In the labyrinthine world of finance, where numbers dance to the rhythm of global markets, credit risk emerges as a formidable specter, casting long shadows over the balance sheets of financial institutions. As the winds of economic volatility sweep across the globe, these institutions find themselves navigating treacherous waters, where the stakes are high and the margin for error is razor-thin. The art and science of managing credit risk exposure in such tumultuous times require a deft blend of strategy, foresight, and resilience. This article delves into the intricate mechanisms and innovative approaches that financial institutions deploy to safeguard their assets and maintain stability amidst uncertainty. From leveraging cutting-edge technology to harnessing the power of data analytics, we explore how these financial titans stand firm against the tempest, ensuring that they not only survive but thrive in an ever-changing landscape. Join us as we unravel the complexities of credit risk management, offering a glimpse into the sophisticated world where finance meets fortitude. Creditworthiness in Turbulent Markets”>

Creditworthiness in Turbulent Markets”>

Navigating Uncertainty Strategies for Assessing Creditworthiness in Turbulent Markets

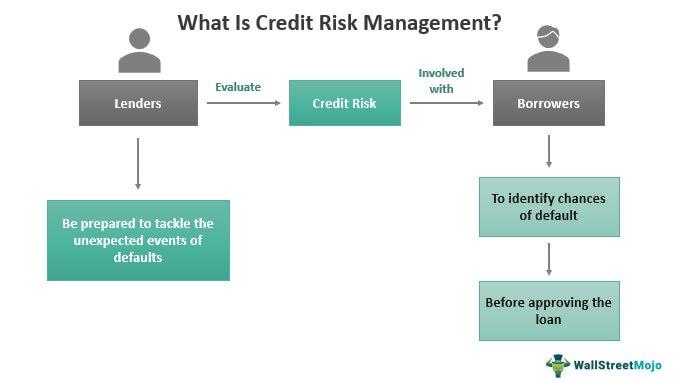

In the face of economic turbulence, financial institutions must deploy innovative strategies to effectively assess creditworthiness and manage credit risk exposure. This begins with leveraging advanced data analytics and machine learning algorithms to enhance predictive accuracy. By analyzing vast datasets, banks can identify subtle patterns and trends that traditional models might overlook, enabling them to make more informed lending decisions. Moreover, the integration of real-time monitoring systems allows institutions to continuously track borrower behavior and market conditions, facilitating proactive risk management.

Another critical strategy involves diversifying the credit portfolio to mitigate potential losses. Financial institutions should focus on spreading risk across various sectors and geographies, ensuring that exposure is not overly concentrated in any single area. Additionally, fostering strong relationships with borrowers can provide valuable insights into their financial health and adaptability during uncertain times. By maintaining open lines of communication, lenders can better understand the challenges faced by borrowers and offer tailored solutions that align with their evolving needs. Ultimately, a combination of technological innovation and strategic diversification is essential for navigating the complexities of credit risk in volatile markets.

Leveraging Technology for Enhanced Credit Monitoring”>

Leveraging Technology for Enhanced Credit Monitoring”>

Innovative Risk Mitigation Techniques Leveraging Technology for Enhanced Credit Monitoring

In today’s rapidly changing financial landscape, institutions are increasingly turning to technology to bolster their credit risk management strategies. Leveraging cutting-edge innovations, they are enhancing their ability to monitor and mitigate risks associated with credit exposure. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, enabling real-time analysis of vast datasets to identify potential risks before they materialize. These technologies provide predictive insights that are far superior to traditional models, allowing for more informed decision-making.

Moreover, financial institutions are utilizing Blockchain to ensure transparency and security in credit transactions. This decentralized technology not only reduces the risk of fraud but also enhances the efficiency of credit processes. Additionally, Big Data Analytics plays a crucial role in understanding customer behavior and creditworthiness by analyzing diverse data sources, such as social media and transaction histories. The integration of these technologies facilitates:

- Proactive risk identification

- Enhanced accuracy in credit scoring

- Improved customer profiling

- Streamlined compliance with regulatory standards

By embracing these innovative techniques, financial institutions are not only safeguarding their portfolios but also paving the way for more resilient and adaptive credit risk management frameworks.

Building Resilience Crafting Robust Credit Policies to Withstand Economic Fluctuations

In the face of economic turbulence, financial institutions are tasked with the critical challenge of managing credit risk exposure. Crafting robust credit policies is essential to navigate these volatile times. Institutions focus on creating dynamic risk assessment models that incorporate real-time data analytics, enabling them to predict and respond to potential credit risks swiftly. By leveraging advanced technologies, they can monitor market trends and adjust credit policies proactively, ensuring they remain resilient against economic fluctuations.

- Adaptive Credit Scoring: Utilizing machine learning algorithms to refine credit scoring models, allowing for more accurate risk assessment.

- Stress Testing: Conducting regular stress tests to evaluate the impact of various economic scenarios on the credit portfolio.

- Portfolio Diversification: Ensuring a well-diversified credit portfolio to minimize the impact of sector-specific downturns.

- Enhanced Due Diligence: Implementing rigorous due diligence processes to assess the creditworthiness of borrowers.

By implementing these strategies, financial institutions not only protect themselves from potential losses but also position themselves as resilient entities capable of thriving amidst economic uncertainties.

Expert Recommendations Strengthening Financial Health Through Proactive Risk Management

In today’s unpredictable financial landscape, institutions are compelled to adopt a robust approach to managing credit risk exposure. By implementing proactive risk management strategies, they can not only safeguard their assets but also seize opportunities for growth. Financial institutions are increasingly leveraging advanced data analytics and machine learning algorithms to anticipate potential risks and make informed decisions. This tech-driven approach allows them to identify patterns and anomalies in borrower behavior, enabling timely interventions and customized credit solutions.

Furthermore, maintaining a diversified credit portfolio is crucial in mitigating risks associated with market volatility. Institutions are advised to:

- Continuously monitor and reassess the creditworthiness of their clients.

- Engage in stress testing to evaluate their resilience against economic downturns.

- Enhance their risk culture by fostering an environment where risk awareness is integrated into every level of decision-making.

By embracing these expert recommendations, financial institutions can fortify their financial health and navigate the complexities of volatile markets with confidence.