In the ever-evolving landscape of global finance, change is the only constant. Regulatory frameworks, once set in stone, are now as fluid as the markets they govern. For businesses navigating this intricate web of compliance requirements, adaptability is not just a strategy—it’s a necessity. As financial watchdogs tighten their grip and new legislation emerges with increasing frequency, organizations must remain agile, proactive, and informed. This article delves into the art and science of adapting to these shifting sands, offering a comprehensive guide to mastering compliance in a world where the rules are always changing. With expert insights and practical strategies, we empower you to transform compliance from a daunting challenge into a dynamic opportunity for growth and resilience. Welcome to the forefront of financial compliance, where staying ahead means staying informed.

Navigating the Maze Understanding the Core of Financial Compliance

In the intricate world of financial compliance, understanding the core principles is essential for any organization striving to remain agile and competitive. As regulations evolve, businesses must adopt a proactive approach to compliance, ensuring they are not only meeting current standards but also anticipating future changes. This involves a deep dive into the regulatory landscape, identifying key trends, and adapting internal processes accordingly. By doing so, organizations can transform compliance from a burdensome obligation into a strategic advantage.

- Stay Informed: Regularly update your knowledge base with the latest regulatory changes. Subscribe to industry newsletters, attend webinars, and participate in compliance forums.

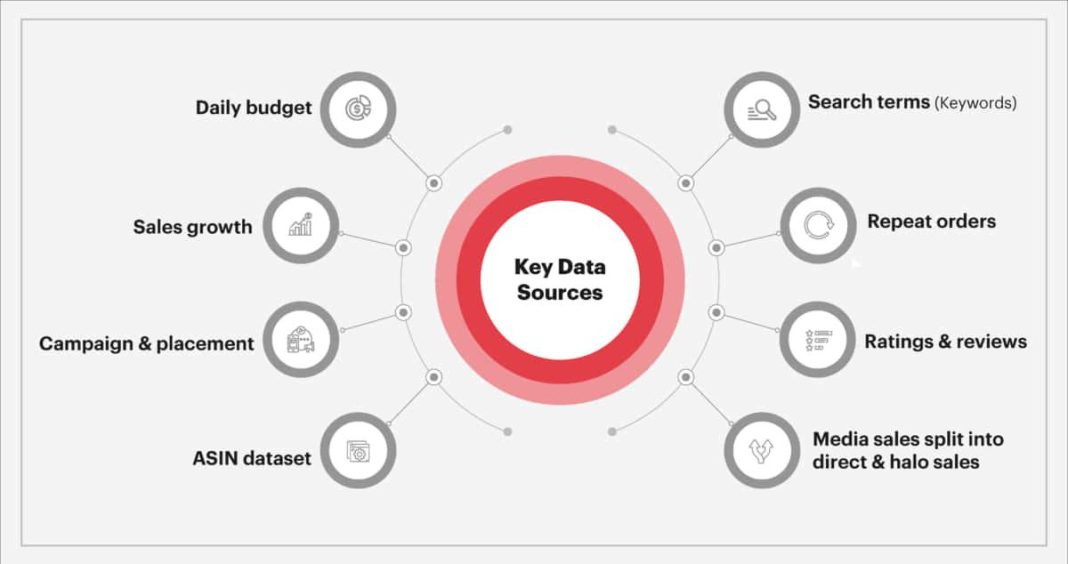

- Invest in Technology: Leverage advanced compliance software to automate monitoring and reporting tasks, reducing the risk of human error and freeing up resources for strategic initiatives.

- Foster a Compliance Culture: Educate your team on the importance of compliance and integrate it into your corporate ethos. This ensures that every employee understands their role in maintaining regulatory standards.

- Engage with Experts: Consult with legal and financial advisors to gain insights into complex regulations and tailor your compliance strategy to fit your organization’s unique needs.

By embracing these strategies, organizations can effectively navigate the complexities of financial compliance, ensuring not only adherence to regulations but also positioning themselves for sustainable growth and success.

Staying Ahead Embracing Proactive Strategies for Regulatory Changes

In the ever-evolving landscape of financial compliance, organizations must adopt proactive strategies to navigate regulatory changes effectively. This requires a dynamic approach that goes beyond mere compliance, focusing on anticipating shifts and adapting swiftly. One key strategy is to foster a culture of continuous learning and awareness. Encourage your team to stay informed about emerging regulations through regular training sessions and industry seminars. This not only equips them with the necessary knowledge but also empowers them to identify potential impacts on your operations.

Another critical aspect is leveraging technology to streamline compliance processes. Implementing advanced compliance management systems can help in tracking regulatory updates and automating reporting tasks. Consider the following proactive measures:

- Regularly audit your current compliance practices to identify areas for improvement.

- Engage with industry experts and regulatory bodies to gain insights into upcoming changes.

- Develop a flexible compliance framework that can be easily adjusted as new regulations arise.

By embracing these strategies, your organization can not only meet current compliance requirements but also position itself as a leader in the financial sector, ready to tackle future challenges with confidence.

Building Resilience Crafting a Robust Compliance Framework

In today’s dynamic financial landscape, establishing a resilient compliance framework is paramount for organizations aiming to navigate the ever-evolving regulatory environment. To achieve this, businesses must focus on crafting a framework that is both adaptable and robust. This involves integrating a series of strategic elements that ensure compliance while fostering agility.

- Continuous Monitoring: Implement real-time monitoring systems to detect and address compliance issues promptly, ensuring that your organization stays ahead of regulatory changes.

- Regular Training: Equip your team with the latest knowledge through ongoing training sessions, enabling them to effectively manage new compliance requirements.

- Technology Integration: Leverage advanced technologies like AI and machine learning to automate compliance processes, reducing human error and increasing efficiency.

- Risk Assessment: Conduct frequent risk assessments to identify potential vulnerabilities in your compliance framework, allowing for proactive adjustments.

- Stakeholder Engagement: Foster open communication with stakeholders to ensure alignment and support for compliance initiatives.

By embedding these core principles into your compliance strategy, you create a resilient framework capable of withstanding the pressures of regulatory change, ensuring both compliance and operational excellence.

Empowering Your Team Fostering a Culture of Continuous Learning

In today’s fast-paced financial landscape, adaptability is key. Encouraging your team to embrace a mindset of continuous learning can significantly enhance their ability to navigate evolving compliance requirements. This begins with fostering an environment where knowledge sharing is not just encouraged but is an integral part of the daily workflow. Create opportunities for team members to attend workshops, webinars, and industry conferences. Encourage them to share insights and updates through regular team meetings or a dedicated online platform.

- Leverage technology: Utilize online learning platforms to provide access to the latest compliance courses and resources.

- Promote collaboration: Encourage cross-departmental projects that require compliance knowledge, enabling team members to learn from each other.

- Mentorship programs: Pair less experienced team members with seasoned professionals to facilitate knowledge transfer and skill development.

By embedding a culture of continuous learning, your team will not only stay ahead of regulatory changes but also develop a proactive approach to compliance challenges, ensuring your organization remains resilient and compliant.