In the ever-evolving landscape of the digital age, where technology and finance intertwine with unprecedented complexity, a new breed of financial fraud risks emerges from the shadows, challenging the fortresses of security and trust. As we stand on the precipice of a future dominated by digital transactions and virtual currencies, the guardians of financial integrity must navigate a labyrinth of sophisticated deceptions. This article delves into the top emerging financial fraud risks that lurk in the digital realm, unraveling the intricate web of cyber threats and cunning schemes that threaten to undermine the very foundation of our financial systems. With an authoritative lens, we explore the dynamic interplay between innovation and exploitation, arming you with the knowledge to anticipate and combat these modern-day financial adversaries. Welcome to the frontlines of the digital financial frontier, where vigilance and foresight are your most formidable allies.

Navigating the Dark Web of Deception: Unmasking New Digital Fraud Tactics

In the labyrinthine corridors of the digital world, financial fraud has evolved into a sophisticated art form, exploiting the very technologies designed to protect us. Today, fraudsters deploy an arsenal of cutting-edge tactics that often leave even the most vigilant users vulnerable. Phishing has metamorphosed beyond simple email scams, now manifesting as highly personalized spear-phishing attacks, targeting specific individuals with tailored messages that mimic legitimate communications. Meanwhile, deepfake technology has introduced a new dimension of deception, where synthetic media can convincingly impersonate voices and faces, tricking victims into authorizing transactions or divulging sensitive information.

- Social Engineering 2.0: Fraudsters are leveraging social media platforms to gather personal data, crafting narratives that are hard to distinguish from reality.

- Cryptocurrency Scams: As digital currencies gain popularity, fraudulent Initial Coin Offerings (ICOs) and Ponzi schemes are on the rise, preying on the uninformed and eager investors.

- Man-in-the-Middle Attacks: With the increasing use of public Wi-Fi, attackers intercept communications between two parties, altering or stealing data without detection.

These emerging threats underscore the necessity for individuals and organizations to remain vigilant, continuously updating their security protocols and awareness strategies to outpace the ever-evolving landscape of digital fraud.

The Rise of AI in Financial Fraud: Understanding the Threat Landscape

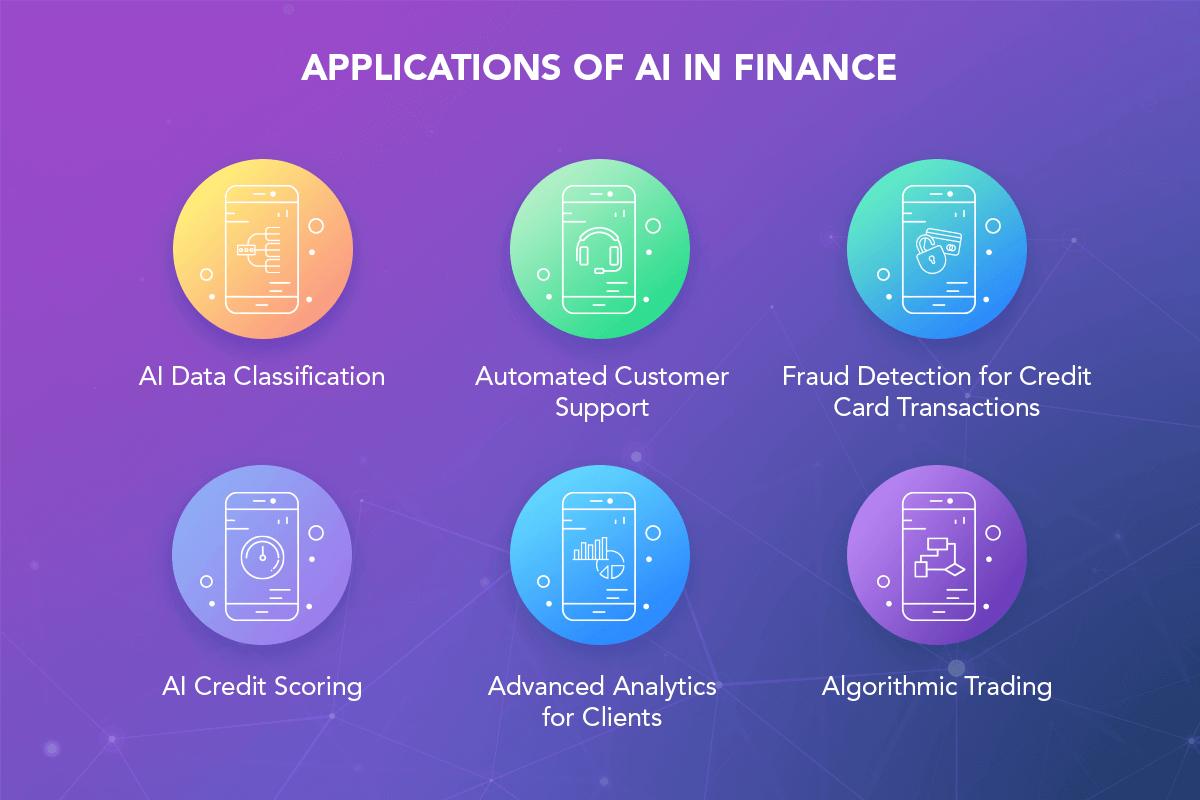

As financial institutions increasingly rely on digital platforms, artificial intelligence has emerged as both a formidable ally and a potential adversary in the battle against financial fraud. AI-driven systems can analyze vast datasets at lightning speed, identifying patterns and anomalies that would be invisible to the human eye. However, the same technology is being leveraged by cybercriminals to orchestrate more sophisticated and elusive scams. This dual-edged sword necessitates a nuanced understanding of the threat landscape.

- Deepfake Technology: Cybercriminals are using AI to create hyper-realistic fake audio and video content, impersonating executives or clients to authorize fraudulent transactions.

- Automated Phishing Attacks: AI algorithms can generate personalized phishing emails at scale, making it increasingly difficult for individuals to discern legitimate communications from fraudulent ones.

- Behavioral Biometrics Manipulation: By studying user behavior, fraudsters can train AI to mimic legitimate user patterns, bypassing traditional security measures.

Financial institutions must stay ahead of these emerging threats by integrating AI into their security frameworks, continuously updating their defenses, and fostering a culture of vigilance among employees and customers alike.

Fortifying Your Digital Fortress: Strategies to Combat Emerging Financial Frauds

In the rapidly evolving digital landscape, financial fraudsters are becoming increasingly sophisticated, necessitating robust defense mechanisms to safeguard your assets. One of the most pressing threats is phishing scams, where cybercriminals masquerade as legitimate entities to extract sensitive information. These scams have evolved beyond simple emails to include spear phishing and vishing (voice phishing), targeting individuals with personalized tactics.

Another significant risk is the rise of cryptocurrency frauds, where the anonymity and decentralized nature of digital currencies are exploited. Fraudsters often use fake investment schemes and ICO scams to lure unsuspecting investors. Additionally, deepfake technology is emerging as a formidable tool for deception, capable of creating convincing audio and video for fraudulent purposes. To combat these threats, it’s essential to employ a multi-layered security approach, including:

- Implementing two-factor authentication across all accounts.

- Regularly updating and patching software to mitigate vulnerabilities.

- Educating yourself and your team on the latest fraud tactics and prevention strategies.

- Utilizing advanced AI-driven security solutions to detect and neutralize threats in real-time.

Empowering Financial Institutions: Proactive Measures for Fraud Prevention

In today’s rapidly evolving digital landscape, financial institutions must stay ahead of the curve to combat emerging fraud risks effectively. To fortify their defenses, institutions should adopt a proactive approach by implementing a combination of advanced technologies and strategic measures. Here are some key strategies to consider:

- Leverage Artificial Intelligence and Machine Learning: Harnessing the power of AI and ML can significantly enhance fraud detection capabilities. These technologies can analyze vast amounts of data in real-time, identifying patterns and anomalies that may indicate fraudulent activity.

- Implement Multi-Factor Authentication (MFA): Strengthening authentication processes with MFA adds an extra layer of security, making it more challenging for fraudsters to gain unauthorized access to sensitive information.

- Regularly Update Security Protocols: Keeping security measures up-to-date is crucial. Regular audits and updates ensure that institutions are protected against the latest threats and vulnerabilities.

- Educate and Train Employees: A well-informed workforce is a powerful line of defense. Regular training sessions on the latest fraud trends and prevention techniques can empower employees to recognize and respond to potential threats swiftly.

By embracing these proactive measures, financial institutions can not only safeguard their assets but also build trust with their customers, reinforcing their reputation as secure and reliable partners in the digital age.