In the fast-paced world of business, where every decision can propel a company to new heights or set it back, the quest for high-quality leads is akin to finding a needle in a haystack. Yet, what if the key to unlocking this treasure trove of potential clients lay hidden in plain sight, embedded within the intricate web of credit data? In this era of data-driven decision-making, credit data emerges as a powerful tool, offering unparalleled insights into consumer behavior and financial reliability. By harnessing the potential of this rich data source, businesses can not only streamline their lead generation processes but also cultivate relationships with prospects who are primed for engagement. Join us as we delve into the transformative power of credit data, exploring how it can serve as a beacon, guiding you to the most promising leads and ensuring your business thrives in an increasingly competitive landscape.

Unlocking Potential with Credit Data Insights

In the ever-evolving landscape of business, leveraging credit data can be a game-changer for identifying high-quality leads. By diving deep into the rich tapestry of credit information, businesses can gain unparalleled insights into potential clients’ financial health and payment behaviors. This data serves as a compass, guiding you towards prospects with a solid credit history and the potential for long-term partnership. Understanding credit patterns allows you to tailor your approach, ensuring that your pitch resonates with the financial realities of your prospects.

- Enhanced Targeting: Pinpoint businesses with a track record of timely payments and financial stability.

- Risk Mitigation: Reduce exposure to high-risk prospects by analyzing credit scores and histories.

- Customized Engagement: Craft personalized strategies that align with the credit profiles of your leads.

Utilizing credit data insights not only streamlines your lead generation process but also enhances the quality of your engagements, ultimately driving growth and fostering stronger business relationships.

Crafting Targeted Strategies for Lead Generation

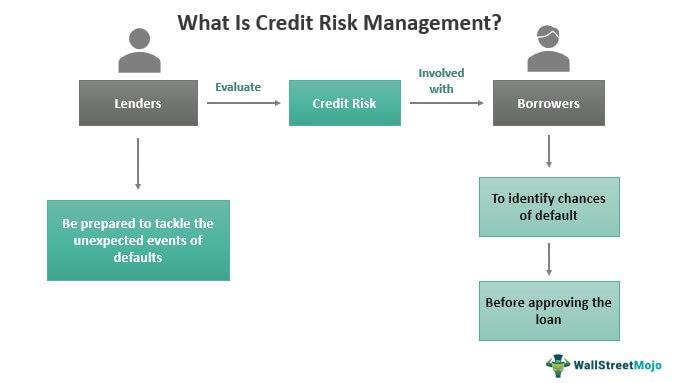

In today’s competitive landscape, leveraging credit data is a game-changer for businesses aiming to pinpoint high-quality leads. By analyzing credit scores, payment histories, and other financial indicators, companies can gain deep insights into potential customers’ financial behaviors and stability. This information allows for the creation of targeted marketing strategies that not only attract leads but also ensure they are the right fit for your business offerings.

- Precision Targeting: Credit data helps identify individuals or businesses with the financial capacity to invest in your products or services.

- Risk Mitigation: Understanding creditworthiness reduces the risk of engaging with leads that may default or be unable to fulfill financial commitments.

- Personalized Engagement: Tailor your communication and offers based on the financial profiles of your leads, enhancing the likelihood of conversion.

By integrating credit data into your lead generation strategy, you transform generic outreach into a finely-tuned process that maximizes ROI and strengthens customer relationships.

Harnessing Credit Data for Precision Marketing

In the ever-evolving landscape of digital marketing, leveraging credit data can significantly enhance your ability to pinpoint high-quality leads. By tapping into the wealth of information contained within credit profiles, businesses can gain insights into consumer behavior, purchasing power, and financial stability. This enables marketers to tailor their strategies, ensuring that their messages reach the right audience at the right time. Imagine the precision of targeting potential customers who not only have the interest but also the financial capability to invest in your products or services.

- Enhanced Targeting: Use credit data to segment your audience based on credit scores, spending habits, and financial behaviors.

- Personalized Messaging: Craft messages that resonate with the financial realities of your audience, increasing engagement and conversion rates.

- Risk Assessment: Identify prospects with a lower risk of default, ensuring that your marketing efforts are directed towards financially stable leads.

By integrating credit data into your marketing toolkit, you not only refine your lead generation process but also enhance the overall efficiency of your campaigns. This data-driven approach ensures that your marketing resources are allocated wisely, ultimately driving higher returns on investment.

Elevating Lead Quality through Data-Driven Approaches

In the quest for high-quality leads, leveraging credit data can be a game-changer. By integrating credit data analytics into your lead generation strategy, you can unlock a treasure trove of insights that go beyond traditional demographic and behavioral data. This approach enables businesses to pinpoint potential customers who not only show interest but also possess the financial stability to engage with your products or services. Imagine filtering through a sea of prospects to find those with the highest likelihood of conversion—credit data makes this possible by providing a deeper understanding of a lead’s financial health and creditworthiness.

- Precision Targeting: Use credit scores and histories to identify leads with the financial capability to invest in your offerings.

- Risk Mitigation: Reduce the risk of non-payment by targeting leads with a proven track record of financial responsibility.

- Enhanced Segmentation: Create more refined audience segments based on credit data, allowing for tailored marketing strategies that resonate with specific financial profiles.

By adopting a data-driven approach that incorporates credit information, businesses can not only enhance lead quality but also optimize marketing efforts, ensuring resources are allocated towards the most promising opportunities. This strategy not only boosts conversion rates but also fosters long-term customer relationships built on mutual financial trust and stability.