In the bustling marketplace of the digital age, where every click, scroll, and swipe holds the potential to unlock new opportunities, businesses are in a relentless pursuit of the next big lead. Yet, in this ocean of possibilities, how does one navigate with precision rather than mere intuition? Enter credit data—a powerful compass that is redefining the art and science of lead generation. As companies strive to connect with the right prospects, credit data emerges as an indispensable tool, offering a treasure trove of insights that can transform a sea of anonymous faces into a map of promising opportunities. This article delves into the pivotal role credit data plays in maximizing lead generation, revealing how it empowers businesses to not only identify potential customers but also tailor their strategies with pinpoint accuracy. Prepare to embark on a journey through the intricate world of credit data, where numbers tell stories and data-driven decisions pave the way to unparalleled success.

Unlocking Potential: How Credit Data Transforms Lead Generation

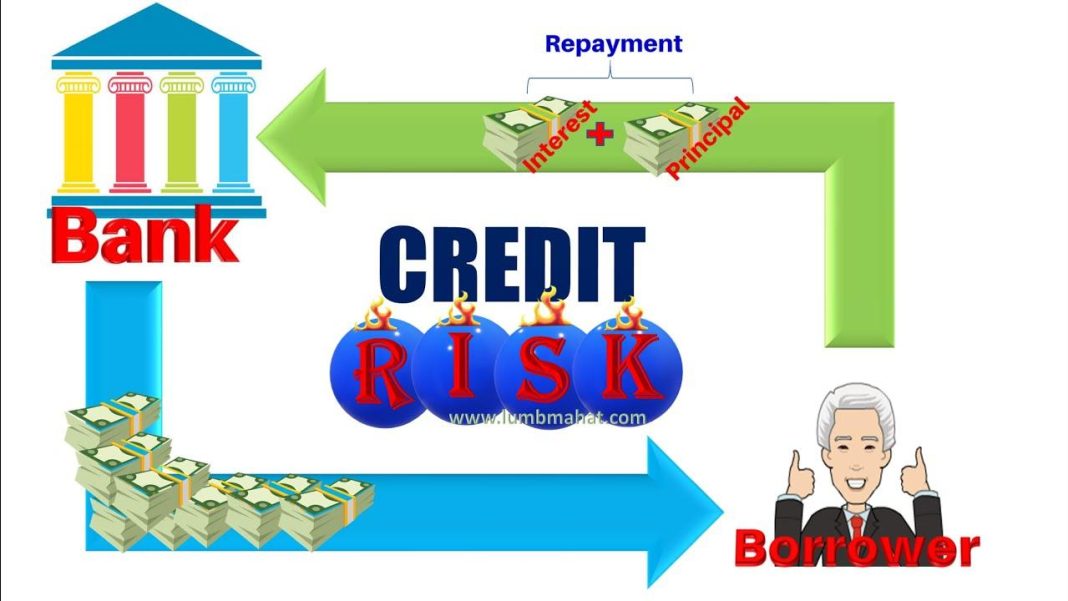

In today’s competitive market, leveraging credit data is not just a strategy—it’s a game-changer. By integrating comprehensive credit insights into lead generation efforts, businesses can precisely target prospects who are not only interested but also financially capable. This approach enhances the quality of leads, ensuring that marketing efforts are directed towards individuals with a higher likelihood of conversion. Credit data provides a wealth of information, from credit scores to payment histories, enabling companies to tailor their offerings and communication strategies effectively.

- Enhanced Targeting: Identify and prioritize leads with optimal credit profiles.

- Personalized Marketing: Craft messages that resonate with the financial realities of potential customers.

- Risk Mitigation: Reduce the likelihood of defaults by understanding creditworthiness upfront.

- Increased Conversion Rates: Focus on leads that are more likely to result in successful sales.

By harnessing the power of credit data, businesses not only improve their lead generation processes but also build stronger, more reliable customer relationships. This data-driven approach is pivotal in maximizing efficiency and ensuring sustainable growth.

Strategic Insights: Leveraging Credit Information for Targeted Outreach

In today’s competitive market, understanding and utilizing credit data can be a game-changer for businesses aiming to enhance their lead generation strategies. By tapping into credit information, companies can identify potential customers who are not only interested but also financially capable of purchasing their products or services. This approach allows for more precise targeting, ensuring that marketing efforts are directed towards individuals with a higher likelihood of conversion.

- Personalized Campaigns: Credit data enables businesses to tailor their outreach efforts, crafting messages that resonate with the financial profiles of their target audience.

- Risk Assessment: By evaluating credit scores, companies can gauge the risk level associated with potential leads, focusing resources on those with a stable financial background.

- Optimized Resource Allocation: Utilizing credit insights helps in prioritizing leads, ensuring that marketing budgets are spent on prospects with the highest potential for return on investment.

Integrating credit data into your lead generation strategy not only enhances the effectiveness of your outreach but also fosters a more efficient and data-driven marketing approach. By leveraging these insights, businesses can significantly improve their conversion rates and overall market presence.

Precision Targeting: Utilizing Credit Data to Refine Audience Segmentation

In the realm of modern marketing, leveraging credit data can significantly enhance the accuracy of audience segmentation, allowing businesses to tailor their strategies with surgical precision. By tapping into credit data, marketers can gain deeper insights into consumer behaviors, preferences, and financial capabilities, which are often overlooked by traditional demographic data. This refined segmentation enables businesses to identify and prioritize high-value prospects, ensuring that marketing efforts are not only targeted but also highly effective.

- Enhanced Consumer Profiles: Credit data enriches consumer profiles by adding layers of financial behavior, providing a more comprehensive understanding of potential leads.

- Improved Targeting Efficiency: With detailed credit insights, businesses can allocate resources more effectively, focusing on audiences with the highest conversion potential.

- Increased ROI: By aligning marketing strategies with precise audience segments, companies can achieve higher return on investment, minimizing wasteful spending on uninterested or unqualified leads.

Actionable Recommendations: Integrating Credit Insights into Lead Generation Tactics

To effectively harness the power of credit data in your lead generation strategy, consider implementing the following actionable recommendations. Begin by segmenting your audience based on credit profiles. This allows for more personalized marketing efforts, ensuring that your message resonates with the specific financial behaviors and needs of each segment. By understanding the credit health of your prospects, you can tailor your offers, such as special financing options or exclusive promotions, to appeal to their unique situations.

- Utilize predictive analytics: Leverage credit data to forecast future buying behaviors and identify high-potential leads.

- Enhance customer profiling: Integrate credit insights with existing customer data to build a more comprehensive profile, improving targeting accuracy.

- Optimize communication channels: Use credit data to determine the most effective channels for reaching different segments, whether through email, social media, or direct mail.

By strategically integrating credit insights into your lead generation tactics, you not only enhance the precision of your marketing efforts but also increase the likelihood of conversion, ultimately driving growth and profitability.