In the intricate tapestry of the financial world, serve as the warp and weft, weaving together a narrative that is both complex and essential. As businesses navigate the ever-evolving economic landscape, understanding these two pivotal elements becomes crucial for survival and success. Credit risk, the specter that haunts every financial transaction, poses a constant challenge, demanding vigilance and strategic foresight. Meanwhile, financial health indicators act as the compass, guiding enterprises through turbulent waters toward stability and growth. This article delves into the symbiotic relationship between credit risk and financial health indicators, offering a comprehensive exploration of how they shape the destiny of businesses. By unraveling the nuances of these financial cornerstones, we aim to equip leaders and decision-makers with the insights needed to fortify their organizations against the uncertainties of tomorrow.

Assessing Credit Risk Understanding Key Financial Ratios

In the realm of credit risk assessment, financial ratios serve as indispensable tools for evaluating a business’s fiscal health. These ratios, when analyzed meticulously, offer a window into the company’s operational efficiency, liquidity, and long-term solvency. Key financial ratios include:

- Liquidity Ratios: These ratios, such as the current ratio and quick ratio, measure a company’s ability to meet its short-term obligations. A robust liquidity position often signals a lower credit risk.

- Profitability Ratios: Metrics like the net profit margin and return on equity provide insights into how effectively a company is generating profit relative to its revenue and shareholder equity. High profitability ratios can indicate a sound financial foundation.

- Leverage Ratios: The debt-to-equity ratio and interest coverage ratio are crucial in assessing the degree of financial leverage and the ability to service debt. Excessive leverage may raise red flags for potential creditors.

By scrutinizing these ratios, financial analysts can discern the underlying strengths and vulnerabilities of a business, thus painting a comprehensive picture of its creditworthiness. Such analysis not only aids in risk mitigation but also enhances decision-making for lenders and investors alike.

Navigating Business Health Indicators A Comprehensive Guide

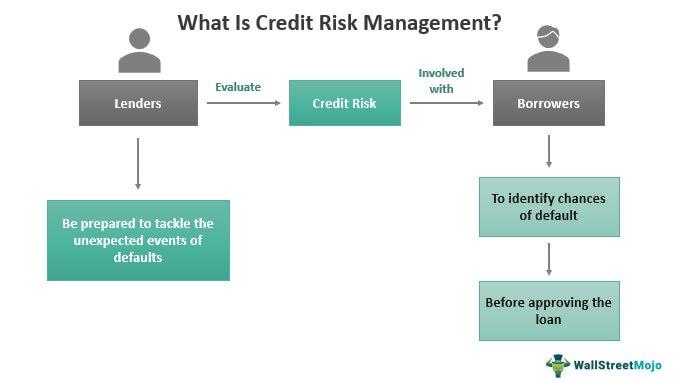

Understanding the intricate landscape of credit risk is crucial for assessing a company’s financial health. This involves evaluating the likelihood that a business will default on its financial obligations. Several indicators can provide insights into this risk, including:

- Debt-to-Equity Ratio: A high ratio may indicate that a company is heavily reliant on debt to finance its growth, which could be a red flag for potential investors.

- Interest Coverage Ratio: This measures a company’s ability to pay interest on its outstanding debt. A low ratio might suggest that the business is struggling to meet its interest obligations.

- Credit Score: Often used as a benchmark, a low credit score can signal potential financial instability, impacting the company’s ability to secure future financing.

Additionally, a comprehensive evaluation of a company’s financial health should include a look at liquidity ratios, such as the current ratio and quick ratio. These metrics assess a company’s ability to meet short-term liabilities with its current assets. Monitoring these indicators not only aids in risk assessment but also empowers businesses to make informed strategic decisions, ensuring long-term sustainability and growth.

Strategic Insights for Mitigating Credit Risk in Business

In today’s volatile economic landscape, businesses must adopt a multifaceted approach to effectively mitigate credit risk. One pivotal strategy is to closely monitor and analyze financial health indicators that provide insights into a company’s ability to meet its financial obligations. These indicators serve as the backbone of a robust credit risk management framework, allowing businesses to make informed decisions and minimize potential losses.

- Liquidity Ratios: These ratios, such as the current ratio and quick ratio, assess a company’s ability to cover short-term liabilities with its short-term assets. A healthy liquidity ratio is a strong indicator of a company’s financial stability.

- Leverage Ratios: Understanding the degree of a company’s financial leverage, through metrics like the debt-to-equity ratio, helps in evaluating the risk associated with its capital structure.

- Profitability Ratios: Metrics such as the net profit margin and return on assets provide insights into a company’s operational efficiency and its ability to generate profits relative to its expenses.

- Cash Flow Analysis: Regular analysis of cash flow statements ensures that a business maintains adequate cash flow to meet its obligations, reducing the risk of default.

By integrating these financial health indicators into their strategic planning, businesses can not only safeguard against credit risk but also enhance their overall financial resilience. This proactive approach ensures that they remain agile and prepared to navigate the complexities of the financial landscape.

Actionable Recommendations for Financial Stability and Growth

To enhance financial stability and drive growth, businesses must adopt a proactive approach towards managing credit risk and evaluating financial health indicators. Start by implementing robust credit assessment procedures. Analyze credit scores and review historical payment behaviors to anticipate potential defaults. Establish clear credit terms and maintain open communication with clients to mitigate risks. Additionally, consider diversifying your customer base to reduce dependency on a single client or sector.

Monitoring financial health indicators is equally crucial. Track key metrics such as liquidity ratios, profitability margins, and cash flow patterns. Regularly updating these metrics provides insights into the company’s financial trajectory and helps in making informed decisions. Engage in scenario planning to prepare for economic fluctuations and unforeseen challenges. Lastly, foster a culture of financial literacy within your organization, ensuring that all team members understand the impact of their roles on the company’s financial health.