In the intricate tapestry of financial markets, liquidity often plays the role of an unsung hero, weaving through the complex threads of credit risk analysis. Imagine a bustling city where the flow of traffic determines the health of its economy; liquidity is the lifeblood that ensures seamless movement, preventing bottlenecks that could lead to systemic gridlock. As we delve into the nuanced world of credit risk, understanding why liquidity matters becomes paramount. It is the pulse that beats beneath the surface, influencing decisions, shaping strategies, and safeguarding against potential pitfalls. This article embarks on a journey to unravel the critical importance of liquidity in credit risk analysis, offering insights that resonate with the seasoned analyst and the curious observer alike. Through this exploration, we will uncover how liquidity serves as both a shield and a compass, guiding financial institutions through the turbulent waters of uncertainty and towards the shores of stability.

Understanding the Interplay Between Liquidity and Credit Risk

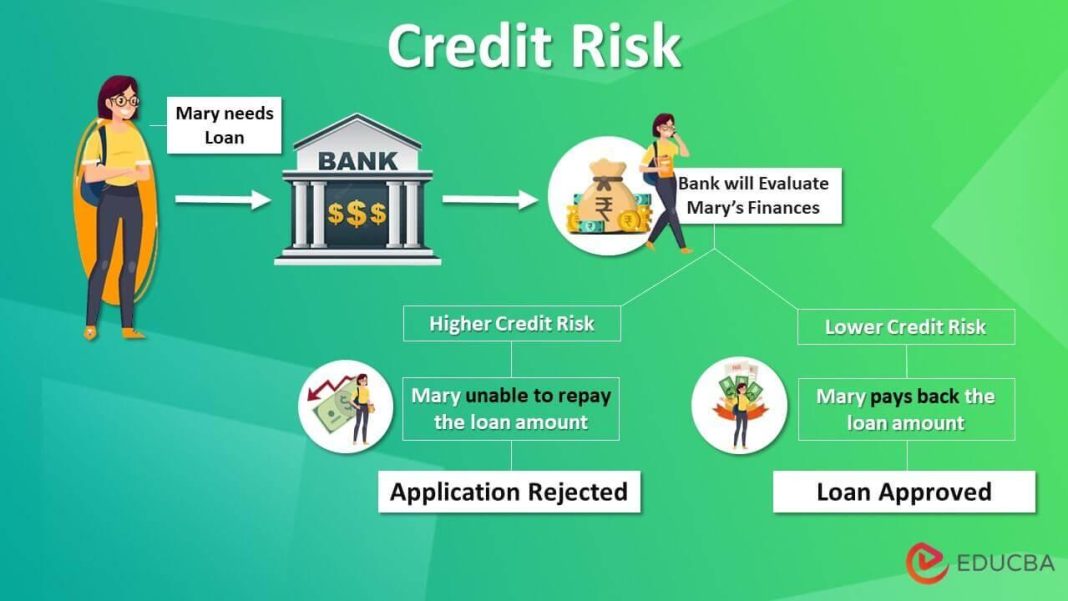

In the intricate world of finance, the delicate balance between liquidity and credit risk is pivotal. Liquidity, the ease with which assets can be converted into cash without affecting their market price, serves as a lifeline for businesses, especially during financial turbulence. Conversely, credit risk refers to the possibility that a borrower may default on their obligations, potentially leading to significant financial losses. The interplay between these two elements is critical for assessing a company’s financial health and stability.

- Liquidity Buffers: Companies with robust liquidity can better withstand unexpected financial shocks, thereby reducing the probability of default.

- Market Perception: Investors often view high liquidity as a sign of financial strength, which can enhance a company’s credit rating and lower its borrowing costs.

- Asset Management: Effective liquidity management allows firms to optimize their asset portfolios, balancing between liquid assets and higher-yielding investments.

Understanding how liquidity influences credit risk is essential for financial analysts, investors, and corporate managers. By maintaining a keen eye on liquidity levels, stakeholders can mitigate potential credit risks, ensuring a more resilient financial environment.

Assessing Liquidity Metrics for Robust Credit Risk Evaluation

In the realm of credit risk analysis, liquidity metrics serve as a vital compass, guiding financial institutions through the complexities of evaluating a borrower’s financial health. These metrics, often overshadowed by profitability and leverage ratios, offer a more immediate glimpse into a company’s ability to meet its short-term obligations. Current Ratio, Quick Ratio, and Cash Conversion Cycle are not just numbers; they are critical indicators of a firm’s operational efficiency and cash flow management. By focusing on these metrics, analysts can discern the subtle nuances of a borrower’s liquidity position, which might otherwise be obscured by more traditional financial indicators.

- Current Ratio: Provides a snapshot of a company’s ability to cover its short-term liabilities with its short-term assets.

- Quick Ratio: Offers a more stringent test by excluding inventory from current assets, emphasizing the most liquid assets.

- Cash Conversion Cycle: Measures the time taken to convert inventory investments into cash flows from sales, highlighting operational efficiency.

Understanding these metrics allows for a more robust credit risk evaluation, equipping analysts with the insights needed to make informed lending decisions. By prioritizing liquidity, financial institutions can better safeguard against potential defaults, ensuring a more resilient credit portfolio.

Strategies for Enhancing Liquidity to Mitigate Credit Risks

To effectively navigate the intricate landscape of credit risk, enhancing liquidity stands as a cornerstone strategy. Liquidity management is not just about having cash on hand; it’s about optimizing the flow of assets to ensure financial stability. Here are some innovative strategies:

- Dynamic Cash Flow Forecasting: Regularly update cash flow projections to anticipate future liquidity needs. This proactive approach allows for timely adjustments and reduces the risk of cash shortfalls.

- Asset-Liability Matching: Align the maturities of assets and liabilities to minimize liquidity gaps. This ensures that the organization can meet its obligations without distress.

- Utilization of Credit Lines: Maintain access to diverse credit facilities. Having a mix of committed and uncommitted lines can provide flexibility and act as a buffer during financial turbulence.

- Investment in Liquid Assets: Allocate a portion of the portfolio to highly liquid assets. These can be quickly converted to cash, providing an immediate source of funds when needed.

By implementing these strategies, businesses can create a robust liquidity framework that not only mitigates credit risks but also supports sustainable growth and resilience in uncertain economic climates.

Integrating Liquidity Analysis into Comprehensive Risk Management

In the intricate dance of credit risk analysis, liquidity often takes center stage, dictating the rhythm and pace of financial stability. Liquidity analysis serves as a critical tool in the risk management arsenal, offering insights into a company’s ability to meet short-term obligations without incurring significant losses. When liquidity is integrated into comprehensive risk management, it acts as a lens through which the financial health of an entity is scrutinized, revealing vulnerabilities that might otherwise remain hidden.

- Early Warning Signals: Monitoring liquidity levels can provide early warnings of potential financial distress, allowing institutions to take preemptive actions.

- Enhanced Decision-Making: By understanding liquidity positions, financial managers can make informed decisions about asset allocation and capital structure.

- Risk Mitigation: Adequate liquidity ensures that firms can withstand economic shocks, reducing the likelihood of default and enhancing overall financial resilience.

Integrating liquidity analysis into risk management frameworks not only strengthens the evaluation process but also fortifies the institution against unforeseen financial challenges. By prioritizing liquidity, businesses can navigate the complexities of credit risk with greater confidence and strategic foresight.