In the intricate tapestry of financial ecosystems, where the balance between risk and reward is delicately poised, debt ratios emerge as the unsung sentinels of credit risk management. These numerical indicators, often overshadowed by more glamorous financial metrics, wield immense power in shaping the strategies of lenders and investors alike. As the guardians of fiscal prudence, debt ratios offer a window into the financial health and sustainability of entities, guiding decision-makers through the labyrinth of credit evaluation. This article delves into the pivotal role these ratios play, unraveling their complexities and underscoring their indispensability in safeguarding financial stability. With an authoritative lens, we explore how debt ratios not only illuminate the path to informed lending but also fortify the very foundations of economic resilience in an ever-evolving financial landscape.

Understanding Debt Ratios as Pillars of Credit Risk Management

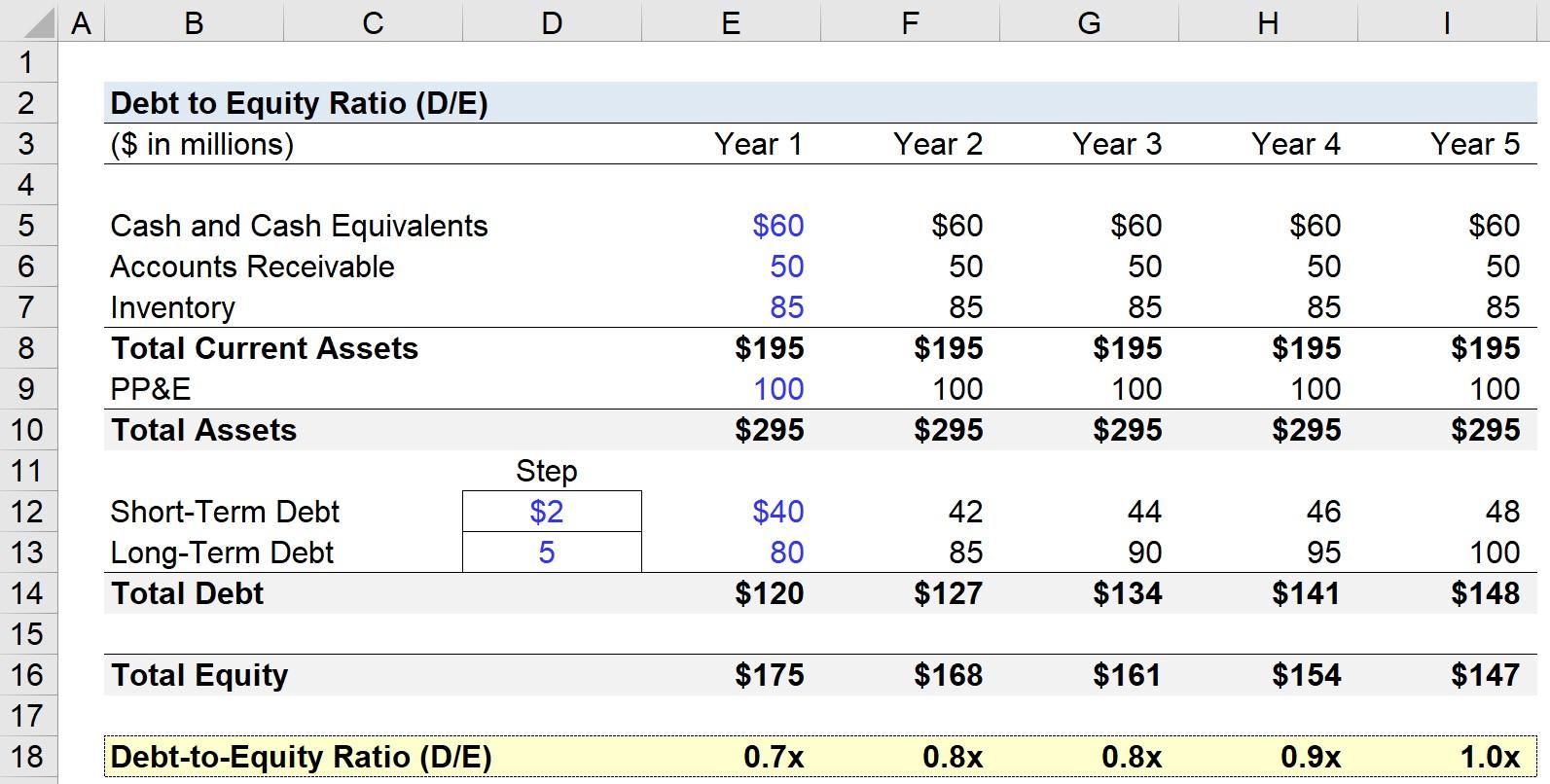

In the intricate world of credit risk management, debt ratios serve as essential indicators that provide a snapshot of a company’s financial health. These ratios are crucial for assessing a company’s ability to meet its debt obligations, thus influencing the decision-making process for lenders and investors. Among the myriad of debt ratios, the debt-to-equity ratio and the interest coverage ratio stand out as particularly significant. The debt-to-equity ratio offers insight into the proportion of a company’s financing that comes from creditors versus shareholders, while the interest coverage ratio measures how easily a company can pay interest on its outstanding debt.

- Debt-to-Equity Ratio: A higher ratio indicates more leverage and potentially higher risk, but it can also suggest growth potential.

- Interest Coverage Ratio: A higher ratio suggests a company is more capable of meeting its interest obligations, reflecting lower credit risk.

Understanding these ratios allows credit risk managers to craft strategies that mitigate potential risks, ensuring a balanced approach to lending and investment. By leveraging these financial metrics, stakeholders can make informed decisions that align with their risk tolerance and financial goals.

Analyzing Key Debt Ratios for Accurate Risk Assessment

In the realm of credit risk management, understanding and interpreting debt ratios is crucial for a precise evaluation of a borrower’s financial health. Debt ratios serve as vital indicators, offering insights into a company’s ability to manage its liabilities and sustain operations. By analyzing these ratios, credit managers can discern potential risks and make informed lending decisions. Key debt ratios include:

- Debt-to-Equity Ratio: This ratio highlights the proportion of debt used to finance a company’s assets relative to shareholders’ equity. A higher ratio may indicate increased financial leverage and potential risk.

- Interest Coverage Ratio: This metric assesses a company’s ability to meet its interest obligations, providing a snapshot of its financial stability. A lower ratio could signal trouble in covering interest expenses.

- Debt-to-Asset Ratio: By comparing total debt to total assets, this ratio helps evaluate the extent to which a company’s assets are financed by debt, revealing insights into its financial structure.

By meticulously examining these ratios, credit risk managers can craft a comprehensive risk profile, enabling them to anticipate potential financial distress and safeguard their portfolios. Such analysis not only aids in mitigating risks but also empowers lenders to offer tailored financial solutions, fostering a sustainable financial ecosystem.

Strategic Implementation of Debt Ratios in Credit Risk Frameworks

Incorporating debt ratios into credit risk frameworks is a strategic maneuver that can significantly enhance the precision of risk assessments. Debt ratios, such as the debt-to-equity ratio and the interest coverage ratio, serve as critical indicators of a borrower’s financial health. By evaluating these ratios, financial institutions can gain insights into a borrower’s ability to manage existing obligations and withstand economic fluctuations. This approach not only aids in identifying potential default risks but also empowers lenders to tailor their lending strategies, ensuring a balanced risk-reward profile.

- Debt-to-Equity Ratio: This ratio provides a snapshot of a company’s leverage, highlighting the proportion of debt used to finance assets compared to equity. A high ratio may indicate potential financial distress, signaling the need for closer scrutiny.

- Interest Coverage Ratio: This metric measures a company’s ability to meet interest payments with its earnings before interest and taxes (EBIT). A lower ratio suggests a higher risk of default, prompting lenders to adjust their risk management strategies accordingly.

By strategically implementing these ratios within credit risk frameworks, financial institutions can refine their credit scoring models, ensuring they are both robust and responsive to market dynamics. This proactive approach not only mitigates risk but also optimizes the allocation of capital, fostering sustainable growth and stability.

Expert Recommendations for Optimizing Debt Ratio Utilization

To effectively manage credit risk, experts emphasize the importance of maintaining an optimal debt ratio. This involves a strategic balance between leveraging debt to fuel growth and ensuring financial stability. A well-optimized debt ratio can enhance a company’s creditworthiness and provide a buffer against economic downturns. Here are some expert recommendations to achieve this balance:

- Regular Monitoring: Continuously track your debt ratios to stay informed about your financial position. Use advanced analytics tools to predict potential risks and adjust strategies accordingly.

- Debt Structuring: Prioritize structuring debt with favorable terms. This includes negotiating lower interest rates and longer repayment periods to improve cash flow and reduce financial strain.

- Diversification: Avoid over-reliance on a single source of debt. Diversifying your debt portfolio can mitigate risks and provide flexibility in times of financial stress.

- Strategic Investment: Use debt to fund projects with high return potential. This not only optimizes debt utilization but also enhances overall profitability.

By implementing these strategies, businesses can not only optimize their debt ratios but also strengthen their overall financial health, making them more resilient to credit risks.