In the intricate dance of finance, where opportunities and risks waltz in a delicate balance, credit risk assessment emerges as the discerning choreographer, guiding lenders through the complex steps of lending decisions. As the financial landscape evolves, so too do the techniques that underpin this crucial process, transforming from traditional methodologies into sophisticated, data-driven strategies. This article delves into the art and science of credit risk assessment, offering an authoritative exploration of the techniques that empower lenders to navigate the uncertainties of borrower behavior and economic fluctuations. From time-honored practices to cutting-edge innovations, we unravel the tools that lenders wield to not only safeguard their investments but also to fuel the growth of businesses and individuals alike. Join us as we explore the meticulous craft of credit risk assessment, where precision meets intuition, and every decision shapes the future of finance.

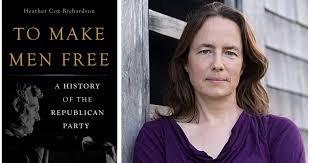

Understanding the Fundamentals of Credit Risk Assessment

In the realm of lending, a profound grasp of credit risk assessment is crucial for safeguarding financial stability and ensuring prudent decision-making. At its core, this process involves evaluating the likelihood that a borrower may default on their obligations. Lenders must consider various factors to paint a comprehensive picture of a borrower’s creditworthiness. These factors often include:

- Credit History: A detailed examination of past borrowing behavior, including payment punctuality and default occurrences.

- Financial Health: Analyzing income streams, existing debts, and overall financial stability to assess repayment capability.

- Market Conditions: Understanding the broader economic environment and industry-specific risks that might impact the borrower’s ability to repay.

- Collateral: Evaluating the value and liquidity of assets pledged as security against the loan.

By meticulously analyzing these components, lenders can not only mitigate potential risks but also tailor their lending strategies to align with their risk appetite. This strategic approach ensures that credit is extended to those most likely to honor their commitments, thereby fostering a robust and resilient lending portfolio.

Advanced Analytical Tools for Accurate Risk Evaluation

In the ever-evolving landscape of credit risk assessment, leveraging advanced analytical tools has become imperative for lenders aiming to make informed decisions. These tools, driven by sophisticated algorithms and vast data sets, offer a multi-dimensional view of a borrower’s creditworthiness. By employing machine learning models, lenders can identify patterns and trends that traditional methods might overlook, thus ensuring a more accurate risk evaluation. Furthermore, these tools facilitate real-time analysis, enabling lenders to respond swiftly to changing market conditions and borrower behaviors.

Key features of these analytical tools include:

- Predictive Analytics: Utilizing historical data to forecast future credit behavior.

- Automated Decision-Making: Streamlining the approval process through AI-driven insights.

- Comprehensive Risk Scoring: Integrating multiple data sources for a holistic risk profile.

- Scenario Analysis: Assessing potential outcomes under various economic conditions.

By incorporating these advanced tools, lenders not only enhance their risk assessment capabilities but also strengthen their competitive edge in the financial market.

Integrating Machine Learning for Predictive Risk Modeling

In the ever-evolving landscape of credit risk assessment, leveraging machine learning offers lenders a powerful tool to enhance predictive accuracy and streamline decision-making processes. By harnessing vast datasets and sophisticated algorithms, lenders can uncover intricate patterns and relationships that traditional methods might overlook. This approach not only aids in predicting default probabilities but also in understanding borrower behavior and market dynamics.

- Data Enrichment: Machine learning models can incorporate a wide array of data sources, including transactional data, social media activity, and economic indicators, providing a more holistic view of potential borrowers.

- Real-time Analysis: Unlike static models, machine learning algorithms can continuously learn and adapt, offering real-time insights and predictions that keep pace with changing market conditions.

- Bias Mitigation: Advanced techniques can help identify and mitigate biases inherent in data, ensuring fairer and more equitable lending practices.

- Scalability: These models can efficiently handle large volumes of data, making them ideal for lenders of all sizes looking to expand their operations without compromising on risk assessment quality.

Implementing machine learning for predictive risk modeling not only enhances the precision of credit risk assessments but also empowers lenders to make informed, data-driven decisions, ultimately leading to more sustainable lending practices.

Best Practices for Mitigating Credit Risk in Lending Institutions

To effectively mitigate credit risk, lending institutions must adopt a multi-faceted approach that encompasses both quantitative and qualitative measures. A robust credit risk management framework is essential, incorporating comprehensive credit assessments and ongoing monitoring. This involves leveraging advanced data analytics and machine learning models to predict potential defaults and assess borrower creditworthiness. Furthermore, establishing a diversified portfolio can significantly reduce exposure to any single borrower or sector, thereby minimizing risk.

Implementing stringent underwriting standards is crucial. This includes:

- Conducting thorough background checks and financial analysis.

- Setting clear credit limits and conditions.

- Regularly reviewing and updating risk assessment criteria.

Additionally, fostering strong relationships with borrowers can lead to better communication and early identification of potential issues. By maintaining a proactive approach and continuously refining risk assessment techniques, lenders can safeguard their financial stability and enhance their decision-making processes.