In the intricate tapestry of the financial world, where every thread weaves a story of risk and reward, credit risk ratings emerge as the silent sentinels guarding the gates of investment. These enigmatic figures, often cloaked in mystery, hold the power to sway decisions, influence markets, and dictate the flow of capital across the globe. Yet, for many, the true essence of credit risk ratings remains obscured by a veil of complexity and jargon. In this exploration, we embark on a journey to demystify these crucial arbiters of financial trust, unraveling their secrets with a discerning eye and authoritative insight. From the subtle nuances that define a company’s creditworthiness to the intricate algorithms that drive rating decisions, we delve deep into the heart of the credit rating universe, illuminating the path for investors, analysts, and curious minds alike. Prepare to uncover the hidden truths behind credit risk ratings, as we reveal their pivotal role in shaping the economic landscape and safeguarding the future of financial stability.

Decoding the Enigma of Credit Risk Ratings

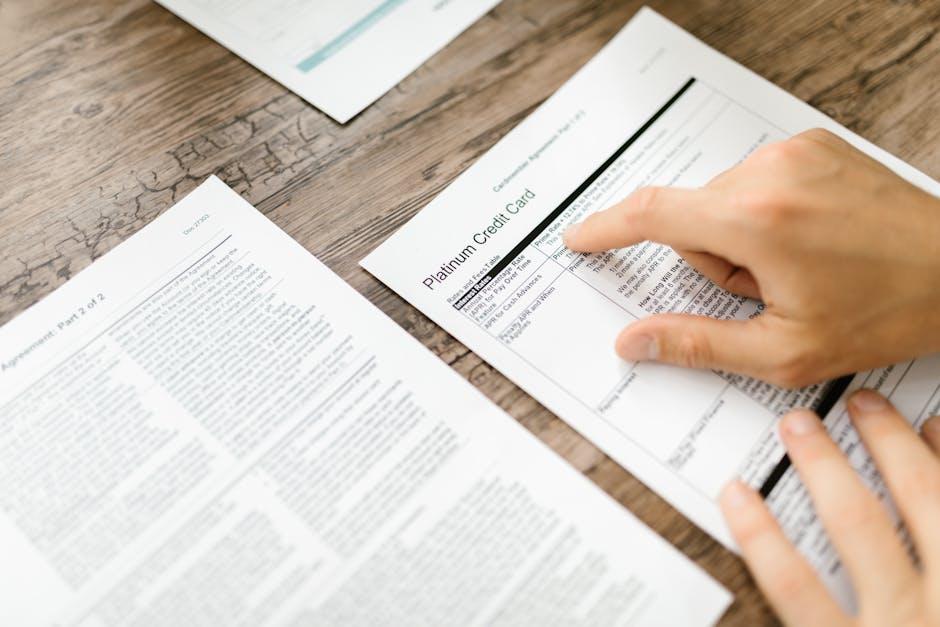

In the intricate world of finance, credit risk ratings stand as a beacon of guidance, illuminating the path for investors and financial institutions alike. These ratings, assigned by agencies like Moody’s, S&P, and Fitch, are not mere numbers or letters; they are complex evaluations of a borrower’s ability to meet financial commitments. Understanding the nuances behind these ratings is crucial for anyone navigating the financial seas. At their core, credit risk ratings are determined by a myriad of factors, including:

- Financial Health: Analyzing balance sheets, income statements, and cash flow to assess stability.

- Market Position: Evaluating the borrower’s competitive standing and market share.

- Economic Environment: Considering macroeconomic conditions that could impact repayment ability.

- Management Quality: Assessing the effectiveness and experience of the leadership team.

Each element contributes to the tapestry of a credit rating, providing a snapshot of risk that can influence investment decisions, interest rates, and even regulatory requirements. By decoding these enigmatic ratings, stakeholders can make informed choices, balancing risk and reward with a keen eye on the future.

The Anatomy of Risk Assessment: Tools and Techniques

In the intricate world of credit risk ratings, the ability to dissect and evaluate potential financial pitfalls is paramount. This is where a suite of sophisticated tools and techniques comes into play, enabling financial institutions to navigate the turbulent waters of credit risk with precision. Quantitative models form the backbone of this process, leveraging historical data and statistical methods to predict future creditworthiness. These models are often complemented by qualitative assessments, which consider factors such as management quality and market conditions, providing a more holistic view of risk.

Among the essential tools employed are:

- Credit Scoring Systems: These systems use algorithms to assign a numerical value to a borrower’s credit risk, streamlining decision-making processes.

- Risk Dashboards: Interactive platforms that offer real-time insights into a portfolio’s risk exposure, allowing for swift adjustments.

- Stress Testing: A technique that simulates extreme market conditions to evaluate the resilience of financial entities.

These tools, combined with expert judgment, form a robust framework for credit risk assessment, ensuring that institutions can safeguard their assets while optimizing their lending strategies.

Mastering the Art of Credit Evaluation: Insider Insights

In the complex world of finance, understanding credit risk ratings is akin to unlocking a treasure trove of financial insight. These ratings are not mere numbers; they are the lifeline that informs investment decisions, guides lending practices, and influences economic stability. Credit risk ratings assess the likelihood of a borrower defaulting on their obligations, providing a snapshot of financial health and future risk. For investors and financial institutions, mastering these ratings is crucial to navigating the turbulent waters of the global economy.

- Analytical Frameworks: Credit risk evaluations are rooted in rigorous analytical frameworks that consider a multitude of factors, from financial statements to market conditions.

- Qualitative and Quantitative Analysis: A blend of qualitative insights and quantitative data forms the backbone of credit risk assessment, offering a comprehensive view of a borrower’s creditworthiness.

- Dynamic Adjustments: As economic conditions evolve, so too do credit ratings, requiring continuous monitoring and adjustment to reflect current realities.

By delving into the intricacies of credit risk ratings, financial professionals can enhance their decision-making processes, ensuring they remain ahead of the curve in an ever-changing financial landscape. This mastery not only safeguards investments but also contributes to a more resilient economic environment.

Strategic Recommendations for Optimizing Credit Risk Management

To effectively navigate the complexities of credit risk management, financial institutions must adopt a multifaceted approach that blends traditional methodologies with innovative strategies. One key recommendation is to enhance data analytics capabilities. By leveraging advanced algorithms and machine learning, institutions can gain deeper insights into borrower behavior, allowing for more accurate risk assessments. Investing in cutting-edge technology not only streamlines the evaluation process but also enables real-time monitoring of credit portfolios, thus reducing potential exposure to defaults.

Moreover, fostering a culture of proactive risk management is essential. This involves:

- Regular training programs for staff to keep them updated on the latest risk assessment tools and techniques.

- Establishing clear communication channels between departments to ensure swift identification and mitigation of emerging risks.

- Encouraging collaboration with external partners, such as fintech firms, to integrate diverse perspectives and solutions.

By implementing these strategic recommendations, organizations can significantly enhance their credit risk management frameworks, ensuring resilience and stability in an ever-evolving financial landscape.