In an age where digital landscapes are as expansive as they are intricate, the question of identity has transcended mere philosophical pondering to become a critical pillar of cybersecurity. As the world hurtles towards an increasingly interconnected future, the sanctity of one’s identity has never been more vulnerable to the machinations of fraudsters lurking in the shadows of cyberspace. This article delves into the sophisticated realm of identity verification methods, exploring the cutting-edge technologies and time-tested strategies that stand as sentinels against the ever-evolving threat of fraud. With a blend of innovative prowess and unwavering diligence, these methods form the bulwark that safeguards personal and organizational integrity in a digital world fraught with peril. Join us as we unravel the complexities of identity verification, illuminating the path to a more secure and trustworthy digital existence.

Enhancing Security Through Biometric Authentication

In the evolving landscape of digital security, biometric authentication stands out as a formidable ally against fraud. By leveraging unique biological traits such as fingerprints, facial recognition, and iris patterns, this method ensures that access is granted only to the rightful individual. Unlike traditional passwords, which can be easily forgotten or hacked, biometrics offer a more robust and personalized layer of security. This technology not only enhances the user experience by simplifying the verification process but also significantly reduces the risk of identity theft.

- Fingerprint Scanning: A quick and reliable method, widely used in smartphones and secure facilities.

- Facial Recognition: Offers a seamless user experience and is increasingly integrated into mobile devices and surveillance systems.

- Iris Recognition: Known for its high accuracy, making it ideal for high-security environments.

By incorporating these biometric methods, organizations can not only protect sensitive information but also build trust with their users. As the technology continues to advance, it becomes an indispensable tool in the fight against digital fraud, offering a secure and efficient way to verify identities.

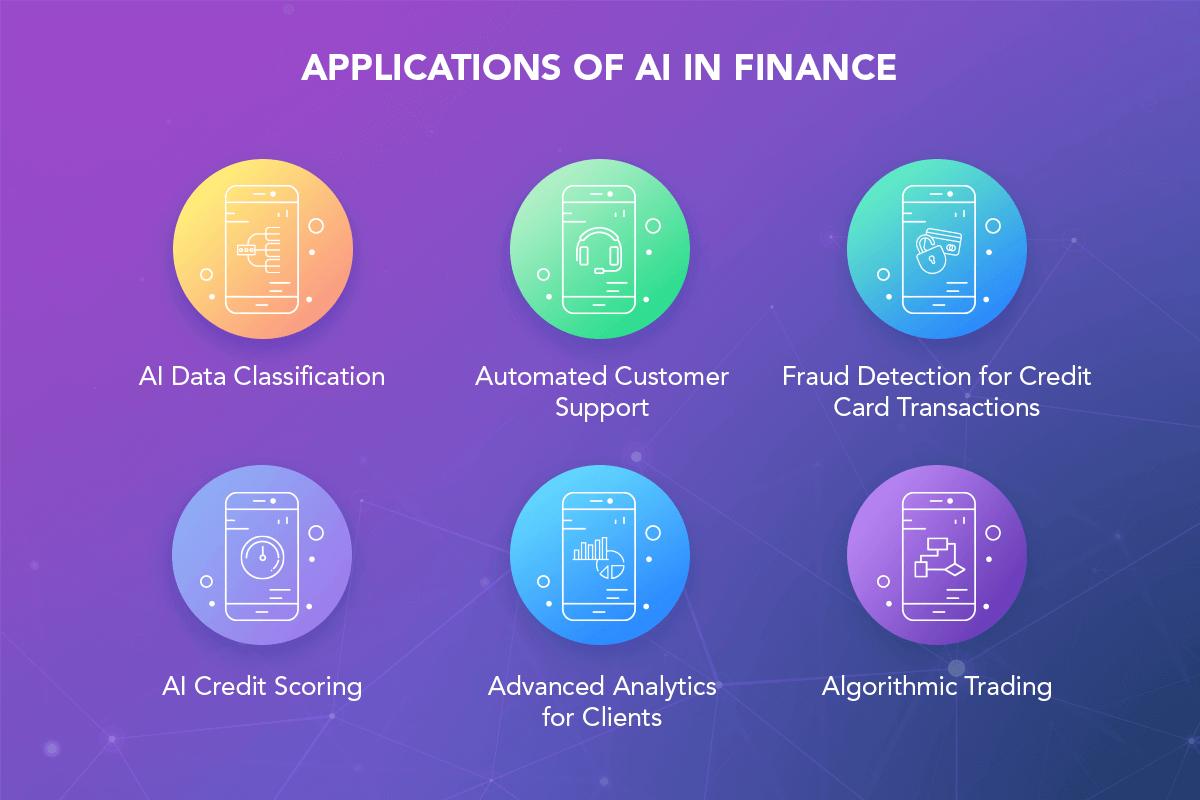

Leveraging Artificial Intelligence for Real-Time Fraud Detection

In the ever-evolving landscape of digital transactions, has become a cornerstone of effective identity verification. By harnessing the power of AI, businesses can deploy sophisticated algorithms that analyze vast amounts of data instantaneously, identifying anomalies and suspicious patterns that human eyes might miss. These intelligent systems not only enhance the speed and accuracy of fraud detection but also adapt to new threats by learning from each interaction.

Key AI-driven methods for identity verification include:

- Behavioral Biometrics: AI systems monitor user behavior such as typing speed, mouse movements, and device usage patterns to create a unique behavioral profile, making it difficult for fraudsters to impersonate legitimate users.

- Facial Recognition: Advanced facial recognition technology, powered by AI, compares live images or videos to stored data, ensuring that the person attempting access is indeed who they claim to be.

- Document Verification: AI tools can swiftly analyze and verify the authenticity of documents by checking for inconsistencies and comparing them against known templates and databases.

These AI-driven techniques not only fortify security measures but also enhance user experience by reducing friction in the verification process. By continuously learning and adapting, AI ensures that businesses stay one step ahead in the fight against fraud.

Implementing Multi-Factor Authentication for Robust Protection

In today’s digital landscape, safeguarding sensitive information requires more than just a strong password. Multi-Factor Authentication (MFA) has emerged as a critical component in the fight against fraud, providing an additional layer of security by requiring users to present multiple forms of verification. This robust approach ensures that even if one credential is compromised, unauthorized access is still thwarted. By combining something you know (like a password), something you have (such as a smartphone or hardware token), and something you are (biometric verification), MFA significantly enhances the security posture of any organization.

- Knowledge Factors: These include passwords or PINs, the traditional gatekeepers of digital accounts.

- Possession Factors: Devices like smartphones or security tokens that generate time-sensitive codes.

- Inherence Factors: Biometric identifiers such as fingerprints, facial recognition, or voice patterns.

Implementing MFA not only deters unauthorized access but also instills confidence in users by demonstrating a commitment to protecting their data. With the rise of cyber threats, adopting MFA is no longer optional but a necessity for any entity serious about maintaining the integrity of its digital ecosystem.

Best Practices for Secure Identity Verification in the Digital Age

In today’s rapidly evolving digital landscape, ensuring the security of identity verification processes is paramount to thwarting fraud. To achieve this, organizations must adopt a multi-layered approach that combines cutting-edge technology with robust security protocols. Biometric authentication, such as fingerprint and facial recognition, offers a high level of security by leveraging unique biological traits that are difficult to replicate. Additionally, two-factor authentication (2FA) provides an extra layer of protection by requiring users to verify their identity through a secondary method, such as a text message or an authentication app.

Furthermore, implementing machine learning algorithms can enhance the detection of fraudulent activities by analyzing patterns and identifying anomalies in real-time. Organizations should also prioritize data encryption to protect sensitive information during transmission and storage. Regular security audits and compliance checks are essential to ensure that identity verification systems remain resilient against emerging threats. By integrating these best practices, businesses can safeguard their digital environments and build trust with their users.