In the labyrinthine world of decision-making, where uncertainty looms at every corner, risk scoring models emerge as the unsung heroes, guiding us with the precision of a compass in a storm. These mathematical marvels, often cloaked in the mystique of complex algorithms and data analytics, are the silent architects behind the critical decisions that shape industries and lives alike. From determining the creditworthiness of an individual to assessing the potential hazards of a new business venture, risk scoring models are the invisible hand that balances opportunity with caution. In this exploration, we delve into the intricate science that underpins these models, unraveling the threads of data, probability, and human insight that weave together to form the tapestry of modern risk assessment. Prepare to embark on a journey through the fascinating intersection of mathematics and intuition, where numbers tell stories and decisions are crafted with calculated foresight.

Understanding the Core Principles of Risk Scoring Models

At the heart of risk scoring models lies a blend of data analytics, statistical methods, and domain expertise. These models are designed to quantify the potential risk associated with an individual or entity, allowing for informed decision-making. The foundation of these models is built upon several core principles:

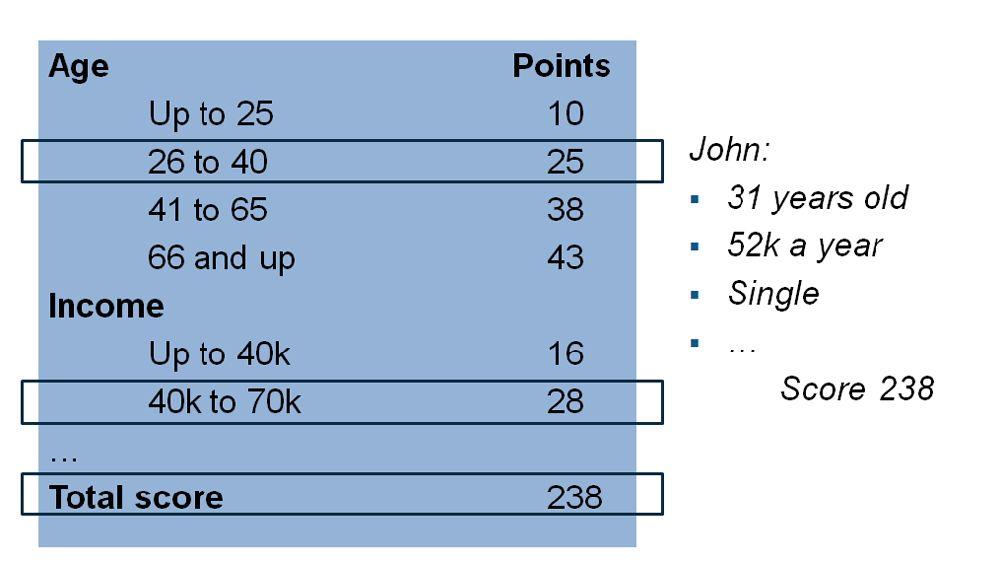

- Data Collection: Gathering relevant and high-quality data is paramount. This includes historical data, behavioral patterns, and demographic information.

- Statistical Analysis: Employing statistical techniques to identify trends and correlations within the data, ensuring that the model can accurately predict risk.

- Model Validation: Regular testing and validation are essential to ensure the model’s accuracy and reliability over time.

- Transparency: A clear understanding of how the model works and the factors it considers is crucial for trust and accountability.

- Adaptability: Risk scoring models must be flexible to adapt to new data and changing conditions in the environment.

These principles not only guide the development of effective risk scoring models but also ensure they remain robust and relevant in a dynamic world. By adhering to these core tenets, organizations can harness the power of risk scoring to drive strategic decisions and mitigate potential threats.

Unveiling the Data-Driven Mechanics Behind Risk Assessment

In the intricate realm of risk assessment, the mechanics of data-driven models are akin to the inner workings of a finely tuned machine. These models leverage vast amounts of data to predict potential risks, transforming raw information into actionable insights. Machine learning algorithms and statistical analysis are at the core, tirelessly processing variables to identify patterns and correlations that might elude human intuition. This process is akin to a symphony where each data point plays a crucial note, contributing to the overall harmony of the risk score.

To understand the science behind these models, consider the following key components:

- Data Collection: Gathering diverse datasets from multiple sources, including historical data, market trends, and behavioral analytics.

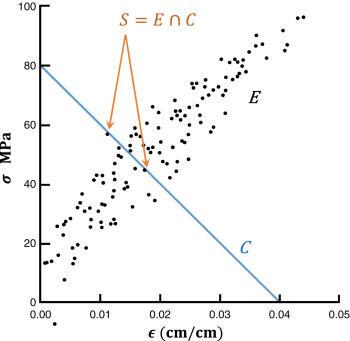

- Feature Engineering: Transforming raw data into meaningful features that can enhance the predictive power of the model.

- Model Training: Utilizing advanced algorithms to train the model on historical data, ensuring it can accurately predict future risks.

- Validation and Testing: Rigorous testing to validate the model’s accuracy and reliability, adjusting parameters as necessary to fine-tune performance.

These elements work in concert to create a robust framework that not only assesses risk with precision but also evolves with changing data landscapes, ensuring businesses remain one step ahead in the risk management game.

Harnessing Predictive Analytics for Accurate Risk Evaluation

In the realm of risk evaluation, predictive analytics serves as a powerful tool, transforming vast amounts of data into actionable insights. By leveraging sophisticated algorithms and machine learning techniques, these models can identify patterns and predict future outcomes with remarkable precision. The core components of these models include:

- Data Collection: Gathering relevant data from diverse sources, ensuring a comprehensive foundation for analysis.

- Feature Engineering: Selecting and transforming variables to enhance the model’s predictive power.

- Model Training: Using historical data to teach the model how to recognize and evaluate risk factors.

- Validation and Testing: Rigorous testing to ensure accuracy and reliability in real-world scenarios.

These elements work in tandem to produce a risk scoring model that not only anticipates potential threats but also suggests strategic interventions. By continuously refining these models, organizations can stay ahead of emerging risks, making informed decisions that safeguard their interests.

Strategic Recommendations for Implementing Robust Risk Scoring Systems

Implementing a robust risk scoring system requires a strategic approach that combines technological prowess with human insight. To begin, organizations should focus on data quality and integration. This involves ensuring that data sources are reliable and seamlessly integrated into the risk scoring model. A well-integrated system not only enhances accuracy but also provides a comprehensive view of potential risks.

- Leverage Advanced Analytics: Utilize machine learning and AI to analyze patterns and predict future risks. These technologies can process vast amounts of data quickly, offering insights that might be missed by traditional methods.

- Continuous Monitoring and Feedback: Establish a feedback loop where the system is continuously monitored and refined based on real-world outcomes. This adaptive approach helps in keeping the risk scoring model relevant and effective.

- Cross-Functional Collaboration: Engage teams from different departments to provide diverse perspectives. This collaboration ensures that the model considers various risk factors and scenarios, making it more robust.

By focusing on these strategic elements, organizations can develop a risk scoring system that not only identifies potential threats but also provides actionable insights to mitigate them effectively.