In the intricate dance of modern business, where opportunity and uncertainty often waltz hand in hand, managing corporate credit risk emerges as both an art and a science. As global markets pulsate with volatility and innovation, the ability to effectively navigate credit risk can spell the difference between a company’s triumph and its downfall. This article delves into the strategies and insights that empower organizations to master this critical aspect of financial stewardship. With an authoritative lens, we explore the nuanced terrain of credit risk management, offering a compass for businesses striving to safeguard their financial health while seizing growth opportunities. Join us as we unravel the complexities and unveil the principles that underpin effective corporate credit risk management, guiding you toward a more resilient and prosperous future.

Understanding the Dynamics of Corporate Credit Risk

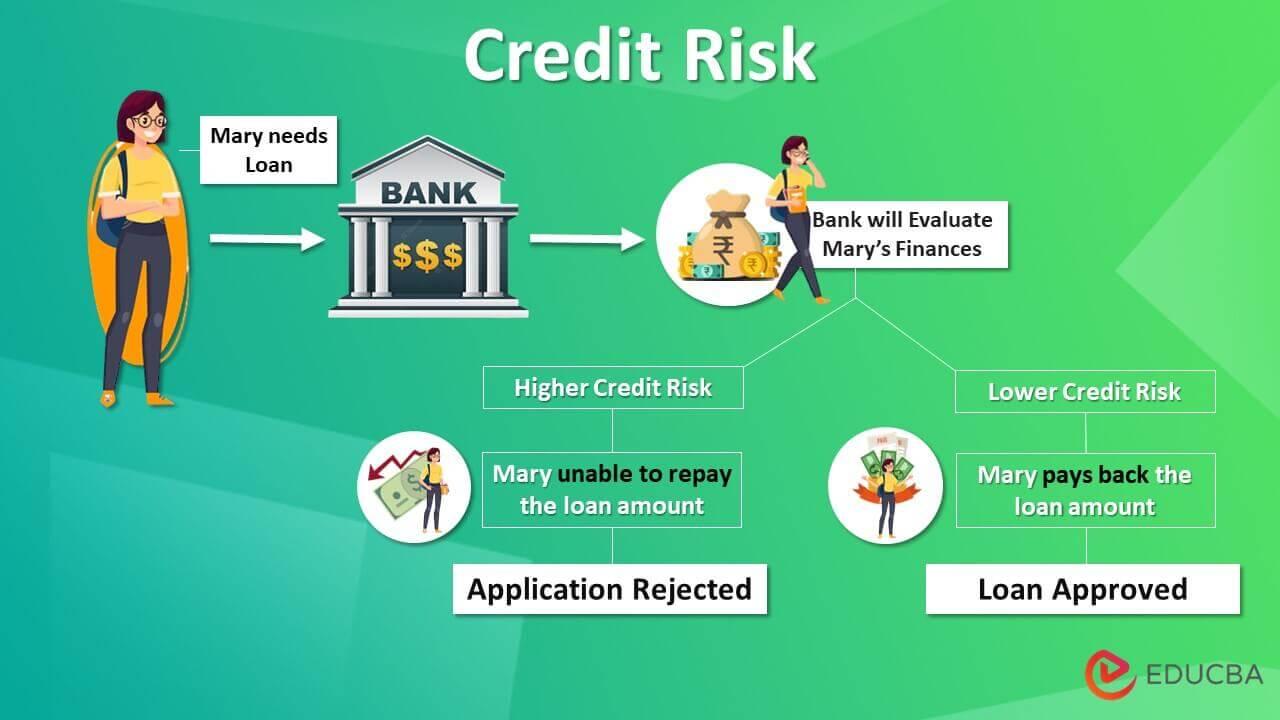

In the intricate world of corporate finance, understanding the dynamics of credit risk is paramount for maintaining a robust financial structure. Credit risk refers to the possibility that a borrower may default on any type of debt by failing to make required payments. To effectively manage this risk, companies must engage in a comprehensive analysis of both internal and external factors. Internally, businesses should evaluate their financial health, including cash flow stability, debt levels, and operational efficiency. Externally, keeping an eye on economic indicators, industry trends, and the creditworthiness of counterparties is crucial. By combining these insights, organizations can anticipate potential risks and devise strategies to mitigate them.

- Conduct Regular Risk Assessments: Regularly assess the creditworthiness of your clients and partners to identify potential red flags early.

- Implement Risk Mitigation Strategies: Utilize tools such as credit insurance, hedging, and diversification to safeguard against potential defaults.

- Leverage Technology: Use advanced analytics and AI-driven tools to gain deeper insights into credit risk profiles and predict future trends.

By mastering these dynamics, businesses can not only protect themselves from unforeseen financial setbacks but also position themselves for sustainable growth and stability in the competitive corporate landscape.

Implementing Robust Risk Assessment Frameworks

In the intricate world of corporate finance, the key to managing credit risk lies in the establishment of a robust risk assessment framework. Such a framework should not only identify potential risks but also quantify and prioritize them. To achieve this, organizations must integrate a blend of qualitative and quantitative measures. This involves the use of advanced analytics, historical data, and predictive modeling to foresee potential credit defaults. Furthermore, the framework should be dynamic, allowing for adjustments as market conditions evolve.

Implementing an effective risk assessment framework involves several critical components:

- Data Integration: Collate data from diverse sources to ensure a comprehensive risk profile.

- Regular Monitoring: Establish continuous monitoring mechanisms to detect changes in creditworthiness promptly.

- Scenario Analysis: Conduct stress testing to evaluate how different economic scenarios might impact credit risk.

- Risk Mitigation Strategies: Develop and refine strategies to mitigate identified risks, such as credit insurance or hedging.

By embedding these elements into the risk assessment process, companies can not only safeguard their financial health but also seize opportunities that others might overlook due to perceived risks. This strategic approach ensures that credit risk management becomes a source of competitive advantage rather than just a compliance exercise.

Leveraging Data Analytics for Predictive Risk Management

In the ever-evolving landscape of corporate finance, data analytics stands as a beacon of innovation, transforming how businesses approach credit risk management. By harnessing the power of predictive analytics, companies can now anticipate potential risks before they manifest, ensuring a proactive rather than reactive approach. This forward-thinking strategy not only safeguards financial health but also enhances decision-making processes, leading to more robust credit portfolios.

Key benefits of integrating data analytics into risk management include:

- Enhanced Accuracy: Advanced algorithms and machine learning models analyze vast datasets to identify patterns and trends that human analysis might overlook.

- Real-time Monitoring: Continuous data streams allow for the immediate detection of anomalies, enabling swift intervention.

- Customized Risk Profiles: Tailored insights provide a nuanced understanding of each client’s creditworthiness, allowing for personalized risk management strategies.

By leveraging these capabilities, organizations not only mitigate potential losses but also position themselves as leaders in the competitive financial arena.

Cultivating a Culture of Proactive Risk Mitigation

In today’s dynamic business environment, fostering a mindset that anticipates and addresses potential risks is essential for safeguarding financial stability. A proactive approach to risk mitigation involves more than just reacting to threats as they arise; it requires embedding risk awareness into the very fabric of the organization. This can be achieved by:

- Encouraging Open Communication: Establish channels for employees to report potential risks without fear of retribution. This transparency can lead to early identification of issues that might otherwise go unnoticed.

- Integrating Risk Management into Decision-Making: Ensure that risk assessments are a mandatory part of strategic planning and operational decisions. This alignment helps in foreseeing challenges and devising strategies to counteract them.

- Regular Training and Development: Equip your team with the skills and knowledge to identify and manage risks effectively. Continuous learning fosters a vigilant workforce ready to tackle potential threats head-on.

By cultivating such a culture, organizations not only protect themselves from unforeseen financial setbacks but also empower their teams to take calculated risks that can lead to innovation and growth.