In the ever-evolving tapestry of global finance, the threads of credit risk weave a narrative as complex as it is influential. As we stand on the precipice of a new financial era, the patterns of global credit risk trends are not merely indicators of economic health; they are the architects of the future financial landscape. From the bustling streets of New York to the emerging markets of Southeast Asia, the ripples of credit risk are felt across every corner of the globe, influencing decisions, shaping policies, and redefining the contours of financial stability. This article delves into the intricate dynamics of these trends, offering a comprehensive exploration of how they are sculpting the future of finance with precision and authority. Prepare to embark on a journey through the sophisticated world of credit risk, where every decision holds the potential to redefine the economic destiny of nations.

Navigating the Storm: Analyzing Emerging Credit Risk Patterns

In the dynamic landscape of global finance, the ability to anticipate and adapt to emerging credit risk patterns is paramount. As we delve into the complexities of this evolving environment, several key trends are reshaping the future of credit risk management. Financial institutions are now compelled to integrate advanced technologies and data analytics to identify potential risks more accurately and swiftly. Artificial intelligence and machine learning are not just buzzwords; they are pivotal tools in predicting creditworthiness and mitigating potential defaults.

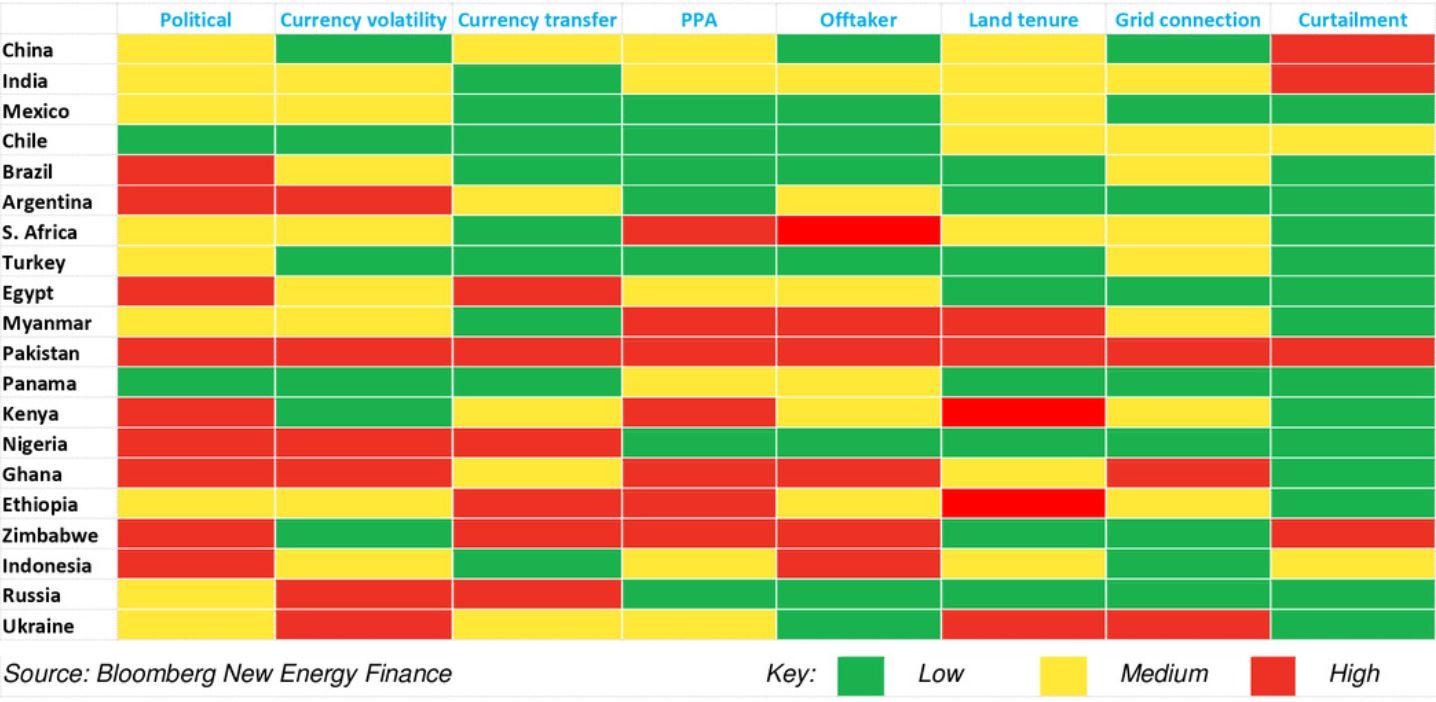

Furthermore, the geopolitical climate and economic uncertainties continue to influence credit risk trends worldwide. Trade tensions, regulatory changes, and environmental factors are all contributing to an unpredictable risk landscape. Financial leaders must focus on:

- Enhancing risk assessment models to accommodate new variables.

- Developing robust contingency plans to handle unforeseen economic shifts.

- Fostering a culture of agility and resilience within their organizations.

By proactively addressing these challenges, financial institutions can not only safeguard their portfolios but also capitalize on new opportunities that arise from a deeper understanding of global credit risk dynamics.

The New Frontier: Technological Innovations in Credit Risk Management

In the rapidly evolving landscape of global finance, the integration of cutting-edge technology into credit risk management is not just an enhancement but a necessity. Financial institutions are increasingly leveraging artificial intelligence and machine learning to predict and mitigate risks with unprecedented accuracy. These technologies enable the analysis of vast datasets, identifying patterns and trends that were previously invisible, thus transforming traditional risk assessment methodologies.

Key innovations driving this transformation include:

- Blockchain Technology: Enhances transparency and security in credit transactions, reducing fraud and improving trust.

- Predictive Analytics: Utilizes historical data to forecast future credit risk scenarios, allowing for proactive decision-making.

- Cloud Computing: Offers scalable solutions for data storage and processing, facilitating real-time risk assessment and reporting.

- RegTech Solutions: Streamlines compliance processes, ensuring adherence to regulatory standards with greater efficiency.

These innovations are not merely reshaping the operational strategies of financial institutions but are setting a new benchmark for risk management practices worldwide. As these technologies continue to evolve, they promise to enhance the resilience and adaptability of the global financial system.

Strategic Imperatives: Adapting Financial Policies to Global Credit Dynamics

In the ever-evolving landscape of global finance, understanding and adapting to the shifting currents of credit risk is paramount. Financial institutions must embrace a suite of strategic imperatives to navigate these changes effectively. At the forefront, dynamic policy frameworks are essential, enabling institutions to remain agile in response to rapid shifts in credit markets. This involves not only recalibrating risk assessment models but also integrating advanced analytics to predict potential disruptions.

- Proactive risk management: Establishing a forward-looking approach that anticipates market changes and prepares for volatility.

- Enhanced data utilization: Leveraging big data and AI to gain deeper insights into credit behaviors and emerging trends.

- Regulatory alignment: Ensuring compliance with evolving international standards while maintaining operational flexibility.

Moreover, fostering cross-border collaborations can provide valuable insights and shared best practices, enhancing the resilience of financial systems. By adopting these strategic imperatives, financial entities can not only safeguard their interests but also seize new opportunities in the global credit arena.

Future-Proofing Finance: Recommendations for Sustainable Risk Mitigation

In an era where financial landscapes are constantly evolving, it is imperative for institutions to adopt strategies that ensure long-term stability and resilience. Sustainable risk mitigation has emerged as a cornerstone for future-proofing finance, demanding a shift from traditional approaches to more innovative, adaptive frameworks. To navigate the complexities of global credit risk trends, financial entities should consider integrating the following key strategies:

- Data-Driven Decision Making: Leverage advanced analytics and AI technologies to enhance predictive accuracy and make informed decisions that preempt potential credit risks.

- Regulatory Alignment: Stay ahead of regulatory changes by establishing agile compliance mechanisms that can quickly adapt to new standards and reduce exposure to regulatory risks.

- Diversification of Portfolios: Expand investment portfolios across various sectors and geographies to mitigate the impact of localized economic downturns.

- Strengthening Stakeholder Engagement: Foster robust communication channels with stakeholders to ensure transparency and build trust, which is crucial for risk management.

By embracing these strategies, financial institutions can not only safeguard themselves against emerging risks but also capitalize on new opportunities, ensuring a sustainable and prosperous future in the ever-changing financial landscape.