In the labyrinthine world of finance, where numbers dance and markets sway, the specter of regulatory compliance looms large, casting a shadow that is both daunting and necessary. It is here, amidst the intricate tapestry of laws and guidelines, that data analytics emerges as a beacon of clarity and precision. As financial institutions navigate the turbulent waters of global markets, the role of data analytics in ensuring regulatory compliance has become not just advantageous, but indispensable. This digital alchemy transforms raw data into actionable insights, enabling firms to not only meet the stringent demands of regulators but to anticipate and adapt to the ever-evolving landscape of financial oversight. In this article, we delve into the transformative power of data analytics, exploring how it equips financial entities with the tools to achieve compliance with agility and foresight, ensuring that they remain steadfast in their commitment to transparency and integrity.

Harnessing Data Analytics to Navigate Complex Regulatory Landscapes

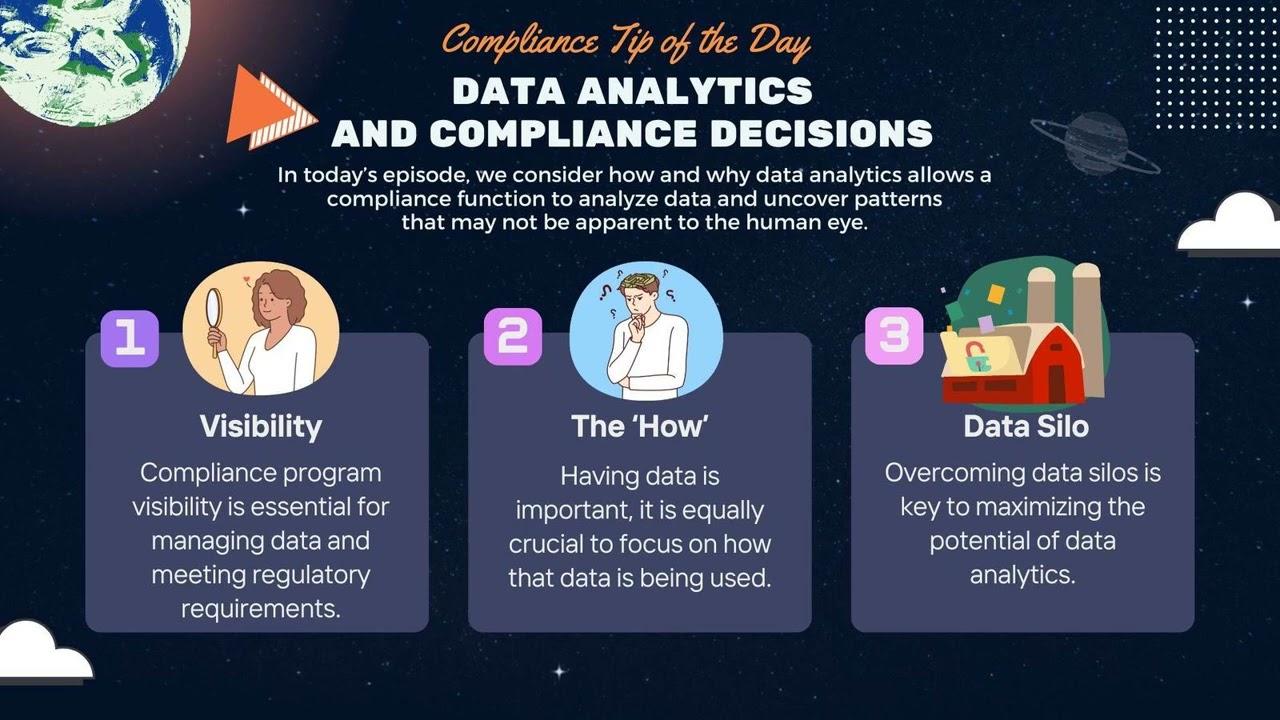

In today’s fast-paced financial world, the complexity of regulatory requirements can be daunting. However, data analytics has emerged as a powerful ally in navigating these intricate landscapes. By leveraging advanced analytical tools, financial institutions can streamline compliance processes and ensure they meet regulatory demands with precision. This not only reduces the risk of non-compliance but also enhances operational efficiency. With data analytics, organizations can identify patterns and trends, allowing them to anticipate regulatory changes and adjust their strategies accordingly.

Key benefits of utilizing data analytics in financial regulatory compliance include:

- Enhanced Risk Management: Data analytics provides insights into potential compliance risks, enabling proactive measures.

- Improved Decision-Making: Access to real-time data facilitates informed decisions, ensuring alignment with regulatory standards.

- Cost Efficiency: Automating compliance processes reduces manual efforts and associated costs.

- Regulatory Intelligence: Continuous monitoring of regulatory updates helps in staying ahead of compliance requirements.

By embracing data analytics, financial institutions can transform regulatory challenges into opportunities for growth and innovation, maintaining a competitive edge in an ever-evolving market.

Transforming Compliance Processes through Predictive Analytics

In the ever-evolving landscape of financial regulation, predictive analytics is emerging as a game-changer, offering unprecedented capabilities to streamline and enhance compliance processes. By leveraging vast datasets, financial institutions can now anticipate regulatory challenges before they arise, enabling proactive management and reducing the risk of non-compliance. Predictive analytics empowers compliance teams to identify patterns and trends, transforming raw data into actionable insights. This approach not only minimizes manual intervention but also enhances the accuracy and efficiency of compliance checks.

- Enhanced Risk Assessment: Predictive models can analyze historical data to foresee potential compliance breaches, allowing institutions to address issues preemptively.

- Resource Optimization: By automating routine compliance tasks, organizations can allocate their human resources to more strategic activities, improving overall productivity.

- Regulatory Agility: With real-time data analysis, financial entities can swiftly adapt to new regulations, ensuring they remain compliant without significant operational disruptions.

As financial markets grow increasingly complex, the integration of predictive analytics into compliance frameworks is not just beneficial but essential. This technological advancement fosters a culture of continuous improvement and vigilance, safeguarding institutions against the ever-present threat of regulatory penalties.

Enhancing Risk Management with Real-Time Data Insights

In the fast-paced world of finance, the ability to harness real-time data insights is transforming risk management and ensuring robust regulatory compliance. Financial institutions are increasingly leveraging data analytics to gain a competitive edge and mitigate risks proactively. By integrating real-time data analytics into their compliance frameworks, these institutions can swiftly identify potential threats and irregularities, allowing for immediate corrective actions. This dynamic approach not only enhances the accuracy of risk assessments but also ensures that organizations remain aligned with ever-evolving regulatory standards.

- Immediate Threat Detection: Real-time data enables instant identification of suspicious activities, reducing the risk of financial fraud.

- Adaptive Compliance Strategies: Continuous data monitoring allows institutions to adapt their compliance strategies to reflect current market conditions and regulatory changes.

- Enhanced Decision-Making: Data-driven insights empower decision-makers with the information needed to implement effective risk management policies.

By embracing these innovative data analytics solutions, financial entities not only safeguard their operations but also foster a culture of transparency and accountability. The integration of real-time data insights is proving to be a pivotal component in navigating the complexities of financial regulatory landscapes.

Strategic Recommendations for Integrating Data Analytics in Compliance Frameworks

To effectively harness the power of data analytics within compliance frameworks, organizations must adopt a strategic approach that aligns with their unique regulatory landscapes. First, establish a robust data governance structure that ensures data integrity and security. This involves setting clear policies for data collection, storage, and access, which are crucial for maintaining compliance and building trust with stakeholders.

Next, leverage advanced analytics tools to enhance risk management capabilities. These tools can help in identifying patterns and anomalies that may indicate potential compliance breaches. Consider the following strategic recommendations:

- Invest in machine learning and AI: These technologies can automate the detection of suspicious activities, reducing the burden on compliance teams.

- Implement real-time monitoring systems: This enables proactive identification of compliance issues, allowing for swift corrective actions.

- Foster a culture of data-driven decision-making: Encourage teams to utilize insights from analytics to inform compliance strategies and operational decisions.

By integrating these strategic elements, organizations can not only meet regulatory requirements but also drive operational efficiency and innovation in their compliance processes.