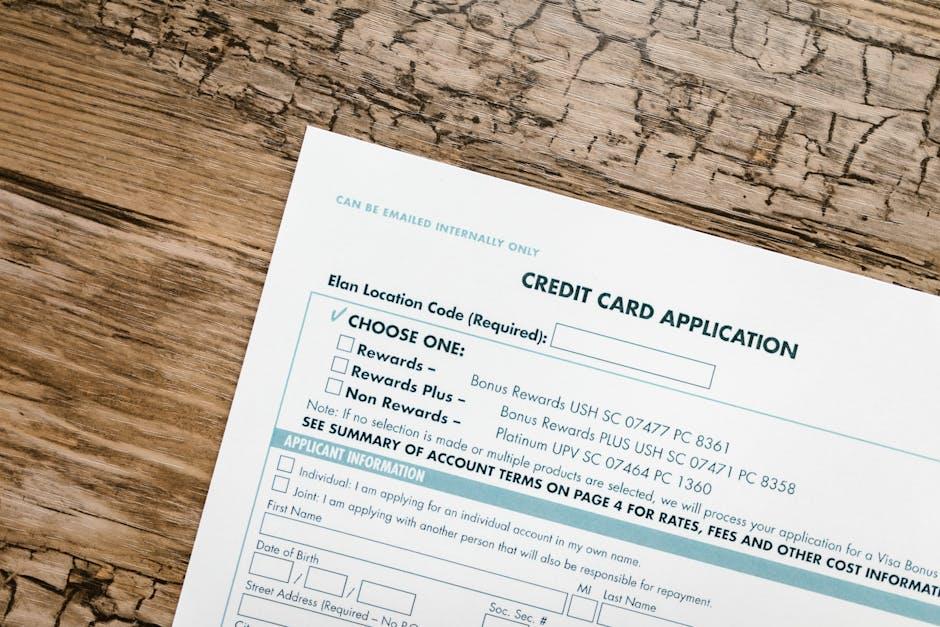

In the ever-evolving landscape of modern business, understanding your customer is no longer just an advantage—it’s a necessity. As companies strive to tailor their offerings and refine their strategies, customer segmentation emerges as a pivotal tool in the marketer’s arsenal. But how can businesses take this strategy to the next level? Enter credit scores: a powerful, yet often underutilized, metric that can transform the way we segment and understand our clientele. In this article, we delve into the art and science of optimizing customer segmentation with credit scores, offering a fresh perspective on how financial insights can illuminate customer behavior, enhance targeting precision, and ultimately drive growth. Prepare to unlock the secrets of a more nuanced segmentation strategy, where numbers tell stories and data drives decisions.

Understanding the Role of Credit Scores in Customer Segmentation

In the realm of customer segmentation, credit scores serve as a powerful tool to delineate and understand consumer behavior. These scores, which reflect an individual’s creditworthiness, can be instrumental in identifying distinct customer segments. By leveraging credit scores, businesses can tailor their marketing strategies, ensuring they reach the right audience with the right message. This nuanced approach not only enhances customer engagement but also optimizes resource allocation, leading to improved ROI.

- Risk Assessment: Credit scores help in evaluating the financial stability of customers, allowing businesses to categorize them into low, medium, and high-risk segments.

- Personalized Offerings: With insights derived from credit scores, companies can craft personalized financial products or services that cater to the specific needs of each segment.

- Enhanced Customer Experience: Understanding credit scores aids in anticipating customer needs and preferences, thereby fostering a more personalized and satisfying customer journey.

By integrating credit scores into customer segmentation strategies, businesses not only gain a competitive edge but also foster stronger, more meaningful relationships with their clientele.

Leveraging Data Analytics for Enhanced Credit-Based Segmentation

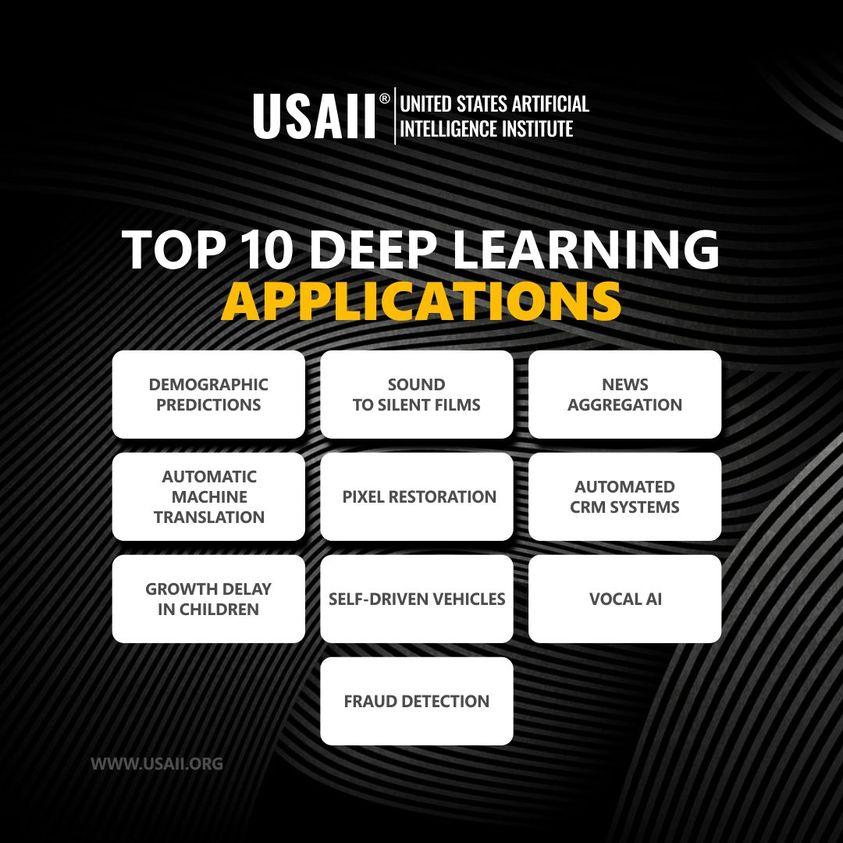

In today’s data-driven landscape, the power of data analytics is transforming the way businesses approach customer segmentation, particularly when it comes to credit scores. By diving deep into credit-based segmentation, companies can uncover patterns and insights that were previously hidden. This approach not only enhances the accuracy of segmentation but also allows for more personalized marketing strategies. Leveraging data analytics enables businesses to identify key customer segments based on creditworthiness, spending habits, and risk levels, thus optimizing resource allocation and improving overall customer engagement.

Consider the following strategies to harness the full potential of data analytics in credit-based segmentation:

- Data Integration: Combine credit score data with other customer data sources to create a comprehensive view of customer profiles.

- Predictive Modeling: Utilize machine learning algorithms to predict future customer behaviors and credit needs.

- Risk Assessment: Develop robust models to assess and categorize customers based on their risk levels, enabling tailored financial products.

- Behavioral Analysis: Analyze transaction data to understand spending patterns and tailor offers accordingly.

By implementing these strategies, businesses can not only refine their customer segmentation but also enhance their ability to meet customer needs effectively, driving growth and profitability.

Crafting Tailored Marketing Strategies Using Credit Insights

In the realm of modern marketing, leveraging credit insights can transform the way businesses approach customer segmentation. By integrating credit scores into your strategy, you can refine your target audience with precision, ensuring that your marketing efforts resonate with the right individuals. Credit scores offer a wealth of information that goes beyond financial health, providing a glimpse into consumer behavior and preferences. This data can be used to create personalized marketing campaigns that speak directly to the needs and desires of your customers.

Consider the following advantages of using credit insights for segmentation:

- Enhanced Targeting: Tailor your marketing messages to specific credit score brackets, ensuring that your offers are relevant and compelling.

- Risk Mitigation: Identify high-risk customers and adjust your marketing strategies accordingly to minimize potential losses.

- Improved Customer Experience: Use credit data to anticipate customer needs and deliver personalized solutions that enhance satisfaction and loyalty.

By harnessing the power of credit insights, businesses can not only optimize their customer segmentation but also drive growth and profitability through more effective marketing strategies.

Mitigating Risks and Maximizing Opportunities with Credit Score Analysis

Understanding and analyzing credit scores can significantly transform how businesses approach customer segmentation. By integrating credit score analysis into your segmentation strategy, you can both mitigate potential risks and uncover lucrative opportunities. Credit scores offer a wealth of information that can be used to refine customer profiles, allowing businesses to tailor their marketing and sales strategies more effectively.

- Risk Mitigation: By identifying customers with lower credit scores, businesses can proactively manage credit risk, adjusting terms and conditions to safeguard against potential defaults.

- Opportunity Maximization: High credit score customers can be targeted with premium offers and loyalty programs, enhancing customer retention and increasing lifetime value.

- Customized Offerings: Segmenting customers based on credit scores allows for personalized product offerings, ensuring that each customer receives the most relevant and appealing options.

Incorporating credit score analysis into your customer segmentation process not only helps in crafting more effective marketing campaigns but also strengthens your overall business strategy by aligning financial risk with growth opportunities. This approach ensures that your business remains agile and responsive to the ever-changing market dynamics.