In the intricate tapestry of modern commerce, where fortunes are made and lost in the blink of an eye, the ability to discern the subtle signals of business credit risk is akin to possessing a sixth sense. While many enterprises rely on the glaring beacons of financial statements and credit scores, there exists a realm of overlooked indicators that, when recognized, can illuminate the path to sound financial decision-making. These hidden harbingers of fiscal health often whisper rather than shout, requiring a keen eye and a discerning mind to interpret their significance. In this exploration, we delve into the shadowy corners of credit risk assessment, unveiling the most overlooked indicators that can transform uncertainty into opportunity and guide businesses away from the precipice of financial peril. Prepare to journey beyond the obvious, as we uncover the nuanced and often underestimated elements that hold the key to a more comprehensive understanding of business credit risk.

Unveiling Hidden Financial Signals to Safeguard Your Business

In the intricate world of business finance, the ability to detect subtle shifts in credit risk can be the difference between thriving and merely surviving. One of the most underestimated indicators is the change in payment patterns. A company that begins to delay payments, even slightly, may be experiencing cash flow issues. These minor delays often precede more significant financial troubles, making them a crucial signal to monitor.

Another overlooked factor is the frequency of credit inquiries. An uptick in the number of times a business’s credit is checked can indicate that they are seeking additional credit lines, possibly due to financial strain. Pay attention to these inquiries as they can provide insight into a company’s liquidity challenges. Additionally, consider examining the age of accounts payable. An increase in the average age can suggest that a business is struggling to pay its suppliers on time, hinting at potential credit risk.

- Payment Pattern Changes: Early warning of cash flow issues.

- Credit Inquiry Frequency: Signals potential liquidity challenges.

- Age of Accounts Payable: Indicates possible supplier payment delays.

Decoding Payment Patterns for Predictive Risk Analysis

Understanding the nuances of payment behaviors can significantly enhance predictive risk analysis. Payment patterns often hold the key to unlocking insights into a business’s creditworthiness. Observing how a company manages its payables and receivables can reveal potential red flags that are often overlooked. For instance, frequent late payments or a sudden shift from early to on-time payments might indicate underlying financial stress or strategic cash flow management.

- Consistency in Payment Timeliness: A consistent record of on-time payments is a positive indicator, whereas sporadic delays could suggest financial instability.

- Changes in Payment Frequency: An increase in payment frequency might indicate an attempt to maintain liquidity or mask cash flow issues.

- Partial Payments: Regular partial payments could be a sign of cash constraints, pointing to potential credit risk.

By meticulously analyzing these patterns, businesses can anticipate potential risks and make informed decisions, thus safeguarding their financial health.

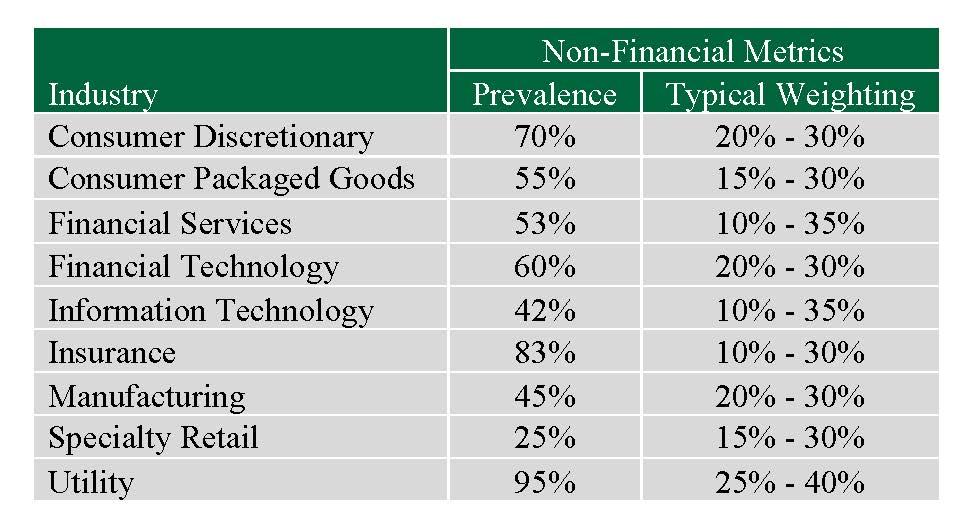

Harnessing Non-Financial Metrics for a Holistic Credit Assessment

In today’s dynamic business landscape, relying solely on traditional financial metrics for credit assessment can be limiting. Non-financial metrics offer a more nuanced view of a company’s health and potential risks. These indicators, often overshadowed by their financial counterparts, can provide invaluable insights into a business’s operational stability and market positioning.

Consider the following non-financial metrics that can enhance your credit risk evaluation:

- Customer Satisfaction and Loyalty: High levels of customer satisfaction can indicate a stable revenue stream and a strong market presence, reducing the risk of credit default.

- Employee Turnover Rate: A low turnover rate suggests a positive work environment and operational stability, while high turnover can signal internal issues that might affect financial performance.

- Supply Chain Robustness: A resilient supply chain can mitigate risks associated with disruptions, ensuring consistent product or service delivery.

- Innovation and R&D Investment: Companies that prioritize innovation may have a competitive edge, indicating potential for growth and long-term success.

By integrating these non-financial metrics into your credit assessment framework, you can achieve a more comprehensive understanding of a business’s risk profile, ultimately leading to more informed lending decisions.

Strategic Recommendations for Mitigating Undetected Credit Risks

In the ever-evolving landscape of business credit, identifying and mitigating undetected risks is crucial for maintaining financial stability. To navigate these challenges, businesses should consider implementing a multi-faceted approach that combines both traditional and innovative strategies. Diversifying credit assessment tools can provide a more comprehensive view of potential risks. This includes integrating advanced data analytics and machine learning models to predict credit defaults more accurately. Furthermore, establishing a robust internal framework for continuous monitoring and assessment of credit portfolios can help in identifying early warning signs.

To further enhance risk mitigation, businesses should focus on the following strategic recommendations:

- Enhance Data Collection: Utilize a variety of data sources, including non-traditional data like social media activity and customer reviews, to gain deeper insights into borrower behavior.

- Strengthen Relationships: Foster open communication channels with clients to better understand their financial health and operational challenges.

- Regular Stress Testing: Conduct regular stress tests on credit portfolios to assess the impact of potential economic downturns or industry-specific challenges.

- Adopt Agile Risk Management: Implement agile methodologies in risk management processes to quickly adapt to changing market conditions and emerging risks.

By embracing these strategies, businesses can significantly reduce the likelihood of encountering unforeseen credit risks, thereby safeguarding their financial interests.