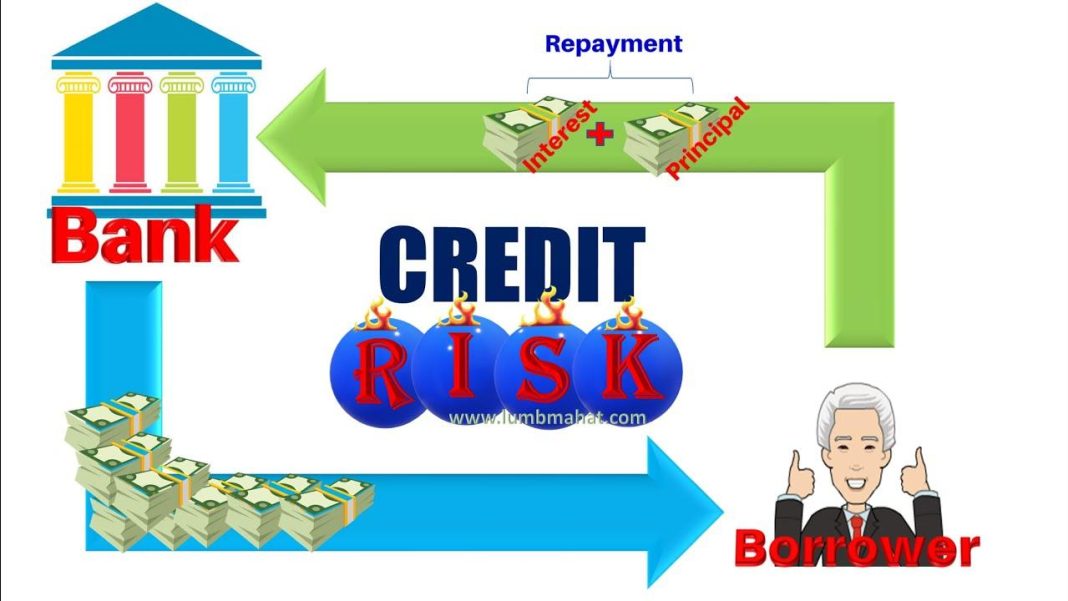

In the intricate dance of global finance, credit risk has long been the shadowy partner, ever-present and often unpredictable. As the world navigates through unprecedented economic shifts—spurred by technological advancements, geopolitical tensions, and the lingering aftershocks of a global pandemic—the nature of credit risk is undergoing a profound transformation. This evolution is not merely a recalibration of old models but a fundamental reshaping of how risk is perceived, assessed, and managed. In this article, we delve into the dynamic landscape of credit risk, exploring how traditional paradigms are being challenged and redefined in an era marked by volatility and uncertainty. Join us as we unravel the complexities of this new frontier, where the stakes are higher, the variables more intricate, and the need for innovative strategies more pressing than ever before.

Navigating the New Landscape of Credit Risk

In the rapidly changing economic environment, credit risk management is undergoing a profound transformation. Financial institutions are now required to adapt to new challenges that were previously unforeseen. Key drivers of this evolution include:

- Technological Advancements: The integration of AI and machine learning in credit assessments is enabling more precise risk evaluations.

- Regulatory Changes: Governments worldwide are implementing stricter regulations to ensure financial stability, necessitating more robust compliance frameworks.

- Globalization: The interconnectedness of economies means that credit risk is no longer confined to local markets but has become a global concern.

As these factors converge, credit risk professionals must develop innovative strategies to navigate this new landscape. This involves not only leveraging cutting-edge technologies but also fostering a culture of agility and foresight within their organizations. By doing so, they can effectively mitigate risks and capitalize on emerging opportunities in a world where change is the only constant.

Unveiling the Impact of Global Economic Shifts on Credit Assessment

In today’s rapidly evolving economic landscape, the process of credit assessment is undergoing a significant transformation. As global economic shifts reshape financial markets, credit risk models must adapt to capture new complexities and uncertainties. Traditional credit assessment methods, once heavily reliant on historical data and static metrics, are now integrating dynamic variables that reflect real-time economic changes. Artificial intelligence and machine learning are at the forefront of this evolution, offering more nuanced insights into borrower behavior and potential risks.

Financial institutions are increasingly recognizing the importance of incorporating diverse economic indicators into their credit assessment frameworks. This includes:

- Geopolitical events that may disrupt global supply chains

- Climate change impacts, influencing industry stability and long-term asset values

- Technological advancements that could alter market dynamics and consumer behavior

By embracing these factors, lenders can better anticipate and mitigate risks, ensuring more resilient credit portfolios in an unpredictable economic environment. The integration of these elements not only enhances the accuracy of credit assessments but also fosters a more comprehensive understanding of the global economic tapestry.

Strategies for Strengthening Credit Risk Management in Uncertain Times

In the face of ongoing global economic shifts, financial institutions must adopt robust and adaptive approaches to credit risk management. Flexibility and foresight are key in navigating these uncertain times. Institutions should focus on enhancing their risk assessment models by incorporating advanced analytics and machine learning technologies. This allows for more accurate predictions and early identification of potential credit defaults.

Furthermore, fostering a culture of continuous monitoring and proactive communication is essential. Consider implementing the following strategies:

- Diversify credit portfolios to spread risk across various sectors and geographies.

- Strengthen borrower relationships by maintaining open lines of communication and offering support during financial difficulties.

- Regularly review and update risk policies to align with the latest economic data and regulatory requirements.

- Invest in employee training to ensure that staff are equipped with the skills to identify and manage emerging risks effectively.

By integrating these strategies, institutions can better position themselves to withstand economic volatility and safeguard their financial stability.

Innovative Tools and Techniques for Future-Proofing Credit Portfolios

In the rapidly changing landscape of global finance, credit portfolios must adapt to withstand the unpredictability of economic shifts. Leveraging innovative tools and techniques is crucial for financial institutions aiming to safeguard their assets and ensure resilience. Emerging technologies such as artificial intelligence (AI) and machine learning (ML) are revolutionizing credit risk assessment by enabling more accurate predictions and dynamic adjustments to credit models. These technologies can analyze vast datasets to identify patterns and trends that human analysts might overlook, providing a more nuanced understanding of potential risks.

Moreover, the integration of blockchain technology offers enhanced transparency and security, reducing the likelihood of fraud and errors in credit transactions. Institutions are also adopting scenario analysis and stress testing to anticipate and prepare for various economic conditions. These techniques help in identifying vulnerabilities within portfolios and developing strategies to mitigate potential impacts. By embracing these cutting-edge tools, financial institutions can not only manage current risks more effectively but also build a robust framework capable of adapting to future challenges.

- AI and ML for predictive analytics

- Blockchain for enhanced security

- Scenario analysis for strategic planning

- Stress testing for resilience assessment