In the ever-evolving landscape of modern marketing, where every dollar counts and consumer behavior is more unpredictable than ever, harnessing the power of credit data has emerged as a game-changer. Imagine possessing a crystal ball that not only reveals the purchasing potential of your target audience but also guides you in crafting campaigns that hit the bullseye every time. This is the promise of credit data—a treasure trove of insights that, when wielded correctly, can transform your marketing strategy from a shot in the dark to a precision-guided missile. In this article, we delve into the art and science of using credit data to stretch your marketing budget to its fullest potential, ensuring that every cent spent is a step closer to achieving your business goals. Join us as we unlock the secrets of credit data, turning numbers into narratives and insights into impact.

Leveraging Consumer Credit Profiles for Targeted Marketing

In today’s competitive market, businesses can no longer afford to cast a wide net and hope for the best. Instead, they must harness the power of consumer credit profiles to tailor their marketing strategies. By doing so, companies can ensure that their marketing budget is spent efficiently, reaching the right audience with the right message. Consumer credit data provides valuable insights into spending habits, financial stability, and purchasing power, enabling marketers to create highly targeted campaigns that resonate with their audience.

Consider the following strategies to make the most of credit data in your marketing efforts:

- Segment Your Audience: Use credit scores to categorize consumers into different financial brackets, allowing for more personalized messaging.

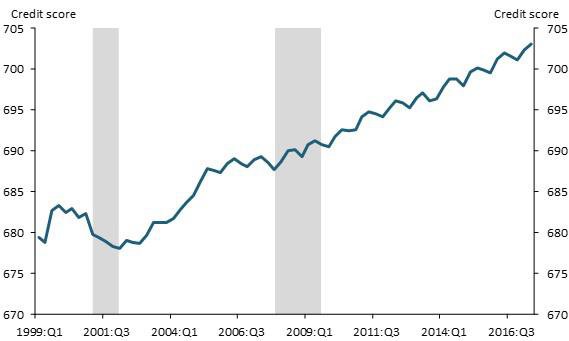

- Predict Consumer Behavior: Analyze credit trends to anticipate future purchasing decisions and adjust your marketing tactics accordingly.

- Enhance Product Offerings: Align your products or services with the financial capabilities of your target audience, ensuring they meet consumer needs.

- Optimize Ad Spend: Focus your advertising budget on high-value segments, reducing waste and increasing return on investment.

By leveraging these insights, businesses can craft marketing campaigns that not only reach but also engage the right consumers, ultimately driving sales and maximizing budget efficiency.

Unlocking Hidden Patterns in Credit Data to Enhance Campaign Precision

In the realm of data-driven marketing, credit data stands as a goldmine for discovering subtle yet powerful patterns that can significantly refine your campaign strategies. By leveraging credit data, marketers can segment audiences with unparalleled precision, ensuring that every dollar spent resonates with the right consumer. This involves analyzing credit scores, spending behaviors, and financial trends to tailor messages that speak directly to the consumer’s financial reality.

- Enhanced Targeting: Utilize credit data to identify high-value customers who are more likely to engage and convert.

- Predictive Insights: Harness predictive analytics to forecast purchasing behavior and adjust your strategies accordingly.

- Customized Messaging: Craft personalized marketing messages that align with the financial profile of your audience, increasing engagement and conversion rates.

By unlocking these hidden patterns, businesses can not only optimize their marketing budgets but also build stronger, more meaningful connections with their audience, ultimately driving higher ROI and brand loyalty.

Strategic Budget Allocation through Credit-Based Segmentation

In the realm of modern marketing, the precision of your budget allocation can be the difference between a successful campaign and a wasted investment. By leveraging credit-based segmentation, businesses can strategically allocate their marketing budgets to target audiences with the highest potential for conversion. This approach allows marketers to categorize customers based on their credit profiles, enabling more personalized and effective outreach strategies.

- Enhanced Targeting: Use credit data to identify high-value customer segments that are more likely to respond to your marketing efforts.

- Cost Efficiency: Allocate resources towards segments with the highest return on investment, minimizing expenditure on less profitable audiences.

- Improved ROI: Tailor your messaging and offers to match the financial behaviors and needs of each segment, driving higher engagement and conversion rates.

By adopting a credit-based segmentation strategy, marketers can ensure that every dollar spent is directed towards the most promising opportunities, optimizing both the reach and impact of their campaigns.

Optimizing Return on Investment with Credit-Informed Marketing Strategies

Incorporating credit data into your marketing strategies can significantly enhance your return on investment by ensuring that your efforts are targeted and efficient. By understanding the credit profiles of your target audience, you can tailor your campaigns to align with their financial behaviors and preferences. This approach allows you to allocate your marketing budget more effectively, focusing on prospects who are most likely to convert. Consider the following benefits of credit-informed marketing:

- Precision Targeting: Use credit data to identify high-value prospects, allowing you to concentrate your resources on individuals with a higher likelihood of engaging with your products or services.

- Personalized Messaging: Craft personalized marketing messages that resonate with the financial realities of your audience, increasing the chances of a successful conversion.

- Risk Mitigation: By understanding the creditworthiness of potential customers, you can mitigate risks associated with offering credit-based promotions or services.

Utilizing credit data not only refines your marketing efforts but also fosters a deeper understanding of your customer base, paving the way for more meaningful interactions and sustained growth.