In the ever-evolving landscape of digital marketing, where the quest for consumer attention is relentless and the competition fierce, the power of personalization has emerged as a game-changer. At the heart of this transformation lies an often underutilized yet immensely potent resource: credit data. Imagine a world where marketing campaigns are not just targeted but tailored with surgical precision, resonating with the unique financial narratives of each consumer. This is not a distant dream but a burgeoning reality, as businesses harness the intricate tapestry of credit data to craft marketing strategies that speak directly to the individual. In this article, we delve into the sophisticated interplay between credit data and personalized marketing, exploring how this synergy is reshaping consumer engagement and redefining the boundaries of what’s possible in the marketing realm. Join us as we uncover the strategies, benefits, and ethical considerations of using credit data to drive marketing campaigns that are not only effective but also deeply personal.

Harnessing Consumer Credit Insights for Tailored Marketing Strategies

In today’s data-driven world, leveraging consumer credit insights has become a cornerstone for crafting marketing strategies that resonate on a personal level. By analyzing credit data, businesses can identify key consumer behaviors and preferences, allowing for the creation of highly targeted campaigns. This approach not only enhances customer engagement but also maximizes ROI by reaching the right audience with the right message at the right time.

Benefits of Utilizing Credit Data in Marketing:

- Precision Targeting: Understand consumer spending habits and tailor offers that align with their financial profiles.

- Enhanced Personalization: Craft messages that speak directly to individual needs and preferences, fostering a deeper connection.

- Improved Customer Segmentation: Segment audiences more effectively by analyzing credit scores and financial behaviors.

- Risk Mitigation: Identify potential credit risks early, allowing for proactive management and tailored communication strategies.

Unlocking the Potential of Credit Data for Hyper-Personalized Campaigns

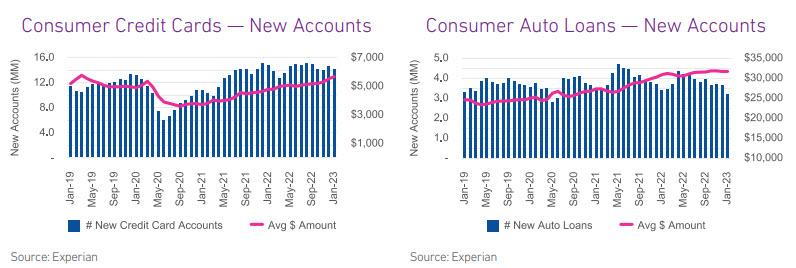

In the era of data-driven marketing, leveraging credit data can significantly enhance the precision and effectiveness of your campaigns. By analyzing consumer credit profiles, marketers can gain invaluable insights into spending habits, financial stability, and creditworthiness. This allows for the creation of hyper-personalized marketing strategies that resonate deeply with individual consumers. Instead of generic messaging, brands can tailor their offers to align with the financial behaviors and needs of their audience, leading to increased engagement and conversion rates.

- Segmentation: Use credit data to segment your audience based on credit scores, spending patterns, and debt levels, ensuring your message reaches the right people.

- Predictive Analytics: Employ predictive models to anticipate future purchasing behaviors and craft campaigns that meet those anticipated needs.

- Risk Assessment: Align your offers with the risk profiles of your customers, ensuring that credit offers are both attractive and feasible.

By integrating credit data into your marketing toolkit, you can move beyond one-size-fits-all approaches, crafting campaigns that speak directly to the unique financial journeys of your customers. This not only boosts customer satisfaction but also strengthens brand loyalty and drives long-term growth.

Strategic Recommendations for Leveraging Credit Information in Marketing

In the evolving landscape of personalized marketing, leveraging credit information can provide a competitive edge. To effectively harness this data, marketers should consider a few strategic recommendations. First, prioritize data privacy and compliance by ensuring that all credit information is collected and used in accordance with legal regulations such as GDPR or CCPA. This not only protects your business but also builds trust with your consumers.

- Segment Your Audience: Use credit data to identify distinct customer segments based on credit scores, purchasing power, and financial behavior. This allows for more targeted marketing efforts that resonate with each segment’s unique needs.

- Enhance Customer Experience: Tailor product offerings and promotional messages based on the credit profiles of your audience. Personalized recommendations can increase engagement and conversion rates.

- Predictive Analytics: Employ predictive analytics to anticipate customer needs and behaviors, enabling proactive marketing strategies that can lead to higher customer satisfaction and loyalty.

By strategically integrating credit information into your marketing campaigns, you can create more personalized, relevant, and effective customer interactions that drive business growth.

Navigating Privacy Concerns in Credit-Based Personalization

In the realm of personalized marketing, leveraging credit data offers a potent means to tailor campaigns with precision. However, this approach is not without its challenges, particularly when it comes to safeguarding consumer privacy. Understanding and addressing these privacy concerns is paramount to maintaining trust and compliance. Here are some key considerations:

- Transparency: Clearly communicate to consumers how their credit data will be used. Transparency builds trust and ensures that individuals are aware of the benefits and potential risks involved.

- Consent: Always obtain explicit consent before using credit data for personalization. This not only aligns with regulatory requirements but also respects consumer autonomy.

- Data Security: Implement robust security measures to protect sensitive information from breaches. This includes encryption, access controls, and regular security audits.

- Compliance: Stay informed about and adhere to relevant data protection laws and regulations, such as GDPR or CCPA, to avoid legal repercussions and maintain ethical standards.

By addressing these privacy concerns head-on, businesses can harness the power of credit data to enhance their marketing strategies while fostering a sense of security and trust among their customers.