In the intricate world of finance, where every decision can ripple through the economy like a stone across a pond, understanding and managing risk is paramount. At the heart of this endeavor lies the credit risk audit—a meticulous process that serves as both a compass and a shield for financial institutions navigating the unpredictable seas of credit lending. As businesses and banks strive to balance opportunity with caution, the credit risk audit emerges as an essential tool, providing clarity and assurance in an environment fraught with uncertainty. This article delves into the art and science of performing a credit risk audit, guiding you through its complexities with authoritative insight. Whether you’re a seasoned auditor seeking to refine your skills or a financial professional aiming to bolster your institution’s defenses, this guide will equip you with the knowledge and strategies needed to master the audit process and safeguard your organization’s financial health.

Understanding the Foundations of Credit Risk Auditing

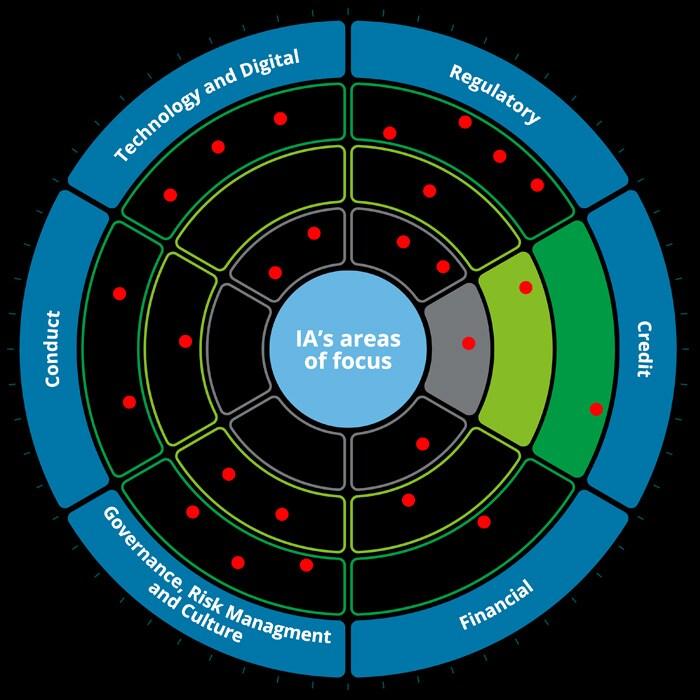

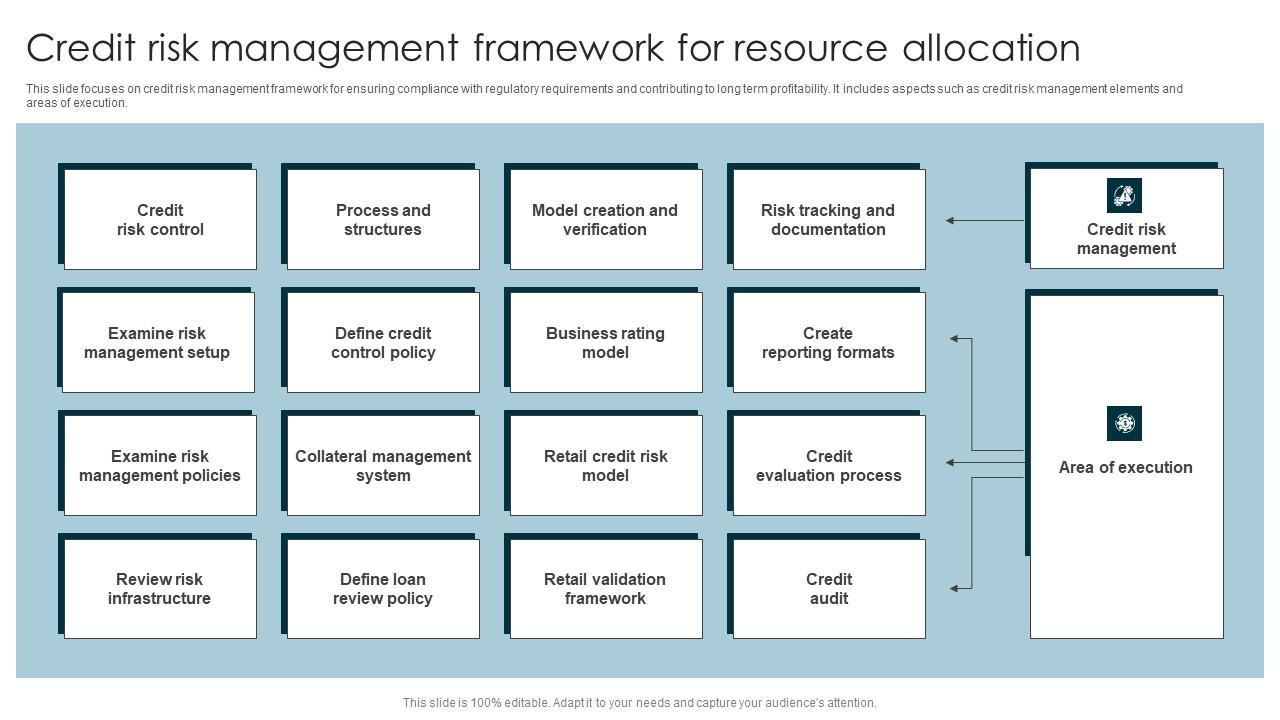

In the realm of financial scrutiny, understanding the core principles of credit risk auditing is crucial for any auditor. At its essence, credit risk auditing involves evaluating the potential for a borrower to default on a loan, thereby impacting the lender’s financial health. This process demands a meticulous examination of a borrower’s creditworthiness and the potential risks associated with their financial behavior. Key elements of this assessment include the borrower’s financial statements, historical payment records, and the economic environment in which they operate. A well-rounded audit doesn’t just highlight potential risks but also offers insights into the robustness of the lender’s credit risk management framework.

- Data Analysis: Scrutinize financial statements and transaction histories to identify patterns and anomalies.

- Risk Assessment: Evaluate both quantitative and qualitative factors that might affect the borrower’s ability to repay.

- Internal Controls: Review the lender’s policies and procedures to ensure they effectively mitigate identified risks.

- Compliance Check: Ensure adherence to relevant regulations and industry standards.

By mastering these foundational elements, auditors can deliver comprehensive evaluations that not only safeguard financial institutions but also enhance their decision-making processes. This ensures that credit risks are not just identified but are also strategically managed, paving the way for more resilient financial operations.

Analyzing Financial Statements with Precision

In the realm of credit risk audits, precision in analyzing financial statements is paramount. Financial statements serve as the backbone of any credit risk assessment, providing insights into the fiscal health and operational efficiency of a business. To achieve a meticulous analysis, auditors should focus on several key elements:

- Liquidity Ratios: Evaluate the company’s ability to meet short-term obligations. This includes the current ratio and quick ratio, which reveal how well a company can cover its liabilities with its assets.

- Profitability Metrics: Scrutinize net profit margins and return on equity to assess how effectively a company is generating profit relative to its sales and shareholder equity.

- Debt Management: Examine the debt-to-equity ratio and interest coverage ratio to understand the company’s leverage and its ability to manage debt obligations.

By focusing on these critical components, auditors can deliver a comprehensive evaluation that not only identifies potential risks but also provides actionable insights for stakeholders. Remember, the devil is in the details, and a thorough analysis can mean the difference between sound financial advice and oversight.

Leveraging Data Analytics for Enhanced Risk Assessment

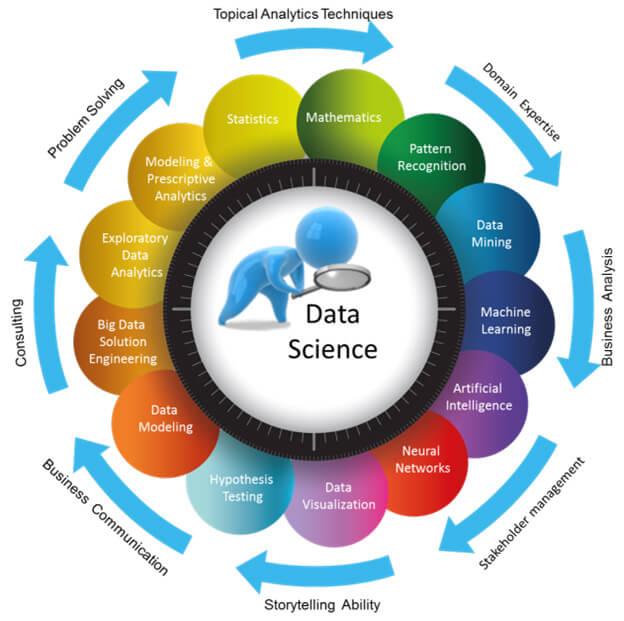

In the realm of credit risk audits, the power of data analytics cannot be overstated. By harnessing advanced analytical tools, financial institutions can transform raw data into actionable insights, enabling a more nuanced understanding of potential risks. This involves leveraging both historical and real-time data to identify patterns and anomalies that may signal credit risk. Predictive modeling plays a crucial role here, allowing auditors to anticipate future trends and behaviors, thus enhancing the precision of risk assessments.

Key strategies include:

- Utilizing machine learning algorithms to detect subtle correlations and patterns in large datasets.

- Incorporating real-time data feeds to keep risk assessments current and responsive to market changes.

- Implementing visual analytics to simplify complex data and highlight critical risk factors at a glance.

By integrating these strategies, organizations can significantly improve their risk assessment capabilities, ensuring a more robust and proactive approach to credit risk management.

Implementing Best Practices for Comprehensive Audit Reporting

To ensure a successful credit risk audit, it is crucial to adhere to a set of best practices that enhance the quality and comprehensiveness of the audit report. Thorough documentation is the cornerstone of any audit process. This involves meticulously recording all findings, methodologies, and the rationale behind every decision. By maintaining detailed records, auditors can provide a clear trail of evidence that supports their conclusions, facilitating transparency and accountability.

Incorporating a multi-perspective analysis is another best practice that enriches the audit report. Auditors should evaluate credit risk from various angles, including financial health, market conditions, and historical data trends. By doing so, they can offer a more holistic view of potential risks. Key elements to include in the report are:

- Risk Assessment Summary: A concise overview of identified risks and their potential impact.

- Methodology Description: A detailed explanation of the tools and techniques used during the audit.

- Recommendations: Actionable insights and strategies to mitigate identified risks.

Adhering to these best practices not only strengthens the audit report but also reinforces the credibility and reliability of the audit process itself.