In the intricate dance of global finance, credit markets have long been the steadfast partners, guiding economies through the ebbs and flows of growth and recession. Yet, in the current economic landscape, these markets are beginning to falter, facing an array of unprecedented risks that threaten to disrupt their rhythm. As we delve into the complexities of this evolving scenario, it becomes clear that a confluence of factors—ranging from geopolitical tensions and technological disruptions to shifting regulatory frameworks and climate-related challenges—are reshaping the very foundations of credit markets. This article seeks to unravel the layers of this multifaceted issue, providing a comprehensive analysis of why credit markets are navigating uncharted waters and what it means for the broader economic tapestry. Join us as we explore the new risks confronting credit markets, offering insights grounded in expertise and foresight, to illuminate the path forward in these uncertain times.

Emerging Threats: Unpacking the New Dynamics in Credit Markets

The credit markets are undergoing a seismic shift, characterized by a complex interplay of emerging threats that challenge traditional risk management paradigms. In this new economic landscape, financial institutions must navigate an intricate web of variables that were previously peripheral. These include:

- Geopolitical Instability: The rise of protectionist policies and trade tensions have led to unpredictable market conditions, affecting creditworthiness and the cost of borrowing.

- Technological Disruption: Fintech innovations are reshaping lending processes, introducing both opportunities and vulnerabilities that can impact credit assessments.

- Climate Change Risks: Increasing environmental regulations and the transition to a low-carbon economy pose significant risks to industries heavily reliant on fossil fuels, influencing their credit ratings.

These dynamics demand a recalibration of risk models and a proactive approach to risk mitigation. Financial entities must harness advanced analytics and robust scenario planning to anticipate and respond to these evolving threats effectively.

The Ripple Effect: How Global Economic Shifts are Reshaping Credit Risks

In today’s interconnected world, the dynamics of global economics are causing a seismic shift in how credit risks are perceived and managed. As economies evolve, so too do the factors influencing credit markets. This evolution is driven by a multitude of elements, including geopolitical tensions, technological advancements, and changing consumer behaviors. These factors are not isolated; rather, they create a ripple effect that impacts credit risks across the globe.

- Geopolitical Instabilities: Trade wars, sanctions, and political unrest are creating uncertainties that can disrupt credit markets, affecting both local and international lending practices.

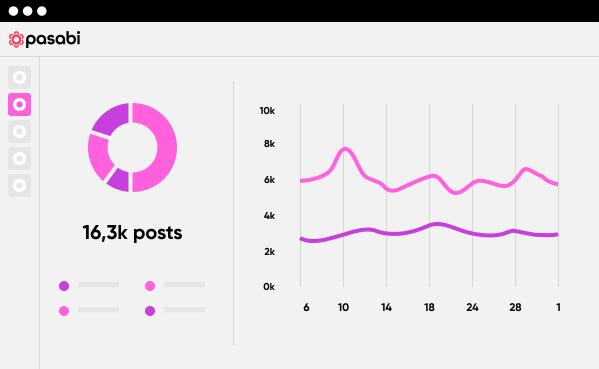

- Technological Disruptions: The rise of fintech and digital currencies is challenging traditional banking models, introducing new credit risk variables that require innovative assessment methods.

- Consumer Behavior Shifts: As consumer preferences evolve, particularly in response to economic pressures, credit markets must adapt to changing demands and repayment capabilities.

Understanding these shifts is crucial for stakeholders aiming to navigate the complexities of modern credit markets. The ability to anticipate and adapt to these changes will define the resilience and success of financial institutions in the face of new and emerging risks.

Navigating Uncertainty: Strategic Approaches for Credit Risk Management

In today’s rapidly evolving economic landscape, credit risk management requires a nuanced approach to effectively address emerging challenges. Financial institutions must pivot from traditional methods and embrace innovative strategies to mitigate risks. Key to this transformation is the integration of advanced analytics and technology, which provide deeper insights into borrower behavior and market trends. Predictive analytics and machine learning models are not just buzzwords; they are essential tools for identifying potential default risks before they materialize.

Moreover, fostering a culture of agility and adaptability within risk management teams is crucial. Consider the following strategic approaches:

- Dynamic Risk Assessment: Continuously update risk models to reflect real-time data and economic indicators.

- Stress Testing: Conduct rigorous stress tests to evaluate the impact of various economic scenarios on credit portfolios.

- Collaborative Risk Sharing: Partner with fintech companies to leverage their expertise in alternative data sources and risk assessment tools.

By implementing these strategies, financial institutions can better navigate the complexities of the current credit market and safeguard their portfolios against unforeseen disruptions.

Future-Proofing Investments: Expert Recommendations for a Volatile Credit Landscape

In an era where economic shifts are as unpredictable as the weather, investors are seeking innovative strategies to safeguard their portfolios. The traditional methods of risk assessment are being challenged by new variables, such as geopolitical tensions and rapid technological advancements. Experts recommend a diversified approach that includes a mix of asset classes and geographic regions to mitigate unforeseen risks. By spreading investments across various sectors, investors can better shield themselves from sector-specific downturns.

Moreover, it is crucial to incorporate flexible investment vehicles that can adapt to changing market conditions. Consider the following expert recommendations:

- Incorporate alternative assets like real estate and commodities to hedge against inflation.

- Utilize technology-driven tools for real-time data analysis and decision-making.

- Engage with financial advisors who specialize in dynamic risk management strategies.

By embracing these forward-thinking tactics, investors can not only protect their assets but also position themselves to capitalize on new opportunities as they arise.