In the ever-evolving landscape of finance, where uncertainty is the only certainty, the art and science of credit risk management have never been more crucial. As global markets pulsate with unprecedented volatility and technological advancements redefine the boundaries of possibility, financial experts find themselves at the helm of a new era. This era demands not only a keen understanding of traditional risk metrics but also an agile adaptation to emerging trends that promise to reshape the future of credit assessment. In this authoritative exploration, we delve into the latest trends in credit risk management, offering a compass to navigate the complexities of modern finance. From the integration of artificial intelligence and machine learning to the rise of sustainable finance and the increasing importance of real-time data analytics, we uncover the strategies and innovations that are empowering financial experts to mitigate risks with precision and foresight. Join us as we unravel the tapestry of contemporary credit risk management, equipping you with the insights needed to stay ahead in a world where the stakes have never been higher. Credit Risk Assessment“>

Credit Risk Assessment“>

Emerging Technologies Revolutionizing Credit Risk Assessment

In the ever-evolving landscape of credit risk management, cutting-edge technologies are reshaping how financial institutions evaluate and mitigate risk. Artificial Intelligence (AI) and Machine Learning (ML) have become pivotal, enabling the analysis of vast datasets with unprecedented speed and accuracy. These technologies facilitate real-time risk assessment, allowing for more dynamic and responsive decision-making processes. Furthermore, blockchain technology is emerging as a game-changer by enhancing transparency and security in credit transactions, thereby reducing fraud and improving trust among stakeholders.

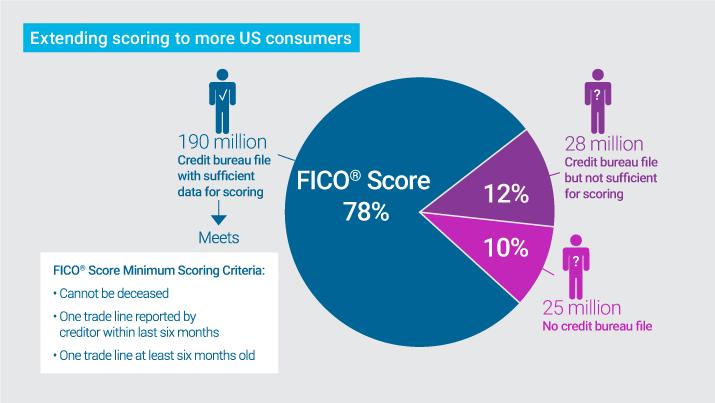

Additionally, the integration of big data analytics provides deeper insights into consumer behavior and creditworthiness, going beyond traditional credit scoring methods. Financial experts are now leveraging alternative data sources, such as social media activity and digital footprints, to gain a more comprehensive understanding of a borrower’s financial habits. This holistic approach not only enhances risk prediction but also opens doors to underserved markets, offering credit access to individuals previously deemed high-risk. As these technologies continue to evolve, they promise to transform credit risk assessment into a more precise and inclusive practice.

Strategic Data Utilization for Enhanced Predictive Accuracy

In the ever-evolving landscape of credit risk management, leveraging data strategically has become paramount for financial experts aiming to enhance predictive accuracy. Advanced analytics and machine learning algorithms are now pivotal in deciphering complex data sets, enabling more precise risk assessments. By harnessing these technologies, financial institutions can identify patterns and trends that were previously obscured, leading to more informed decision-making processes.

- Data Integration: Combining data from various sources, including transactional, behavioral, and external market data, to create a comprehensive risk profile.

- Real-time Analysis: Utilizing real-time data processing to monitor credit risk dynamically, allowing for immediate response to potential threats.

- Predictive Modeling: Developing sophisticated models that incorporate historical data and current market conditions to forecast future risks with greater accuracy.

Financial experts are increasingly adopting these methodologies to not only mitigate risks but also to seize opportunities for growth. As the industry continues to innovate, the strategic use of data will remain a cornerstone of effective credit risk management.

Innovative Approaches to Stress Testing and Scenario Analysis

In the ever-evolving landscape of credit risk management, financial experts are increasingly turning to innovative methodologies to enhance their stress testing and scenario analysis processes. Traditional models are being supplemented, and in some cases, replaced by advanced techniques that leverage cutting-edge technology and data analytics. This shift is driven by the need for more accurate, real-time insights into potential risk exposures, allowing financial institutions to make more informed decisions.

- Machine Learning Algorithms: These are being integrated to analyze vast datasets, identifying patterns and predicting outcomes with unprecedented accuracy.

- Cloud-Based Platforms: Offering scalability and flexibility, these platforms enable institutions to run complex simulations without the constraints of on-premises infrastructure.

- Scenario-Based Analysis: Moving beyond static models, this approach incorporates dynamic variables and real-world events, providing a more comprehensive view of potential risks.

- Collaborative Tools: Financial teams are utilizing platforms that allow for seamless collaboration, enhancing the speed and efficiency of risk assessments.

By embracing these innovative approaches, financial experts are not only improving their risk management capabilities but also ensuring their organizations are better prepared for the uncertainties of the future. As these trends continue to develop, staying ahead of the curve will be crucial for maintaining a competitive edge in the industry.

Strengthening Risk Mitigation through Advanced Analytics

In the rapidly evolving landscape of credit risk management, leveraging advanced analytics has become a cornerstone for financial experts aiming to enhance their risk mitigation strategies. By harnessing the power of big data and sophisticated algorithms, institutions can now predict potential risks with unprecedented accuracy, allowing for more informed decision-making. This proactive approach not only helps in identifying high-risk profiles but also in customizing risk strategies tailored to individual customer behaviors.

- Predictive Modeling: Utilize machine learning to forecast credit defaults and identify emerging risk patterns.

- Real-time Data Analysis: Implement systems that process data in real-time to quickly adapt to market changes.

- Behavioral Insights: Analyze customer behavior to preemptively address potential risk factors.

- Enhanced Reporting: Generate detailed reports that provide deeper insights into risk exposure and mitigation efficacy.

Integrating these advanced analytical techniques not only fortifies the financial institution’s defense mechanisms but also enhances the overall customer experience by offering personalized solutions. As financial landscapes continue to shift, staying ahead with cutting-edge analytics is not just advantageous—it’s essential.