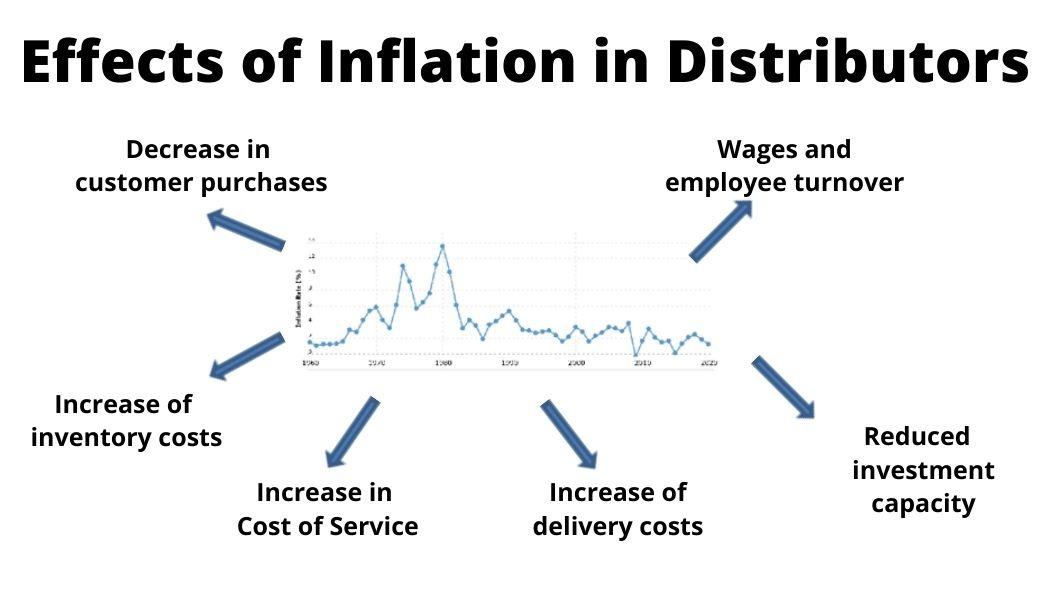

In the intricate dance of global economics, inflation often plays the role of an unpredictable partner, leading even the most seasoned financial institutions into uncharted territory. As the cost of goods and services rises, so too does the complexity of managing credit risk, a cornerstone of financial stability. This article delves into the multifaceted impact of inflation on credit risk management, exploring how institutions must adapt their strategies to navigate the turbulent waters of economic change. By examining the interplay between inflationary pressures and credit risk, we aim to shed light on the challenges and opportunities that lie ahead for financial professionals. With an authoritative lens, we will uncover the tools and tactics essential for safeguarding financial health in an era where inflation is not just a number, but a force reshaping the landscape of credit and risk.

Navigating Economic Tides Understanding Inflations Ripple Effect on Credit Risk

In the ever-shifting landscape of global finance, inflation acts as a silent tide, influencing the delicate balance of credit risk management. As prices surge, the purchasing power of money diminishes, creating a ripple effect that extends far beyond consumer wallets. For lenders, this means a recalibration of risk assessments and credit strategies is imperative. Understanding the intricate relationship between inflation and credit risk is crucial for financial institutions aiming to maintain stability and profitability.

- Borrower Behavior: Inflation often leads to increased interest rates, which can strain borrowers’ ability to repay loans. This shift necessitates a reevaluation of borrower creditworthiness and a potential tightening of lending criteria.

- Asset Valuation: As inflation rises, the value of collateral may fluctuate, impacting the security of loans. Lenders must adjust their asset valuation models to account for these changes, ensuring they are not overexposed to depreciating assets.

- Operational Costs: The operational costs for financial institutions can increase with inflation, affecting their bottom line. Efficient cost management strategies become essential to offset these pressures and maintain competitive interest rates.

By proactively adapting to these challenges, financial institutions can safeguard their portfolios against the uncertainties of inflationary pressures. Embracing advanced data analytics and predictive modeling tools can further enhance their ability to navigate these economic tides with confidence.

Strategic Adaptation Enhancing Credit Risk Frameworks Amid Rising Prices

In the current economic landscape, characterized by escalating inflation rates, financial institutions must engage in strategic adaptation to fortify their credit risk frameworks. Inflation can erode purchasing power and affect borrowers’ ability to repay, thereby amplifying credit risk. To navigate these challenges, organizations should consider the following strategies:

- Dynamic Risk Assessment: Continuously update risk models to incorporate real-time economic data, ensuring they reflect the latest inflation trends and their potential impact on borrowers.

- Enhanced Monitoring: Implement advanced analytics and machine learning techniques to monitor borrower behavior and detect early signs of financial distress.

- Portfolio Diversification: Diversify lending portfolios across various sectors and geographies to mitigate concentration risk associated with inflation-sensitive industries.

- Stress Testing: Conduct rigorous stress tests under various inflation scenarios to assess the resilience of credit portfolios and identify vulnerabilities.

By integrating these adaptive strategies, financial institutions can not only safeguard their assets but also seize opportunities in a volatile market, thereby maintaining a robust and resilient credit risk management framework.

Data-Driven Decisions Leveraging Analytics to Mitigate Inflation-Induced Risks

In an era where inflationary pressures loom large, the strategic deployment of analytics becomes a cornerstone for robust credit risk management. By harnessing the power of data-driven insights, financial institutions can anticipate and mitigate the multifaceted risks posed by inflation. Advanced analytics tools enable organizations to sift through vast datasets, uncovering hidden patterns and trends that traditional methods might overlook. This proactive approach allows for the identification of potential default risks, facilitating timely interventions and informed decision-making.

Financial entities can leverage analytics to enhance their credit risk frameworks through several key strategies:

- Predictive Modeling: Employing sophisticated algorithms to forecast borrower behavior and creditworthiness under various inflation scenarios.

- Real-Time Monitoring: Utilizing dashboards and alerts to track economic indicators and their impact on credit portfolios continuously.

- Scenario Analysis: Conducting stress tests to evaluate the resilience of credit portfolios against inflation-induced shocks.

By integrating these analytical techniques, institutions not only safeguard their assets but also position themselves to capitalize on opportunities amidst economic uncertainty.

Proactive Measures Crafting Resilient Strategies for Inflationary Challenges

In the face of escalating inflation, businesses must adopt a proactive stance to safeguard their credit risk management strategies. Crafting resilient approaches involves a deep dive into dynamic forecasting and robust scenario analysis. By anticipating potential inflationary impacts, companies can adjust their credit policies, ensuring they remain both competitive and secure. This may include:

- Diversifying credit portfolios to mitigate risks associated with specific sectors vulnerable to inflation.

- Implementing advanced data analytics to continuously monitor economic indicators and swiftly adapt credit terms.

- Strengthening collaborative frameworks with financial partners to share insights and develop joint strategies.

Moreover, investing in employee training to enhance risk assessment skills ensures that teams are equipped to identify and respond to inflation-driven credit risks effectively. By embedding these proactive measures into their strategic framework, organizations can transform potential challenges into opportunities for growth and resilience.