In the fast-paced world of finance, where transactions zip across the globe in milliseconds and fortunes are made or lost in the blink of an eye, the specter of fraud looms large. Financial institutions, the guardians of this vast flow of capital, are locked in a perpetual battle against an ever-evolving adversary: fraudsters armed with sophisticated tools and cunning strategies. As the digital landscape expands, so too does the complexity of threats, necessitating a robust defense mechanism that can keep pace with the speed of commerce. Enter real-time fraud detection solutions—a technological marvel that stands as the vanguard in the fight against financial deception. These systems, powered by cutting-edge algorithms and artificial intelligence, offer an unyielding shield, capable of identifying and neutralizing threats as they occur. In this article, we delve into the intricacies of these formidable solutions, exploring how they empower financial institutions to safeguard their assets and uphold the trust of their clientele in an increasingly perilous digital age.

Unmasking Deception The Art and Science of Real-Time Fraud Detection

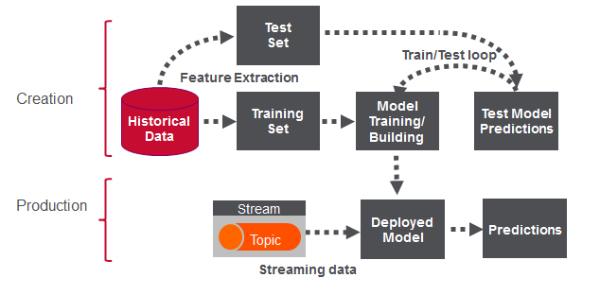

In the fast-paced world of finance, where every second counts, financial institutions are turning to cutting-edge solutions to combat the ever-evolving threat of fraud. These real-time detection systems are a blend of advanced algorithms and artificial intelligence, designed to scrutinize vast amounts of transactional data with precision and speed. By employing machine learning models, these systems can identify unusual patterns and anomalies that may indicate fraudulent activity, often before it even occurs. This proactive approach not only protects assets but also enhances customer trust and satisfaction.

- Machine Learning: Adaptive algorithms that learn from historical data to predict and identify potential fraud.

- Behavioral Analytics: Monitoring user behavior to detect deviations from normal patterns.

- Real-Time Alerts: Instant notifications that allow for immediate action against suspicious activities.

- Data Integration: Seamless assimilation of data from various sources for comprehensive analysis.

With these sophisticated tools, financial institutions can stay one step ahead of fraudsters, safeguarding their operations and maintaining the integrity of the financial ecosystem. By leveraging the art and science of real-time detection, they are not just reacting to fraud but anticipating and preventing it.

Harnessing AI and Machine Learning for Proactive Fraud Prevention

In today’s fast-paced digital economy, financial institutions are increasingly turning to the power of Artificial Intelligence (AI) and Machine Learning (ML) to stay one step ahead of fraudsters. By leveraging these cutting-edge technologies, banks and financial services can implement real-time solutions that not only detect fraudulent activities but also predict and prevent them before they occur. This proactive approach is crucial in safeguarding customer assets and maintaining trust in the financial system.

- Dynamic Pattern Recognition: AI algorithms can analyze vast amounts of transaction data to identify unusual patterns that may indicate fraudulent behavior. This dynamic recognition goes beyond static rule-based systems, adapting to new threats as they emerge.

- Behavioral Analytics: By studying the normal behavior of users, ML models can detect anomalies that deviate from typical activity, flagging potential fraud in real-time.

- Automated Alerts and Responses: AI-driven systems can automatically trigger alerts and initiate countermeasures when suspicious activities are detected, minimizing the time window for potential fraud.

By integrating AI and ML into their fraud prevention strategies, financial institutions not only enhance their security posture but also streamline operations, reduce false positives, and ultimately provide a seamless experience for their customers.

Building a Fortress Integrating Real-Time Solutions into Financial Systems

In the ever-evolving landscape of financial technology, the integration of real-time solutions into financial systems is akin to constructing an impregnable fortress. This transformation is driven by the urgent need to outpace sophisticated fraud tactics. Real-time fraud detection not only enhances security but also builds trust with clients by safeguarding their assets and personal information. Financial institutions are increasingly adopting cutting-edge technologies such as machine learning and artificial intelligence to monitor transactions as they occur, identifying anomalies with unparalleled precision.

- Instantaneous Analysis: Leveraging advanced algorithms to scrutinize transaction patterns in real-time.

- Proactive Defense: Identifying and neutralizing threats before they can cause harm.

- Seamless Integration: Ensuring that security measures are woven into the fabric of existing systems without disrupting operations.

These solutions not only fortify defenses but also empower institutions to respond swiftly to emerging threats, maintaining the integrity of financial ecosystems. By embedding real-time capabilities, financial entities are not just reacting to fraud but are proactively creating a secure environment that anticipates and neutralizes threats before they materialize.

Best Practices and Recommendations for Robust Fraud Defense Strategies

To ensure a formidable defense against fraudulent activities, financial institutions must adopt a multi-layered approach that combines technology, policy, and human expertise. Implementing machine learning algorithms is crucial for identifying and adapting to emerging fraud patterns in real-time. These algorithms can analyze vast amounts of transaction data, flagging anomalies that might indicate fraudulent behavior. Additionally, integrating behavioral analytics helps in understanding customer patterns, allowing institutions to detect deviations that could signal unauthorized activities.

Beyond technology, it is essential to establish a culture of vigilance within the organization. Regular training sessions for employees can keep them informed about the latest fraud tactics and prevention techniques. Moreover, developing comprehensive incident response plans ensures that the institution can swiftly and effectively address any security breaches. Financial institutions should also foster collaboration with industry peers and law enforcement agencies to share insights and strategies. By combining these practices, organizations can build a robust defense system that not only reacts to fraud but anticipates and mitigates it proactively.