In the bustling world of commerce, where opportunities abound and innovation thrives, there lurks an ever-present adversary—fraud. Like a shadowy figure in the night, it can strike when least expected, leaving a trail of financial ruin and tarnished reputations in its wake. As a business leader, safeguarding your enterprise against this formidable foe is not just a necessity; it is a testament to your commitment to integrity and resilience. Welcome to our comprehensive guide on implementing a fraud prevention program for your business—a strategic blueprint designed to fortify your defenses and ensure your organization stands unyielding against the tide of deception. In the following pages, we will unravel the complexities of fraud, explore the latest in prevention technologies, and empower you with the knowledge to protect your business’s most valuable assets. Prepare to embark on a journey that transforms vigilance into victory, as we equip you with the tools to outsmart even the most cunning of fraudsters.

Understanding the Anatomy of Fraud and Its Impact on Business

Fraud is a complex beast, weaving through the very fabric of business operations and leaving a trail of financial and reputational damage in its wake. At its core, fraud is an intentional act of deception designed to secure an unfair or unlawful gain. It can manifest in various forms, such as embezzlement, financial statement fraud, and cyber fraud. Each type has its unique characteristics, but they all share the potential to cripple a business’s operations and erode trust among stakeholders.

The impact of fraud on a business can be profound and multifaceted. It often results in significant financial losses, which can be devastating, especially for small to medium-sized enterprises. Beyond the immediate financial implications, fraud can also lead to:

- Reputational damage: Once a business is associated with fraudulent activities, it can be challenging to rebuild trust with customers, partners, and investors.

- Legal consequences: Companies may face lawsuits, regulatory fines, and other legal repercussions.

- Operational disruptions: Fraud investigations can divert resources and attention away from core business activities.

Understanding these aspects is crucial for businesses aiming to safeguard their assets and maintain their integrity in a competitive market.

Crafting a Comprehensive Fraud Prevention Strategy Tailored to Your Needs

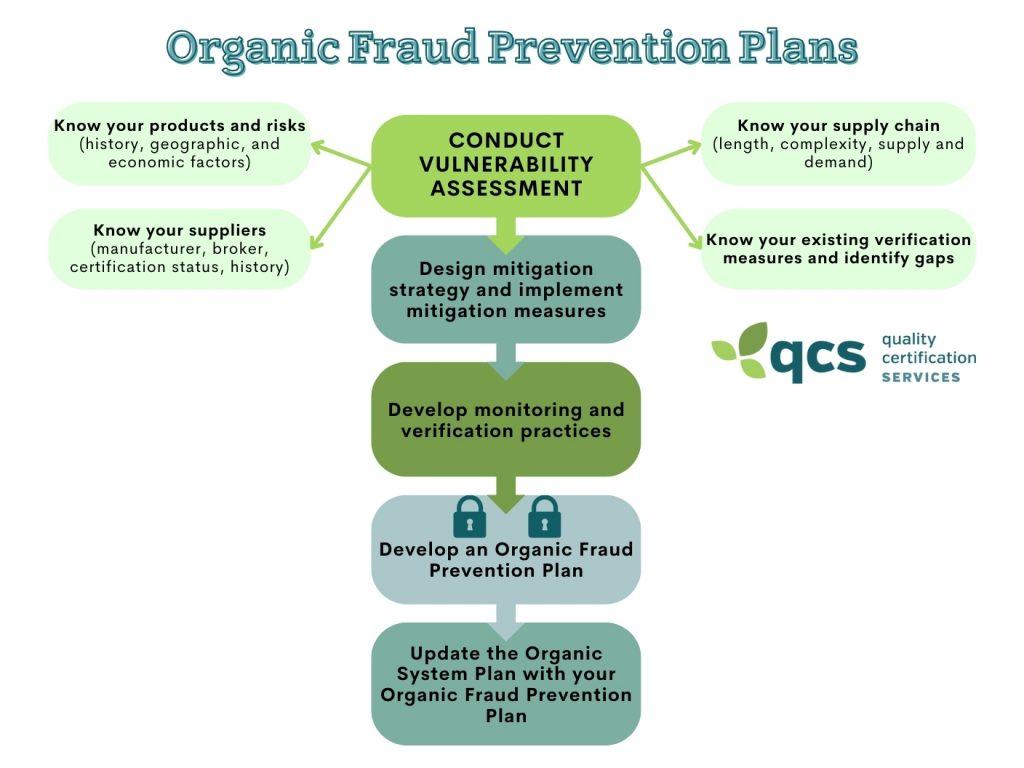

In today’s digital landscape, a one-size-fits-all approach to fraud prevention simply won’t cut it. Crafting a strategy that aligns with your specific business needs requires a deep understanding of your industry, customer base, and operational processes. Start by conducting a thorough risk assessment to identify potential vulnerabilities. This will allow you to prioritize the areas that need the most attention and allocate resources efficiently.

- Understand Your Threat Landscape: Analyze the types of fraud most prevalent in your industry. This could range from identity theft to transaction fraud, each requiring a unique set of defenses.

- Leverage Technology: Implement advanced tools such as AI-driven analytics and machine learning to detect anomalies and patterns that could indicate fraudulent activity.

- Employee Training: Ensure your team is well-versed in recognizing suspicious activities and understands the protocols for reporting them.

- Regular Audits: Schedule periodic reviews of your fraud prevention measures to ensure they remain effective and adapt to emerging threats.

By tailoring your fraud prevention strategy to the unique aspects of your business, you not only protect your assets but also build trust with your customers, demonstrating a commitment to their security and well-being.

Leveraging Technology and Data Analytics for Proactive Fraud Detection

In the digital age, businesses must harness the power of technology and data analytics to stay ahead of fraudsters. By utilizing advanced tools and systems, companies can transform their fraud detection strategies from reactive to proactive. Data analytics plays a pivotal role in this transformation, enabling businesses to sift through vast amounts of information to identify patterns and anomalies that may indicate fraudulent activity. This process not only helps in early detection but also in predicting potential threats before they materialize.

- Real-time Monitoring: Implement systems that provide continuous oversight of transactions and user behavior, allowing for immediate identification of suspicious activities.

- Machine Learning Algorithms: Deploy machine learning models that learn from historical data to predict and flag potential fraud, improving accuracy over time.

- Data Integration: Combine data from various sources to create a comprehensive view of customer interactions, enhancing the ability to detect inconsistencies.

- Automated Alerts: Set up automated alerts for transactions that deviate from established norms, enabling quick response to potential threats.

By embedding these technologies into your fraud prevention program, you not only safeguard your business but also build trust with your customers, assuring them of a secure and reliable service.

Fostering a Culture of Integrity and Vigilance Among Employees

Building a workplace environment that prioritizes integrity and vigilance is crucial in mitigating the risks of fraud. Leadership commitment is the cornerstone of this culture. Leaders must consistently model ethical behavior and openly communicate the importance of honesty and accountability. Regular training sessions should be conducted to educate employees on recognizing and reporting suspicious activities. These sessions can include real-world scenarios and role-playing exercises to enhance understanding and engagement.

Encouraging a proactive stance among employees involves establishing clear channels for reporting unethical behavior. Ensure that these channels are easily accessible and maintain confidentiality to protect whistleblowers. Foster an atmosphere where employees feel empowered to speak up without fear of retaliation. Additionally, recognize and reward employees who demonstrate integrity and vigilance, reinforcing the value of these traits within the organization. By embedding these practices into the fabric of your business, you cultivate a resilient defense against fraud.