significantly enhance customer engagement strategies. By integrating credit insights into marketing efforts, businesses can tailor their approaches to meet the specific needs and preferences of their audience. This not only fosters a more personalized experience but also boosts the effectiveness of marketing campaigns.

- Targeted Offers: Utilizing credit scores allows marketers to create customized offers that resonate with individual financial profiles, ensuring that promotions are both relevant and appealing.

- Risk Assessment: By assessing credit data, companies can identify potential risks and adjust their strategies accordingly, optimizing resource allocation and minimizing financial exposure.

- Customer Loyalty: Personalized financial solutions based on credit insights can enhance customer satisfaction and loyalty, encouraging repeat business and long-term relationships.

Incorporating credit scores into marketing performance strategies not only sharpens targeting precision but also enhances the overall customer journey, leading to improved engagement and business success.