In the ever-evolving landscape of global commerce, the only constant is change itself. For businesses navigating the intricate web of compliance requirements, this axiom holds particularly true. Regulatory frameworks shift like tectonic plates, reshaping the business environment and demanding agility and foresight from those who wish to thrive. As new laws emerge and existing ones are amended, the challenge lies not only in understanding these changes but in seamlessly integrating them into the very fabric of your operations. In this authoritative guide, we delve into the strategies and insights necessary to transform compliance from a daunting obligation into a strategic advantage. Join us as we explore how to future-proof your business by embracing adaptability and ensuring that your compliance practices are not just reactive, but resilient and forward-thinking.

Navigating the Compliance Landscape: Understanding Regulatory Shifts

In the ever-evolving world of business regulations, staying ahead of compliance requirements is crucial for maintaining a competitive edge. To effectively adapt, businesses must first develop a proactive approach to monitoring regulatory changes. This involves setting up automated alerts for new legislation, subscribing to industry newsletters, and engaging with professional networks that focus on compliance updates. Such vigilance ensures that your business is not caught off guard by sudden shifts in the regulatory landscape.

Another essential strategy is to cultivate a culture of compliance within your organization. Encourage open communication about regulatory changes and their potential impacts. Implement regular training sessions to keep your team informed and prepared. Consider the following key actions:

- Conduct regular compliance audits to identify potential gaps.

- Invest in compliance management software to streamline processes.

- Collaborate with legal experts to interpret complex regulations.

- Empower employees with the knowledge and tools they need to ensure compliance.

By embedding these practices into your business operations, you can navigate the compliance landscape with confidence and agility.

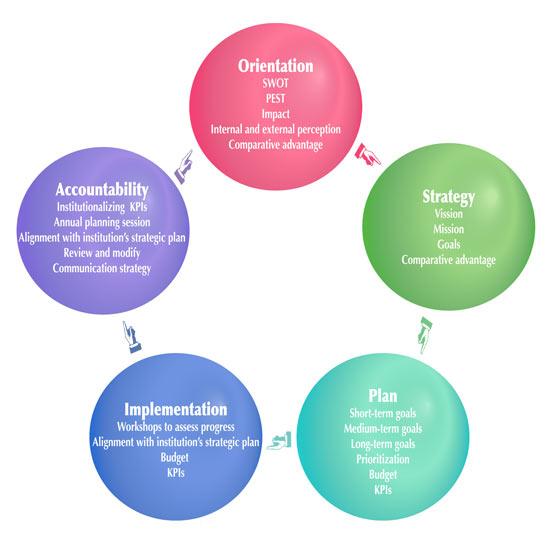

Strategic Planning for Compliance: Building a Robust Framework

In the ever-evolving landscape of regulatory requirements, businesses must be proactive in crafting a strategic compliance framework that is both adaptable and resilient. This involves not just meeting current regulations but anticipating future changes. A robust framework should be grounded in a thorough understanding of your industry’s regulatory environment and should incorporate several key elements:

- Risk Assessment: Regularly evaluate potential compliance risks and vulnerabilities within your operations.

- Policy Development: Create clear, comprehensive policies that align with regulatory standards and are easily accessible to all employees.

- Training and Education: Implement ongoing training programs to ensure all staff are informed about compliance requirements and best practices.

- Monitoring and Auditing: Establish continuous monitoring systems and conduct periodic audits to ensure compliance and identify areas for improvement.

- Technology Integration: Leverage technology to streamline compliance processes and enhance data security and reporting capabilities.

By embedding these elements into your strategic planning, you not only safeguard your business against potential compliance breaches but also enhance operational efficiency and foster a culture of accountability and transparency.

Harnessing Technology for Compliance: Tools and Innovations

In today’s fast-paced regulatory landscape, leveraging technology is no longer optional but essential for maintaining compliance. Businesses can harness a variety of innovative tools designed to streamline compliance processes and ensure adherence to ever-evolving regulations. Automation software can significantly reduce the burden of manual compliance checks by systematically monitoring and reporting regulatory changes. This not only minimizes human error but also ensures timely updates to compliance protocols.

Moreover, adopting cloud-based solutions offers unparalleled flexibility and scalability, allowing businesses to manage compliance data securely and efficiently across multiple locations. Artificial Intelligence (AI) and Machine Learning (ML) technologies can further enhance compliance efforts by predicting potential compliance risks and suggesting proactive measures. Key innovations include:

- Real-time monitoring systems: Continuously track compliance status and flag potential issues.

- Data analytics tools: Analyze large volumes of data to identify compliance trends and patterns.

- Blockchain technology: Ensure transparency and traceability in compliance documentation.

By integrating these technologies, businesses can not only meet current compliance requirements but also adapt swiftly to future regulatory changes, ensuring sustained operational integrity and trust.

Cultivating a Compliance Culture: Training and Engagement Strategies

To ensure your business remains agile in the face of evolving compliance landscapes, it’s crucial to embed a culture of compliance through effective training and engagement strategies. Start by developing a comprehensive training program that not only educates employees on current regulations but also instills a proactive mindset towards compliance. This can be achieved by incorporating interactive workshops, scenario-based learning, and regular refresher courses that keep compliance at the forefront of your team’s priorities.

Engagement is equally vital. Encourage open communication channels where employees feel empowered to discuss compliance challenges and propose solutions. Foster a sense of ownership by involving team members in the development of compliance strategies and rewarding innovative ideas. Consider the following strategies to boost engagement:

- Create a compliance ambassador program to recognize and support employees who exemplify compliance excellence.

- Leverage digital tools to facilitate real-time feedback and compliance updates.

- Host regular Q&A sessions with compliance experts to demystify complex regulations.

By weaving these elements into the fabric of your organization, you not only ensure adherence to current standards but also build a resilient framework capable of adapting to future regulatory shifts.