In the ever-evolving landscape of modern business, where competition is fierce and consumer attention spans are fleeting, the quest for innovative marketing strategies is relentless. Enter credit-based marketing—a transformative approach that promises to revolutionize the way businesses connect with their audience. Imagine a strategy that not only enhances customer engagement but also builds loyalty and drives sustainable growth. This is not just a fleeting trend; it’s a paradigm shift that empowers businesses to harness the power of consumer credit data to tailor their marketing efforts with unprecedented precision. In this article, we delve into the mechanics of credit-based marketing, exploring how it can become the cornerstone of your business strategy, turning potential into performance and prospects into loyal patrons. Prepare to discover why embracing this cutting-edge approach could be the key to unlocking unparalleled success in your industry.

Harnessing Consumer Credit Data for Precision Targeting

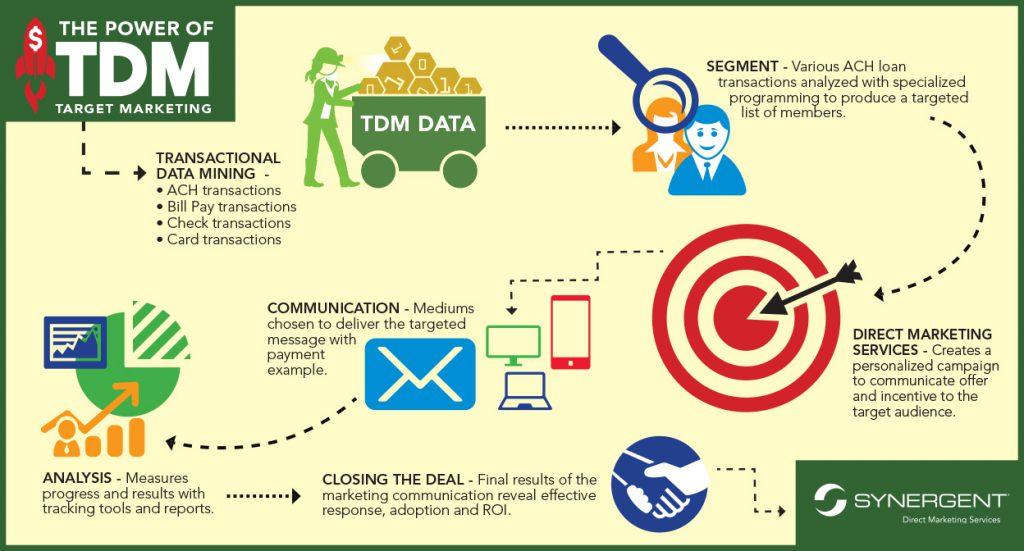

In the dynamic landscape of modern marketing, leveraging consumer credit data emerges as a powerful tool for precision targeting. By tapping into this rich vein of information, businesses can craft highly personalized marketing strategies that resonate with individual consumer profiles. This approach not only enhances the effectiveness of marketing campaigns but also fosters a deeper connection with the audience. Credit-based insights allow marketers to understand spending habits, financial behaviors, and creditworthiness, which are crucial in tailoring offers that align with consumer needs and preferences.

- Enhanced Personalization: Utilize credit data to segment audiences and deliver tailored messages that speak directly to their financial realities.

- Improved ROI: By targeting the right audience with the right message, businesses can significantly boost their return on investment.

- Risk Mitigation: Credit data helps in identifying potential financial risks, allowing businesses to make informed decisions and avoid potential pitfalls.

Incorporating consumer credit data into your marketing strategy not only refines targeting precision but also sets the stage for a transformative business approach. By understanding and anticipating consumer needs, businesses can stay ahead of the competition and build lasting customer relationships.

Unlocking the Power of Personalized Offers Through Credit Insights

In today’s competitive marketplace, understanding the financial behavior of your customers is more crucial than ever. By leveraging credit insights, businesses can craft personalized offers that resonate deeply with individual consumers. This approach not only enhances customer satisfaction but also drives engagement and loyalty. Imagine a scenario where your marketing team can predict which customers are more likely to respond to a specific offer based on their credit history. This is not just a possibility; it’s a reality with credit-based marketing.

- Enhanced Targeting: Tailor your promotions to match the financial capabilities and preferences of your audience.

- Increased Conversion Rates: Offers that align with customer credit profiles are more likely to result in successful transactions.

- Customer Loyalty: Personalized offers create a sense of understanding and trust, fostering long-term relationships.

By integrating credit insights into your marketing strategy, you can unlock a new level of personalization that not only meets but exceeds customer expectations. This strategic advantage allows businesses to stay ahead of the curve, ensuring that every marketing dollar spent is an investment in future growth.

Building Trust and Loyalty with Transparent Credit-Based Strategies

In today’s competitive marketplace, establishing trust and loyalty with your customers is more crucial than ever. Transparent credit-based strategies offer a unique opportunity to foster this trust by aligning your marketing efforts with the genuine needs and expectations of your audience. By providing clear and honest information about credit options, businesses can empower consumers to make informed decisions, ultimately leading to a more loyal customer base.

- Clarity in Communication: Clearly explain credit terms and conditions to avoid any confusion.

- Customer Empowerment: Offer tools and resources that help customers understand their credit options.

- Consistent Engagement: Maintain regular communication to build a lasting relationship with your audience.

These strategies not only enhance customer satisfaction but also position your brand as a trustworthy partner in their financial journey. By prioritizing transparency, you create a foundation of trust that encourages repeat business and word-of-mouth referrals, transforming your business into a respected leader in your industry.

Maximizing ROI with Data-Driven Credit Marketing Campaigns

In today’s competitive market, leveraging data-driven strategies in credit marketing can significantly enhance your return on investment. By harnessing the power of consumer credit data, businesses can craft highly personalized marketing campaigns that resonate with their target audience. This approach not only improves customer engagement but also drives higher conversion rates. Here’s how you can optimize your marketing efforts:

- Targeted Audience Segmentation: Utilize credit data to segment your audience based on creditworthiness, spending habits, and financial behavior. This allows for more precise targeting, ensuring your message reaches the right people at the right time.

- Personalized Messaging: Tailor your marketing messages to align with the financial needs and preferences of different customer segments. Personalized content increases relevance and fosters stronger connections with potential customers.

- Predictive Analytics: Implement predictive analytics to anticipate customer needs and behaviors. By understanding future trends, you can proactively design campaigns that address potential demands, staying ahead of the competition.

By integrating these data-driven strategies, businesses can not only enhance their marketing efficiency but also build long-lasting relationships with their customers, ultimately transforming their bottom line.