In the rapidly evolving landscape of digital marketing, precision is the name of the game. Brands are no longer content with casting wide nets in hopes of catching the right audience; instead, they are honing their strategies to reach the right individuals at the right time with pinpoint accuracy. Enter the transformative power of credit data—a treasure trove of insights that, when harnessed correctly, can revolutionize audience targeting. This article delves into the art and science of leveraging credit data to craft marketing strategies that resonate with unparalleled precision. With an authoritative lens, we will explore how businesses can navigate this complex yet rewarding terrain, unlocking the potential to engage audiences with messages that truly matter. Prepare to embark on a journey where data-driven decisions meet creativity, forging connections that are as strategic as they are impactful.

Unlocking Consumer Insights through Credit Data Analysis

In today’s data-driven landscape, harnessing the power of credit data can transform how businesses understand and engage with their audiences. By delving into credit data analysis, companies can uncover valuable consumer insights that go beyond traditional demographic information. This approach enables a more nuanced understanding of consumer behavior, preferences, and purchasing power, which is crucial for crafting targeted marketing strategies.

Key benefits of utilizing credit data for audience targeting include:

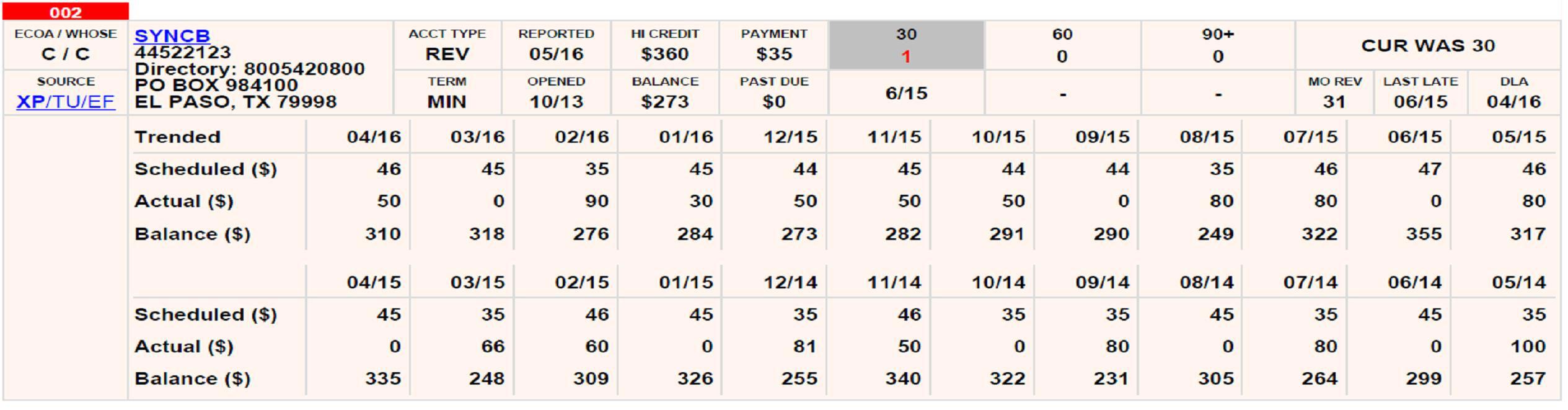

- Enhanced Segmentation: Identify and categorize consumers based on credit profiles, enabling personalized marketing campaigns that resonate with specific financial behaviors.

- Predictive Analytics: Leverage historical credit data to forecast future consumer trends and spending patterns, allowing for proactive marketing initiatives.

- Risk Assessment: Evaluate potential risks associated with targeting certain consumer segments, ensuring marketing efforts are both effective and financially sound.

By integrating credit data into your marketing toolkit, you can achieve a level of precision in audience targeting that not only enhances engagement but also drives conversion rates.

Crafting Targeted Marketing Strategies with Precision

In today’s competitive market, leveraging credit data is not just an option but a necessity for businesses aiming to enhance their marketing strategies. By tapping into this rich data source, companies can craft marketing campaigns that are not only targeted but also highly personalized. Credit data provides insights into consumer behavior, spending habits, and financial stability, allowing marketers to segment their audience with unparalleled precision. This segmentation enables the creation of tailored messages that resonate with specific consumer groups, increasing the likelihood of conversion.

- Enhanced Audience Segmentation: Use credit scores to identify and prioritize high-value customers, ensuring your marketing efforts are directed where they matter most.

- Personalized Messaging: Develop campaigns that speak directly to the financial needs and preferences of your audience, fostering stronger connections and brand loyalty.

- Risk Mitigation: Understand potential financial risks associated with certain consumer segments, allowing for strategic decision-making and resource allocation.

By integrating credit data into your marketing strategy, you position your brand to not only meet but exceed consumer expectations, ultimately driving growth and profitability. Embrace this data-driven approach to stay ahead in the ever-evolving marketplace.

Enhancing Audience Segmentation for Maximum Impact

To truly harness the power of credit data in audience targeting, it’s essential to dive deeper into the nuances of segmentation. This means moving beyond traditional demographic metrics and embracing a more dynamic approach. By integrating credit data, marketers can uncover insights that were previously hidden, enabling them to tailor their strategies with precision. Consider these elements when refining your audience segmentation:

- Credit Scores: Use credit scores to predict consumer behavior, identifying potential high-value customers who are more likely to engage with premium offerings.

- Spending Patterns: Analyze spending habits to determine which segments are more inclined towards specific product categories, allowing for targeted promotions.

- Debt Levels: Understanding the debt profiles of your audience can help in crafting messaging that resonates with their financial situations, increasing engagement.

By leveraging these data points, marketers can create a more refined and impactful audience segmentation strategy, ensuring that every campaign hits the mark with its intended audience.

Implementing Ethical Practices in Credit Data Utilization

In the pursuit of leveraging credit data for audience targeting, it is imperative to integrate ethical considerations into every step of the process. This ensures not only compliance with legal standards but also fosters trust with your audience. Here are some key practices to consider:

- Transparency: Clearly communicate to your users how their credit data will be used. Providing detailed privacy policies and easy-to-understand consent forms can help build a transparent relationship.

- Data Minimization: Collect only the data that is absolutely necessary for your targeting purposes. This reduces the risk of data breaches and aligns with the principle of minimizing data collection.

- Bias Mitigation: Regularly audit your data sets and algorithms to identify and eliminate any biases that may affect targeting outcomes. Ensuring fairness in your targeting practices is crucial for maintaining ethical standards.

- Secure Data Handling: Implement robust security measures to protect sensitive credit data from unauthorized access. Encryption, access controls, and regular security audits are essential components of a secure data handling strategy.

By embedding these ethical practices into your data utilization strategy, you not only comply with regulations but also enhance the credibility and integrity of your brand.