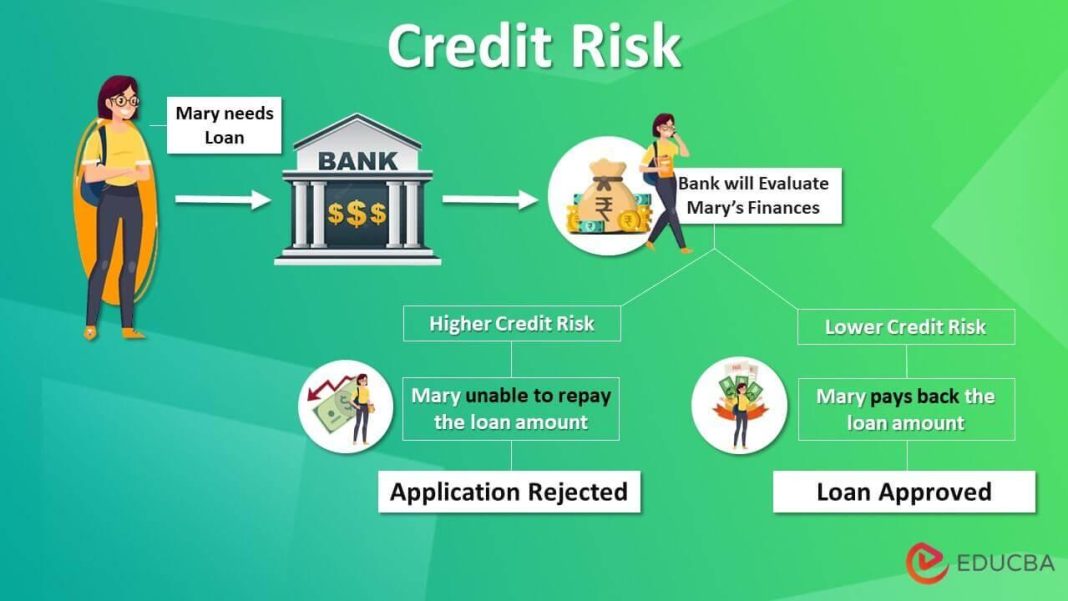

In the shadowy corridors of the financial world, where fortunes are made and lost in the blink of an eye, lies an enigmatic process shrouded in secrecy: credit risk assessment. This intricate dance of numbers and intuition dictates who receives the golden key to capital and who remains locked out. While lenders project an air of transparency and fairness, there exists a hidden tapestry of strategies and considerations that rarely see the light of day. In this article, we will pull back the curtain on credit risk assessment, revealing the unspoken truths and the silent calculations that govern this crucial financial ritual. Prepare to delve into the depths of a world where data meets discretion, and discover what lenders won’t tell you.

Unveiling the Hidden Metrics Behind Credit Scores

When it comes to understanding your credit score, the surface-level numbers only tell part of the story. Beneath the veneer of those three digits lies a labyrinth of lesser-known metrics that significantly influence your financial portrait. These hidden factors are the unspoken criteria that lenders scrutinize but seldom disclose. To truly grasp the nuances of credit risk assessment, it’s essential to delve into these overlooked elements.

- Payment Patterns: Beyond merely tracking whether payments are made on time, lenders analyze the consistency and frequency of payments. Irregularities can signal financial instability.

- Credit Utilization Trends: While the general rule is to keep your credit utilization below 30%, lenders also look at how this ratio fluctuates over time. Sudden spikes can raise red flags.

- Debt Composition: Not all debts are created equal. A diverse mix of credit types, such as installment loans and revolving credit, can paint a more favorable picture than a portfolio heavily weighted with one type.

- Account Age: The average age of your credit accounts provides insight into your financial maturity. Lenders prefer a long credit history as it demonstrates reliability and experience.

By understanding these concealed metrics, individuals can better navigate the credit landscape and optimize their financial strategies, ensuring they are viewed favorably in the eyes of potential lenders.

The Silent Impact of Economic Trends on Your Creditworthiness

While many focus on personal financial habits when considering their creditworthiness, few realize the subtle yet profound influence of broader economic trends. Economic fluctuations can quietly alter the landscape of credit risk assessment, reshaping how lenders perceive your financial reliability. For instance, during periods of economic downturn, lenders may tighten their criteria, becoming more conservative in their evaluations. Conversely, in times of economic growth, there might be a more lenient approach, allowing for greater flexibility in credit approval.

- Interest Rate Shifts: Changes in national interest rates can directly affect borrowing costs, influencing your ability to manage existing debt and take on new credit.

- Inflationary Pressures: As inflation rises, the purchasing power of money decreases, potentially leading to increased debt burdens and affecting your credit score.

- Employment Trends: Economic health often dictates job stability, which in turn impacts income consistency—a critical factor in credit assessments.

Understanding these external factors can empower you to better navigate the financial landscape, ensuring that you remain a step ahead in maintaining and improving your creditworthiness.

Strategies Lenders Use to Predict Borrower Behavior

In the intricate world of credit risk assessment, lenders employ a variety of sophisticated strategies to anticipate how borrowers might behave. These strategies often remain shrouded in mystery, yet they are pivotal in determining who gets approved for loans and at what interest rates. At the core of these strategies lies the use of advanced data analytics and machine learning algorithms. By analyzing vast datasets, lenders can identify patterns and trends that signal potential risks or opportunities. This approach allows them to go beyond traditional credit scores, incorporating factors such as spending habits, social media activity, and even geo-location data.

Lenders also rely on behavioral scoring models, which assess a borrower’s creditworthiness based on their past behavior. These models take into account a range of factors, including:

- Payment History: Consistency and punctuality in past payments.

- Credit Utilization: The ratio of credit used to credit available.

- Account Age: The length of time accounts have been active.

- Recent Credit Inquiries: The number of recent requests for new credit.

By leveraging these tools and techniques, lenders can make more informed decisions, reducing their risk exposure while tailoring loan products to fit individual borrower profiles. This meticulous approach not only safeguards lenders but also ensures that borrowers are offered terms that reflect their unique financial behaviors.

How to Fortify Your Financial Profile Against Lender Bias

To safeguard your financial standing from potential lender bias, it’s crucial to take proactive steps that enhance your credibility and reliability. Start by ensuring your credit report is accurate and up-to-date. Regularly check for errors or outdated information, and dispute any inaccuracies with the credit bureaus. This simple action can significantly improve your credit score, which is a key factor lenders consider. Additionally, focus on maintaining a low credit utilization ratio by keeping your credit card balances well below their limits. This demonstrates responsible credit management and can positively influence lender perceptions.

- Build a Diverse Credit Portfolio: Lenders often favor applicants with a mix of credit types. Consider responsibly managing a combination of credit cards, installment loans, and retail accounts to showcase your ability to handle different credit forms.

- Strengthen Your Financial Literacy: Educate yourself on financial principles and credit management. This knowledge empowers you to make informed decisions and communicate effectively with lenders, showcasing your financial acumen.

- Leverage Professional Guidance: Engage with financial advisors or credit counselors who can provide personalized strategies to bolster your financial profile. Their expertise can help you navigate complex financial landscapes and present a stronger case to lenders.