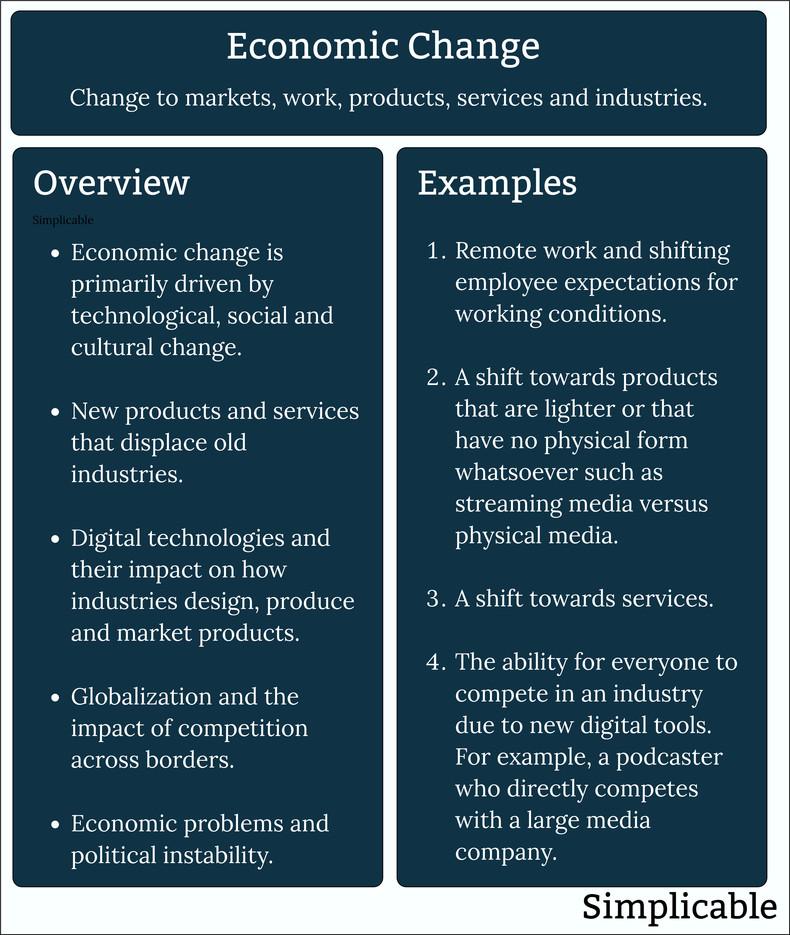

In the ever-evolving landscape of global finance, the ground beneath our economic feet is shifting with unprecedented speed and complexity. As the world grapples with the aftermath of a pandemic, geopolitical tensions, and technological disruptions, the intricate web of credit risk is being rewoven in ways that demand our immediate attention. Economic shifts are no longer mere ripples in the vast ocean of commerce; they are seismic waves reshaping the contours of credit risk management. In this article, we delve into the multifaceted challenges emerging from these economic transformations, exploring how they are redefining traditional paradigms and compelling financial institutions to rethink their strategies. With an authoritative lens, we will navigate the turbulent waters of this new era, uncovering the forces at play and the innovative responses required to stay afloat in a world where the only constant is change.

Navigating the Storm Understanding the Roots of Emerging Credit Risks

In today’s rapidly evolving economic landscape, understanding the origins of emerging credit risks is crucial for businesses and financial institutions alike. As global markets experience unprecedented shifts, the roots of these risks can often be traced back to several key factors:

- Geopolitical Tensions: With increasing political instability in various regions, credit markets are becoming more volatile. These tensions can lead to sudden changes in trade policies, affecting the flow of capital and creating uncertainties in credit assessments.

- Technological Disruptions: The rapid pace of technological advancements is reshaping industries, leading to both opportunities and threats. While innovation drives growth, it also introduces new risks as traditional business models are challenged, impacting creditworthiness.

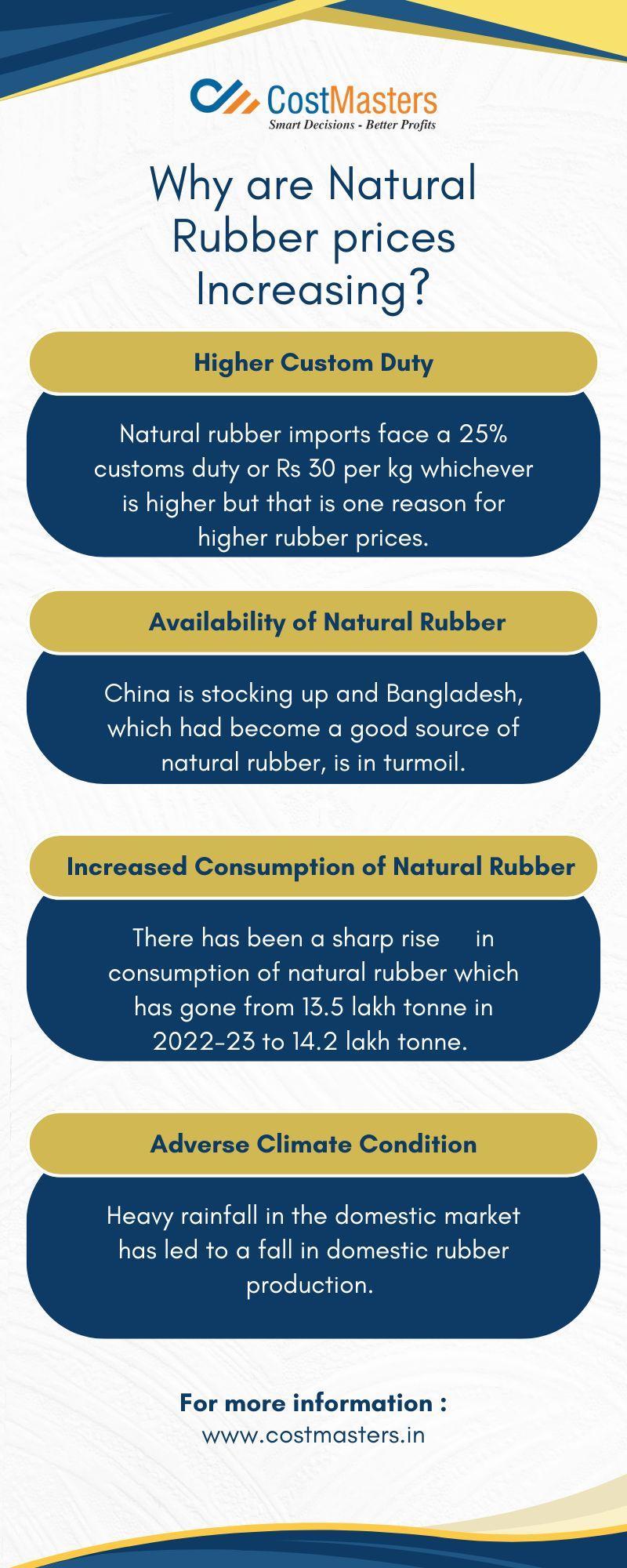

- Climate Change: Environmental concerns are no longer just a social issue but a financial one. Climate-related risks, such as natural disasters and regulatory changes, are increasingly affecting credit markets, forcing lenders to reconsider their risk assessment strategies.

By delving into these underlying causes, stakeholders can better prepare for the challenges ahead, ensuring that they remain resilient in the face of economic turbulence.

Analyzing Market Volatility How Economic Trends Are Reshaping Credit Landscapes

In today’s rapidly evolving economic environment, the dynamics of credit risk are undergoing a profound transformation. The once predictable patterns of market behavior are now punctuated by sudden and often unexpected shifts, driven by a complex interplay of global economic trends. Interest rate fluctuations, geopolitical tensions, and technological advancements are just a few of the factors that are reshaping the credit landscapes. As these elements converge, they create a tapestry of volatility that challenges traditional risk assessment models and demands a more nuanced understanding of market forces.

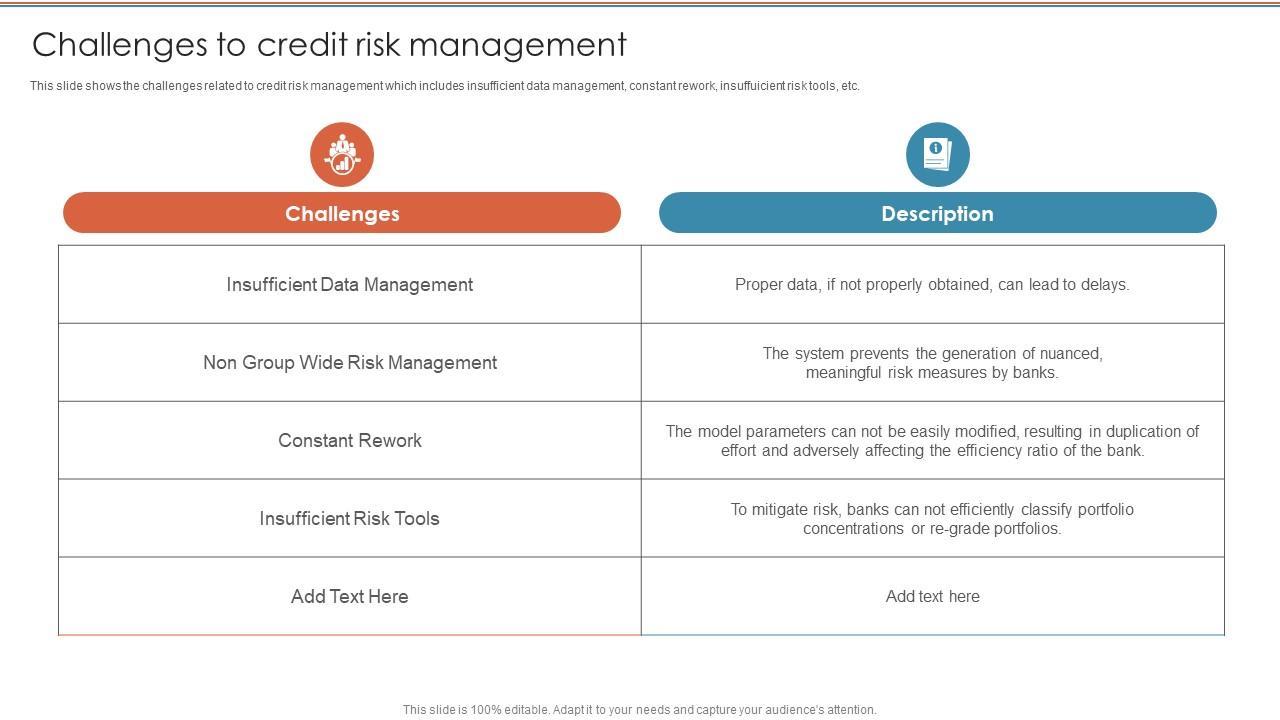

To navigate these turbulent waters, financial institutions must adapt by embracing innovative strategies and tools. Key considerations include:

- Data Analytics: Leveraging big data to gain insights into emerging market trends and consumer behavior.

- Risk Diversification: Expanding portfolios to include a broader range of asset classes to mitigate risk.

- Regulatory Compliance: Staying ahead of evolving regulations to ensure robust risk management frameworks.

By adopting these approaches, organizations can not only manage existing risks but also anticipate future challenges, positioning themselves to thrive in an era of unprecedented economic change.

Strategic Approaches to Mitigating New Credit Threats

In today’s rapidly evolving economic landscape, financial institutions must adopt innovative strategies to effectively manage emerging credit risks. One critical approach is the integration of advanced data analytics and machine learning technologies. By leveraging these tools, organizations can enhance their predictive capabilities, allowing for more accurate risk assessments and proactive decision-making. This not only aids in identifying potential threats before they materialize but also helps in customizing credit solutions tailored to individual client profiles.

Another essential strategy involves fostering a culture of agility and resilience within the organization. This can be achieved through:

- Continuous training and development: Equipping teams with the latest knowledge and skills to adapt to new risk environments.

- Dynamic policy frameworks: Establishing flexible credit policies that can swiftly respond to economic shifts.

- Collaborative ecosystems: Building partnerships with fintech firms and other stakeholders to share insights and resources.

By embracing these strategic approaches, financial institutions can not only mitigate new credit threats but also seize opportunities for growth in an uncertain economic climate.

Innovative Solutions for Strengthening Financial Resilience in Uncertain Times

In the face of evolving economic landscapes, businesses are encountering unprecedented credit risk challenges that demand innovative solutions. The shift towards digital economies, fluctuating global markets, and unpredictable geopolitical events have intensified the need for robust financial resilience strategies. Organizations must now navigate a complex web of factors that influence creditworthiness, from volatile interest rates to rapidly changing consumer behaviors. To effectively manage these risks, companies are turning to advanced data analytics and artificial intelligence, leveraging these technologies to gain deeper insights into credit trends and customer profiles.

Key strategies for strengthening financial resilience include:

- Dynamic Credit Scoring Models: Utilizing machine learning algorithms to create adaptive credit scoring systems that can quickly respond to market changes.

- Predictive Analytics: Implementing tools that forecast potential credit risks, allowing businesses to proactively adjust their strategies.

- Enhanced Risk Management Frameworks: Developing comprehensive frameworks that integrate financial, operational, and strategic risk assessments.

- Collaborative Ecosystems: Building partnerships with fintech firms to access innovative risk management solutions and share best practices.

By embracing these approaches, organizations can better prepare for economic uncertainties and safeguard their financial stability in the face of emerging credit risk challenges.