In the bustling marketplace of the digital age, where convenience and speed are the currency of choice, the shadowy specter of credit card fraud lurks, ready to pounce on the unsuspecting. As we increasingly trade cash for clicks, the need to safeguard our financial transactions has never been more critical. This article serves as your trusted guide through the labyrinth of digital commerce, offering expert insights and actionable strategies to fortify your defenses against the cunning tactics of cybercriminals. With authority and clarity, we unravel the complexities of credit card fraud prevention, empowering you to navigate the virtual marketplace with confidence and peace of mind. Welcome to your ultimate resource for securing your digital wallet in an ever-evolving landscape of risk and reward.

Securing Your Digital Wallet: Essential Practices for Safe Transactions

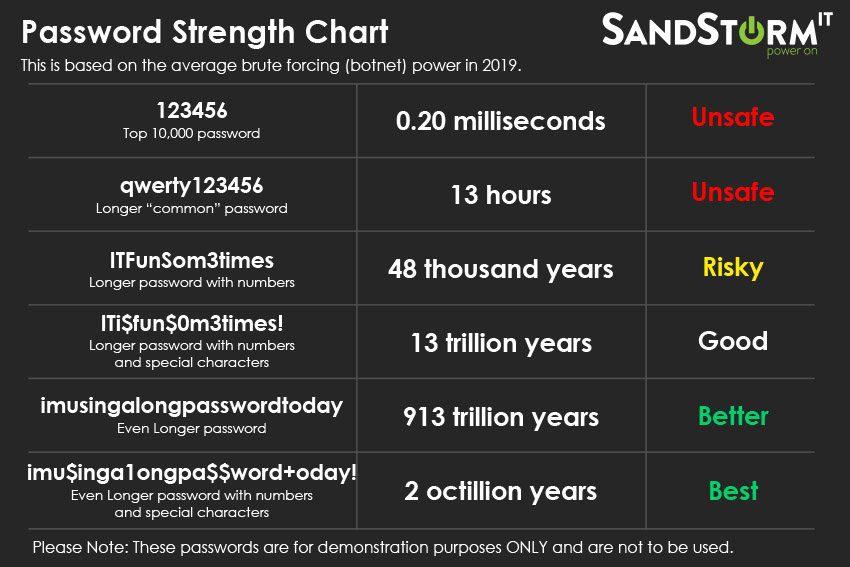

In the rapidly evolving landscape of digital finance, ensuring the security of your digital wallet is paramount. Implementing a few strategic practices can significantly reduce the risk of credit card fraud. Start by using strong, unique passwords for your digital accounts, and consider enabling two-factor authentication for an added layer of security. Regularly update your software and apps to protect against vulnerabilities that hackers may exploit.

- Monitor your transactions: Regularly check your account statements for any unauthorized activities.

- Use secure networks: Avoid public Wi-Fi when making transactions; instead, use a secure, private connection.

- Stay informed: Be aware of the latest phishing scams and tactics used by cybercriminals.

Additionally, leverage the security features offered by your financial institution, such as alerts for suspicious activities. By adopting these practices, you can enjoy the convenience of digital transactions with confidence, knowing that your financial information is well-protected.

Mastering the Art of Strong Passwords and Multi-Factor Authentication

In the digital age, safeguarding your financial information begins with crafting strong passwords and embracing multi-factor authentication (MFA). A robust password is your first line of defense against unauthorized access. Consider using a combination of uppercase and lowercase letters, numbers, and special characters. Avoid predictable patterns or easily accessible personal information. Instead, opt for a passphrase—a sequence of random words or a sentence that is easy for you to remember but difficult for others to guess.

Beyond passwords, multi-factor authentication adds an extra layer of security by requiring more than one form of verification. This could include:

- Something you know, like a password or PIN.

- Something you have, such as a smartphone app or a hardware token.

- Something you are, like a fingerprint or facial recognition.

By implementing MFA, even if your password is compromised, unauthorized users will face additional hurdles. Embrace these practices to fortify your defenses against credit card fraud and ensure your digital transactions remain secure.

Spotting the Red Flags: Identifying Phishing and Scam Tactics

In the ever-evolving landscape of digital transactions, recognizing the subtle cues of phishing and scam tactics is crucial for safeguarding your financial information. Cybercriminals often employ cleverly disguised emails or websites that mimic legitimate entities, luring unsuspecting victims into divulging sensitive details. To stay one step ahead, be vigilant for unexpected requests for personal information, especially those that create a sense of urgency or fear. Legitimate organizations rarely ask for sensitive data through email or text messages.

- Check the sender’s email address: Scammers often use addresses that are similar to, but not exactly the same as, the company’s official domain.

- Look for poor grammar and spelling: Professional organizations typically maintain high standards in their communications.

- Hover over links: Before clicking, hover your mouse over any links to see where they actually lead. Phishing links often lead to unfamiliar or suspicious URLs.

- Be wary of attachments: Avoid opening unexpected attachments, as they may contain malware designed to steal your information.

By keeping these red flags in mind, you can effectively shield yourself from the pervasive threat of credit card fraud in the digital realm. Remember, staying informed and cautious is your best defense against cybercriminals.

Leveraging Advanced Technologies: The Role of AI in Fraud Prevention

In the rapidly evolving landscape of digital transactions, Artificial Intelligence (AI) has emerged as a formidable ally in the fight against credit card fraud. By harnessing the power of machine learning algorithms, financial institutions can now analyze vast datasets in real-time, identifying patterns and anomalies that would be impossible for human analysts to detect. AI systems can continuously learn from new data, enhancing their ability to predict and prevent fraudulent activities with remarkable accuracy.

Key benefits of utilizing AI in fraud prevention include:

- Real-time monitoring: AI systems can scrutinize transactions as they occur, flagging suspicious activities instantly.

- Adaptive learning: Machine learning models evolve with each transaction, becoming more adept at recognizing emerging fraud tactics.

- Reduced false positives: By accurately distinguishing between legitimate and fraudulent transactions, AI minimizes disruptions for genuine customers.

- Cost efficiency: Automating fraud detection processes reduces the need for extensive manual oversight, saving both time and resources.

As digital transactions continue to grow, integrating AI into fraud prevention strategies is not just advantageous but essential for safeguarding financial ecosystems.